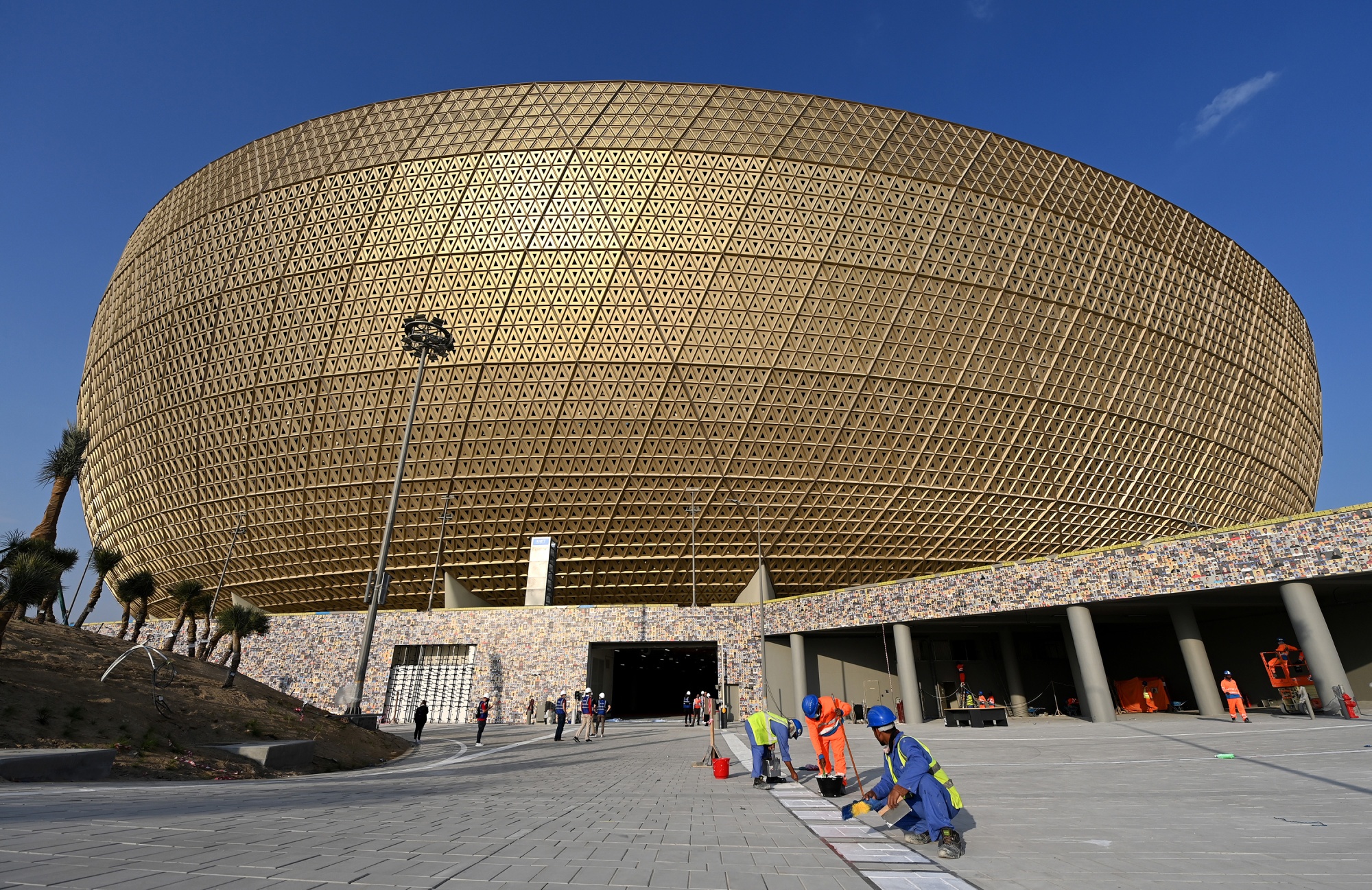

The new 80,000-seat stadium rising from the desert that will host the final of the World Cup in December can be seen from the air. They may also notice that there are tanker lines in the Persian Gulf to collect natural gas.

Football and an increasingly indispensable fuel are coming together to give a bigger influence on the global stage. As the World Cup showcases its ability to acquire international prestige, the tiny peninsula is promising to turn into the bigger player it always wanted to be.

The war in Ukraine has boosted Middle East oil producers like Saudi Arabia and Kuwait, but the financial and geopolitical rewards on offer for Qatar make it the winner.

Several of the European Union's most senior officials have flown to Doha in recent weeks, all with the same message: we need your gas as fast as possible. Germany has told businesses to negotiate. Russia cut off supplies to Poland and Bulgaria this week.

The first quarter of this year showed that energy exports from the country would reach $100 billion for the first time in four years. It will be able to spend more money in global stock markets and on foreign policy goals thanks to that. The World Cup is expected to have a $20 billion economic boost.

As gas and oil prices rise, it will be a windfall for Qatar.

The Ministry of Development Planning and Statistics is in the state of Qatar.

It made 2022, the year that Qatar will make its mark on the sporting calendar, more valuable than just the year it will happen, because it enriched what is already one of the wealthiest countries and boosted its clout in a way that looked unlikely a year ago.

Europe is clamoring for natural gas, known as Liquefied Natural Gas, after a $30 billion project to boost its exports by 60 percent. Competition for long-term supply contracts is likely to increase because of the extra demand.

Some analysts doubted that there would be enough business to justify the expansion plan. According to a report on April 20, Qatar is talking to customers about a bigger expansion.

Karen Young is a senior fellow at the Middle East Institute in Washington.

It's quite a change for the 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 800-381-0266 Saudi Arabia, the United Arab Emirates and allies spent more than three years trying to get rid of it's economic ties to Iran. The price of gas fell to record lows because of the coronaviruses, which many said was an inevitable trend for consumers to switch from fossil fuels to cleaner, renewable energy.

The treatment of foreign workers building the infrastructure for the World Cup was slammed by human rights activists. According to the International Labour Organization, at least 50 of them died in 2020.

European gas prices are near all-time highs after the economic boycott ended. They have more than tripled in the past year, first as demand rebounded from the Pandemic and then due to Russia's invasion of Ukraine.

The emir is in demand in the US and Europe. At a White House meeting with President Joe Biden in late January, the two discussed the stability of global energy supplies.

gas was at the forefront of their talks, despite the fact that Biden designated them a major non-NATO ally. The White House and Saudi Arabia are at odds because of their refusal to increase oil production in order to bring down prices.

One of the world's richest countries has been made possible by gas.

The International Monetary Fund is owned by Citigroup.

The benefits are already accruing to the state of Qatar. The $200 billion economy is expected to grow 4.4% this year, the most since 2015, according to Citigroup. Back to the levels of places like the Cayman Islands and Switzerland, the gross domestic product per person will soar to $80,000.

The World Cup construction boom that powered the economy in recent years comes to an end just as the start of a gas cycle.

The question is what to do with the windfall. Its track record shows that it has always been in tune with its allies in the U.S. and Europe.

A person familiar with the matter says most of the money will be used to bolster the fund. That would allow the Qatar Investment Authority to accelerate its push into technology stocks, as it already invests in companies such as Volkswagen AG, as well as New York and London real estate.

The fund could be used to further the goals of the country. The government pledged $5 billion of investments in Egypt. That was part of a plan by Gulf states to support the North African country, which has been battered by a rise in food prices.

Foreign policy investments haven't always paid dividends. Billions of dollars have been put into Russian assets by the QIA in the past decade. The value of those has gone down.

The Muslim Brotherhood ran the government in Egypt after the Arab Spring uprising. The Egyptian military ousted the President in 2013). The boycott of the Gulf states was due to the criticism they received from fellow Gulf states for their support of Sheikh Tamim.

After the takeover of Gaza by Hamas, Sheikh Hamad invested in it and supported the revolution in Syria to overthrow Assad. He is still in power as the war continues.

Emir Turns Qatari Into Power Behind Middle East Uprisings.

Young at the Middle East Institute said thatQatar can play an interesting regional role, but it comes with a lot of risk.

The importance of world gas supply has been a long journey. The North Field is an offshore giant that Shell discovered in 1971. The company abandoned it. It was too far away to be piped to major markets.

By the 1990s, the finances of Qatar were under strain due to falling oil production and prices. The energy minister at the time thought gas was the future.

Engineers brought down the cost of making Liquefied Natural Gas, which allowed it to be shipped across the world. The country became the world's biggest exporter thanks to demand in Japan and Taiwan. Competition from Russia made Europe a harder market to crack.

In 1997 or 1998 I went to Germany and talked to officials about whether or not the country could be a supplier.

When Russia began Europe's deadliest conflict since World War II and when Putin threatened to shut down gas exports, the argument that they needed many suppliers was proved correct. The EU has imposed stinging trade and business penalties on Russia, but excludes oil and gas.

Europe gets around 40% of its gas from Russia, so it's not possible for Qatar to produce enough. More than 80% of its cargo goes to Asia. Most of those are sold under multi-year contracts that are not canceled.

Gas prices are way above production costs.

The source is Bloomberg.

The future bonanza is clear. Morgan Stanley expects Europe's pivot from Russian energy to spur a 60% increase in global LNG consumption. Spot gas prices in Asia and Europe will be as high as $25 per million British thermal units through at least next year, according to Goldman. That is more than six times the break-even price for the project. The American banks are similarly bullish about oil, which is linked to most of the supply contracts in the country.

A multi-pronged strategy has been put in place by the EU to take on more gas from outside of Russia. Robert Habeck, the Economy Minister of Germany, traveled to Doha to meet the emir in March and pledged to build his country's first Liquefied Natural Gas import terminals. New facilities are being looked at by countries such as Estonia.

The EU's chief diplomat, Josep Borrell, attended this year's edition of the Doha Forum foreign-policy conference. Ukrainian President Volodymyr Zelenskiy got a long applause for a video address in which he said that Russia could be stopped from using energy as a weapon to blackmail the world.

Russia's invasion and the uncertainty of gas supply to Europe have changed the game for Qatar.