Sure raises $100M at $550M valuation in order to help companies launch insurance products using its flexible APIs

Sure, an insurance startup, announced today that $100 million of Series C funding has been closed at a $550million valuation.

Declaration Partners, a New York-based European growth investor Kinnevik, and Declaration Partners, New York, led the financing. WndrCo was also involved as well as existing backers W. R. Berkley (Menlo Ventures) and W. R. Berkley (W. R. Berkley). This round brings the total amount raised by Santa Monica-based startups to $123.1million since its 2015 inception.

Sure launched its first enterprise SaaS product in 2016 and counts both traditional financial services companies and fintech companies as customers. Farmers Insurance, Chubb and Intuit are among its customers. All three offer insurance programs based on Sures infrastructure.

Sure won't disclose exact revenue numbers, but it claims to be profitable since 2019. Wayne Slavin, the CEO and cofounder of Sure, claims that its annual recurring revenues (ARR), has increased by more than 3X each year for several years.

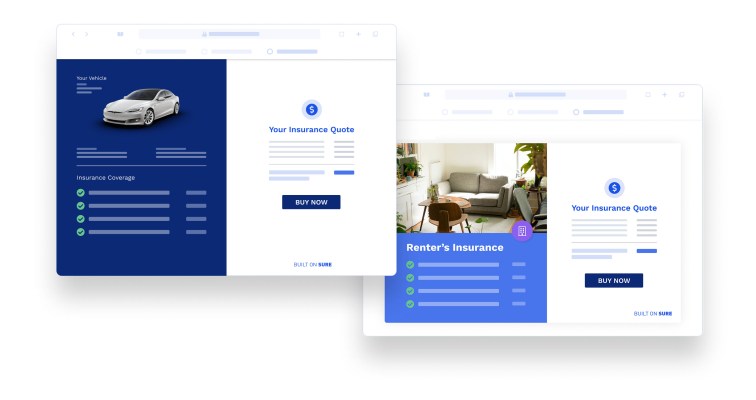

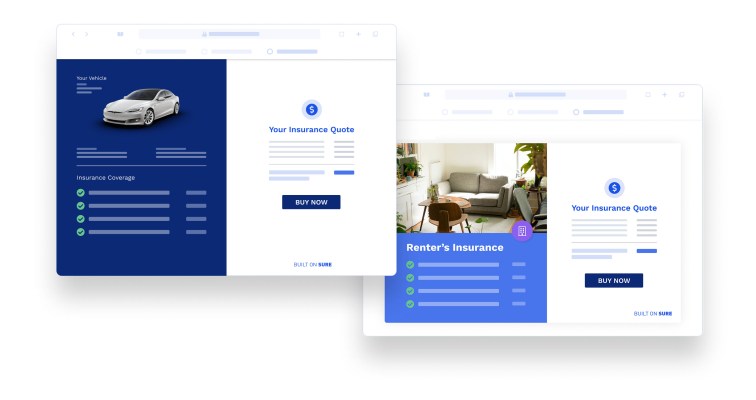

Sure claims that it has developed technology infrastructure that modernizes insurance processes and embeds it into consumer experiences. This means that companies can sell insurance directly in milliseconds using Sures infrastructure.

According to Slavin, the company is an innovator in embedded insurance.

He explained that embedded insurance is insurance that has been integrated into existing digital products of the brand across all industries.

These can include car insurance that is included in the purchase of an electric car online or purchasing a used car through Carvana, to business insurance purchased when your company opens a bank account.

Slavin states that the benefits of using its APIs enable companies to quickly go to market with new products.

Slavin explained to TechCrunch that Sure distinguishes itself in three key pillars that are important to customers: tried-and-true technology infrastructure, speed to market and the ability offer fully embedded customer experiences. Many players are trying to ride the embedded wave, just like any industry that has been disrupted. Because they are built from the ground up, embedded insurance experiences are truly unique and pioneered in Sure.

The company intends to use the capital raised from its growth round to expand its global reach, launch new products faster and streamline customer experience.

According to Slavin, international expansion will be in the form new customers and offices in Europe and Latin America, Asia as well as existing clients with successful domestic programs who plan to expand their insurance services to international customers.

Sure plans to keep hiring. Sure currently has 80 employees, an increase of more than 50% from last year. In 2022, the company intends to triple its engineering staff.

A partner at Declaration Partners, Brian Stern said that his firm was attracted to Sure by its belief in Slavin as a visionary leader and the large global market for this transformative technology.

He said that Sure is focused on the customer experience, convenience, and how to embed this capability in a consumer's relationship with a brand.

Kinneviks Ola Nordbye stated that Sure is used by a few of his portfolio companies.

He wrote via email that we like the way it allows customers to have better experiences and unlocks huge untapped profits for brands that already have their customer base. This is the most challenging fintech space to succeed in, especially when it comes insurance. Sures state of the art tech platform impressed us. It is far more advanced than you would expect from an early stage company. The founder has a clear vision and solid financial KPIs, such as profitability and growth.

Nordbye stated that Sure is unique because it creates new revenue streams for both sides of the equation (brands and insurance companies) and that they do this as a software company and not as a risk carrier.

She added that the fact that they can deliver holistic offerings at an incredible speed of implementation is truly unique.