The venture capital market is slowing down, which means early-stage founders are chasing a smaller pool of money.

The number of seed deals funded between Q4 2021 and Q1 2022 fell by 41% and the dollar volume fell by 31%.

It is more important than it was a year ago for teams to partner with an investor who understands the business well enough to add value in this environment.

We are interviewing active investors to learn more about what they are looking for and how they prefer to be approached, because a founder's pitch is the first step on that journey.

You can save 20% off a one- or two-year subscription with the discount code.

Each of them was asked to name a pro forma pitch practice they think should be stopped. Entrepreneurs who exaggerate the size of their market are sabotaging themselves, according to angel investor Marjorie Radlo-Zandi.

She said to not be tempted to overstate your market size. Some investors don't expect to invest in the next unicorn.

Thanks to everyone who participated.

If you already have an established network, this article isn't for you. If you are a first-time founder, please read and share.

I hope you have a great weekend!

Walter Thompson Senior Editor, TechCrunch+

Your partner.

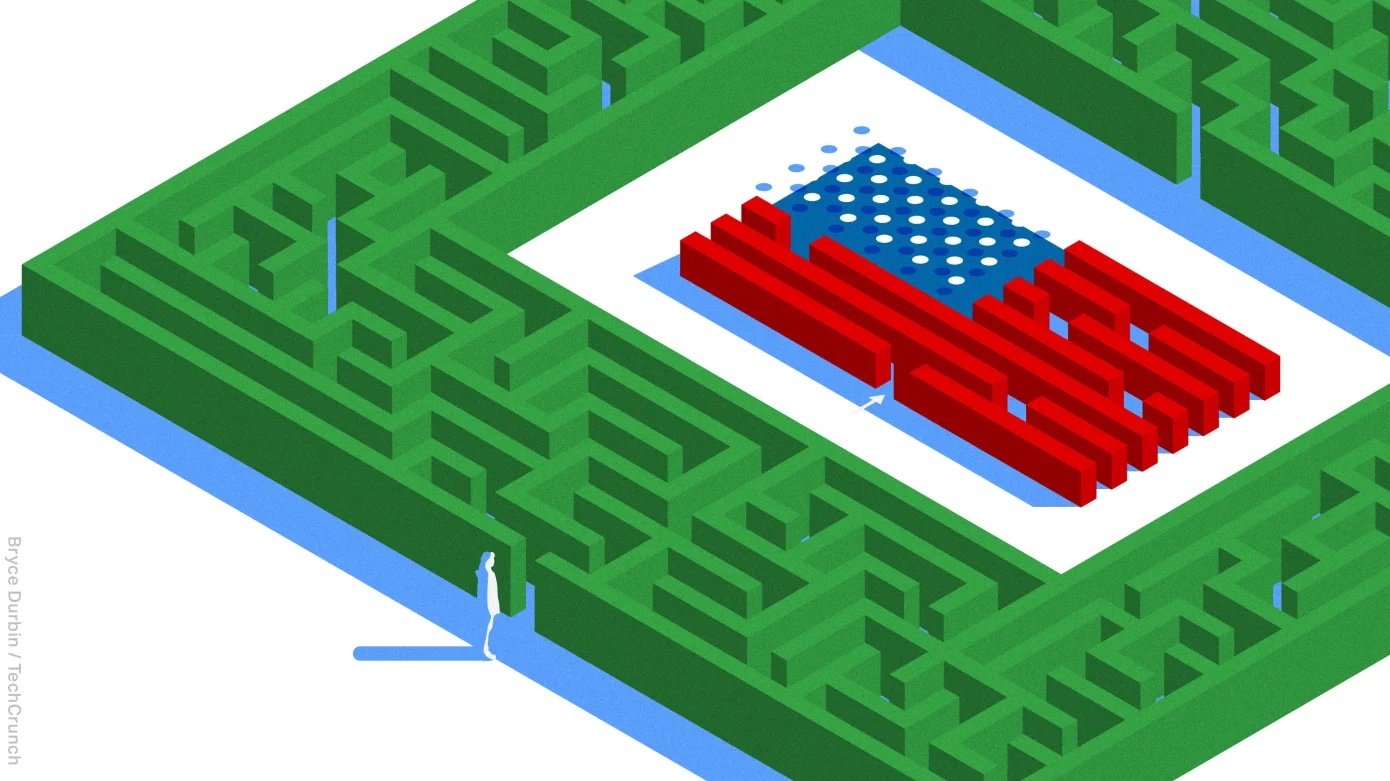

How to pitch me: 6 investors discuss what they’re looking for in April 2022

Every company that relies on recurring revenue watches its Churn Rate closely.

Sid Jain, a senior analyst at ChartMogul, says Churn is complex and confusing, but for early-stage companies, it is one of a few real-time metrics that can help founders run experiments and gather feedback.

Jain explains the differences between customer and revenue Churn, shares formulas for calculating benchmarks, and answers the question: "What is a good monthly Churn Rate?"

Study up on churn rate basics to set customer and revenue benchmarks

The image is from TechCrunch.

On Tuesday, April 26, at 2:30 p.m. 4:30 p.m. Senior Editor Walter Thompson will host a Twitter Space where Sophie Alcorn will answer questions about immigration law for startups.

The conversation is open to everyone, so if you have questions, please submit them on social media and click here to get a reminder when the chat begins.

Thank you, dear Sophie.

What are the visa options for a graduate of a U.S. university who wants to start a business?

Can the company or co-founders sponsor a recent graduate?

The founder is forward-looking.

Dear Sophie: Can a startup sponsor a graduating co-founder?

Consumers have embraced buy now, pay later services in recent years.

Criminals are using stolen data to target retailers using dark web marketplaces.

Brittany Allen, trust and safety architect at Sift, says that the only way to get ahead of the scam is for the vendors to have the right defense strategy in place.

Fraud as a service: Scammers are using encrypted messaging to undercut BNPL revenue

EyeEm (opens in a new window) is an image.

A persuasive pitch isn't the first step in raising money.

Before approaching investors, founders need to perform due diligence on themselves to make sure they are aware of any intellectual property liability.

William Wilson, a partner at Goodwin Law, says that if these issues are not tackled during a financing, it could cause delays, time-consuming and expensive remediation, and lead to lower valuations.

In a guest post, he identifies 10 potential pitfalls and outlines steps that startups can take to better prepare for them.

10 IP and commercial contract loose ends to tie up before you approach investors

On Tuesday, April 26, at 2:30 p.m. 4:30 p.m. I'm hosting a Twitter Space with an immigration law attorney based in Silicon Valley, who writes a column on the website, called DearSophie.

We will discuss relevant issues for technology workers and founders who are considering setting up shop in the U.S., including H-1B visas, pathways for international student founders, what to do if you weren't selected in the green card lottery, and information.

Please click through to set a reminder for the chat and submit your immigration-related questions so we can raise them during the Q&A, because this Space is open to everyone.

CISOs should ask 4 questions about the metaverse.

The metaverse is still taking shape, but it is causing headaches for cybersecurity professionals.

It will definitely create a threat attack surface of titanic proportions if technology places users inside virtual environments where they can transact. David Fairman says that organizations must be able to answer these questions.

4 questions every CISO should be asking about the metaverse