You can subscribe to the New Economy Daily newsletter and follow us on social media.

Vice President Luis de Guindos said that a rate increase by the European Central Bank is likely in July.

The end of net asset purchases should not happen in July, according to the Spanish newspaper El Correo. Rates will rise after that and may happen within weeks or months. He said that July is possible, but not likely.

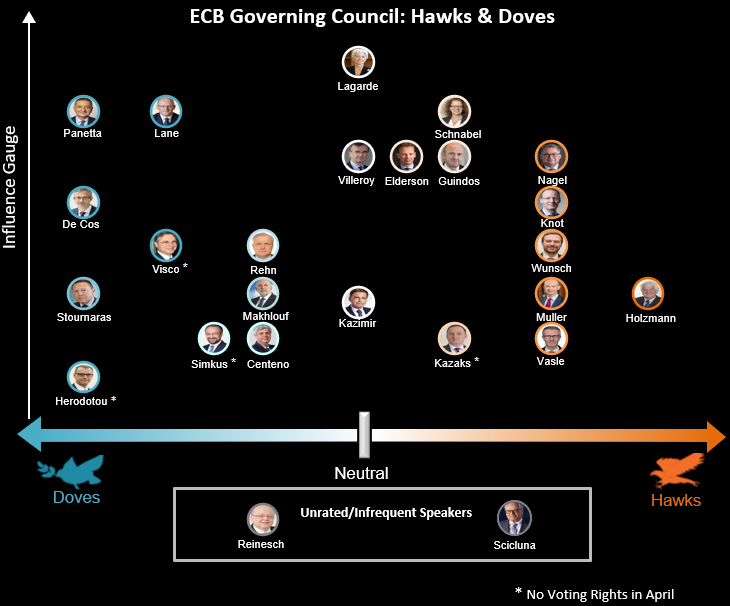

Some policy makers want the first rate hike in more than a decade to come as soon as July. The decision will depend on the data and the new projections in June.

The vice president of the European Central Bank said that a significant weakening of growth was already visible.

Growth will be positive in 2022, even so, if we stick to the technical definition of a recession.

There are other key statements from the interview.