Machine learning and artificial intelligence research is too much for anyone to read. The purpose of this column is to collect some of the most relevant recent discoveries and papers and explain why they matter.

Scientists conducted a fascinating experiment this week in artificial intelligence to predict how platforms like food delivery and ride-sharing businesses affect the economy. A group of researchers tested a system to predict a startup's success from public web data, while a team from ETH Zurich developed a system that can read tree heights from satellite images.

The market-driven platform work builds on the open source research environment for understanding how artificial intelligence could improve economic policy. The new work was detailed in a study that was published in March.

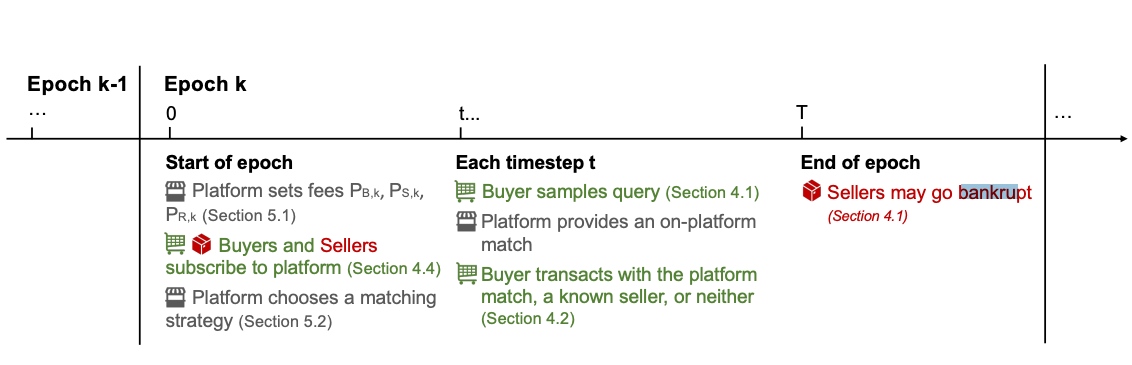

The goal was to investigate two-sided marketplaces like Amazon, DoorDash, and TaskRabbit that enjoy larger market power due to surging demand and supply. The researchers trained a system to understand the impact of interactions between platforms and consumers.

Reinforcement learning is used to reason about how a platform would operate under different design objectives.

The researchers found that a platform designed to maximize revenue tends to raise fees and extract more profits from buyers and sellers during economic shocks at the expense of social welfare. They found a platform's revenue-maximizing incentive to be in line with the welfare considerations of the overall economy when platform fees are fixed.

The system they plan to open source could provide a foundation for either a business or policymaker to analyze a platform economy under different conditions, designs and regulatory considerations.

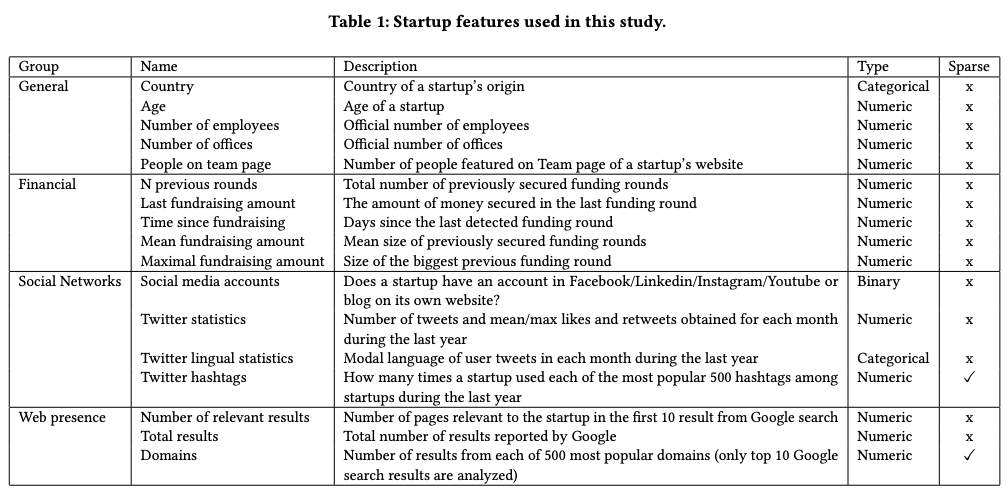

Researchers from Skopai claim to be able to predict the ability of a startup to attract investments using publicly available data, which they say is the first of its kind. The coauthors say that they can get prediction results from data from startup websites, social media, and company registries.

Applying artificial intelligence to due diligence is not new. Some firms are using technology to inform their investments. By the year 2025, 75% of VCs will use artificial intelligence to make investment decisions, up from less than 5% today. There are dangers beneath the surface that some see value in. In 2020, the Harvard Business Review found that an investment algorithm outperformed novice investors but exhibited biases, for example frequently selecting white and male entrepreneurs. This reflects the real world and highlights the tendency of Artificial Intelligence to amplify existing prejudices.

Scientists at MIT, along with researchers at Cornell and Microsoft, claim to have developed a computer vision system that can identify images down to the individual individual. This might not sound significant, but it is a huge improvement over the conventional method of teaching.

Computer vision programs learn to recognize objects by being shown examples of objects that have been labeled by humans. This time consuming, labor intensive process of applying a class label to the image is no longer possible thanks to STEGO. The system isn't perfect, but it can segment out things like roads, people and street signs.

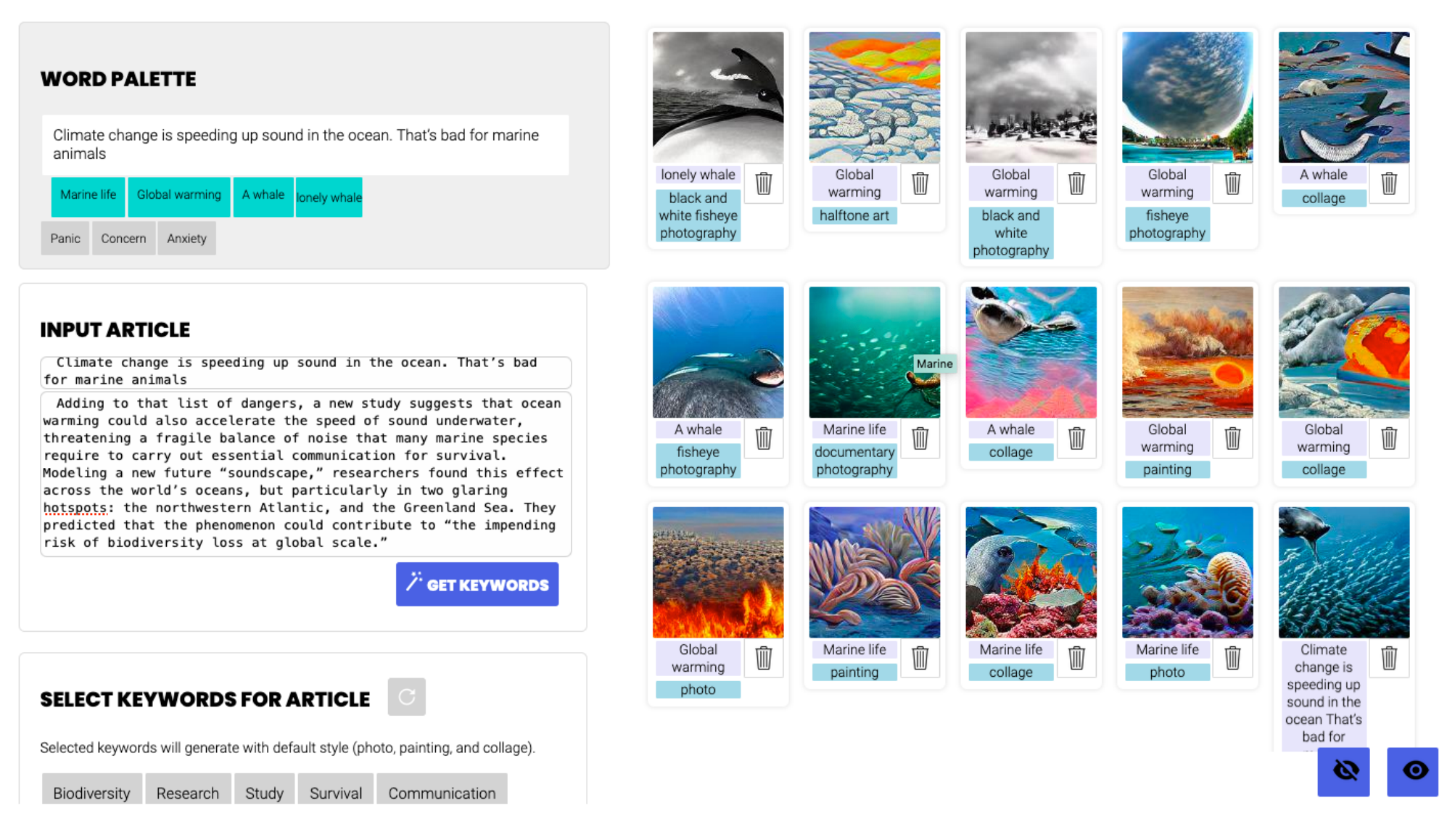

We are approaching the day when academic work like DALL-E 2, OpenAI's image-generating system, becomes productized. A new research from Columbia University shows a system that can be used to create featured images for news stories from text descriptions.

The researchers said that those who tried it were more efficient at creating featured images for articles and created more results than users. It's not hard to imagine a tool like Opal eventually making it's way into a content management system.

The authors wrote that Opal gave users a structured search for visual concepts and a way to illustrate based on an article's tone, subjects and intended illustration style.