The three-decade era of low inflation was not a coincidence.

Bank of Canada governor Tiff Macklem said he is prepared for rates to go above three per cent to get the consumer price index back to its two per cent target.

The photo was taken by Justin Tang.

There is only one positive thing to say about the latest inflation numbers.

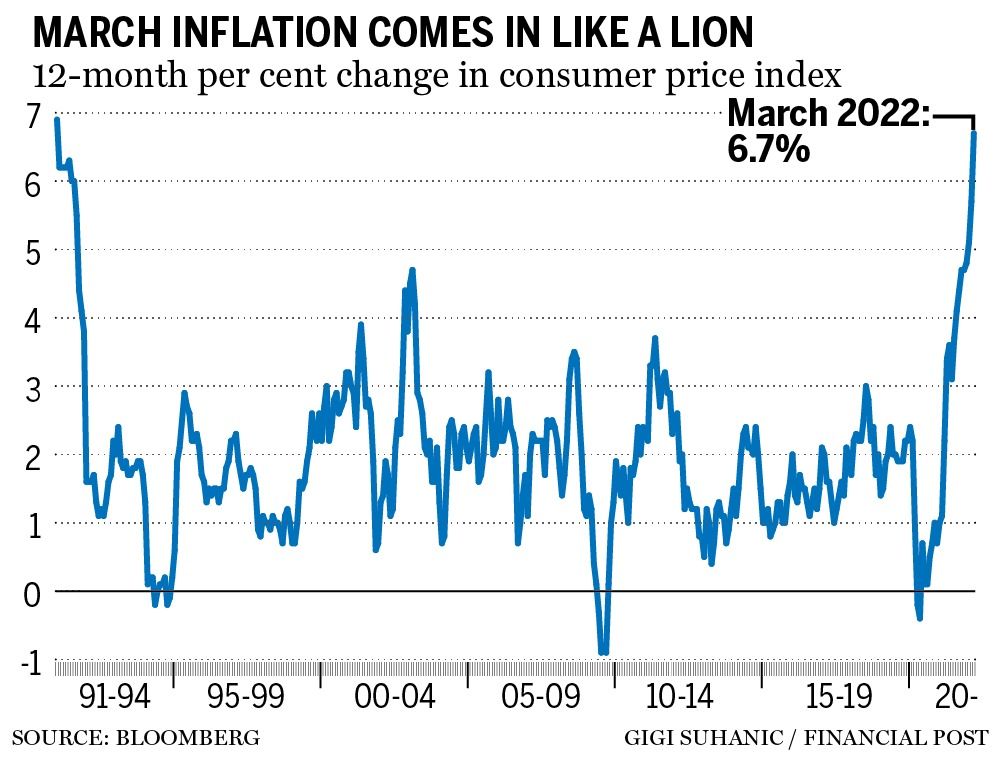

The biggest increase in the consumer price index since January 1991, and the biggest increase since the Bank of Canada started, occurred in March.

It is an alarming number. Bay Street forecasters had a median estimate of 6.1 per cent. The Bank of Canada said last week that the consumer price index would increase in the first quarter by an average of 5.8 per cent. The central bank predicts 5.8 per cent inflation in the second quarter.

Things will look better with the help of math. The consumer price index jumped above the Bank of Canada's comfort zone of one per cent to three per cent in April 2021. The way inflation is measured has a lot to do with the increase. The index collapsed in the spring of 2020 when deflation from the COVID recession was the bigger threat, so the increases 12 months later were being exaggerated.

Base effects should start working in the opposite direction next month. The sight of the headline number going down might help the Bank of Canada governor quell fears about runaway inflation.

There is little reason to think that will be enough. The introduction of the goods and services tax inflated the consumer price index in 1991. The March increase would have been the biggest since early 1983, the time of the western world's last big fight with extreme cost pressures. The adoption of inflation targets in the 1990s was inspired by memories. The era of low inflation that existed for three decades wasn't a fluke, and Macklem and his counterparts in the United States and elsewhere must now show the system they created works.

The Bank of Canada will increase its policy rate in the second half of the year, according to a note by Charles St-Arnaud.

Macklem increased the benchmark rate by half a point last week in order to send a message that they are serious about controlling inflation. Macklem said he is prepared to go above three per cent if the consumer price index goes back to the target of two per cent.

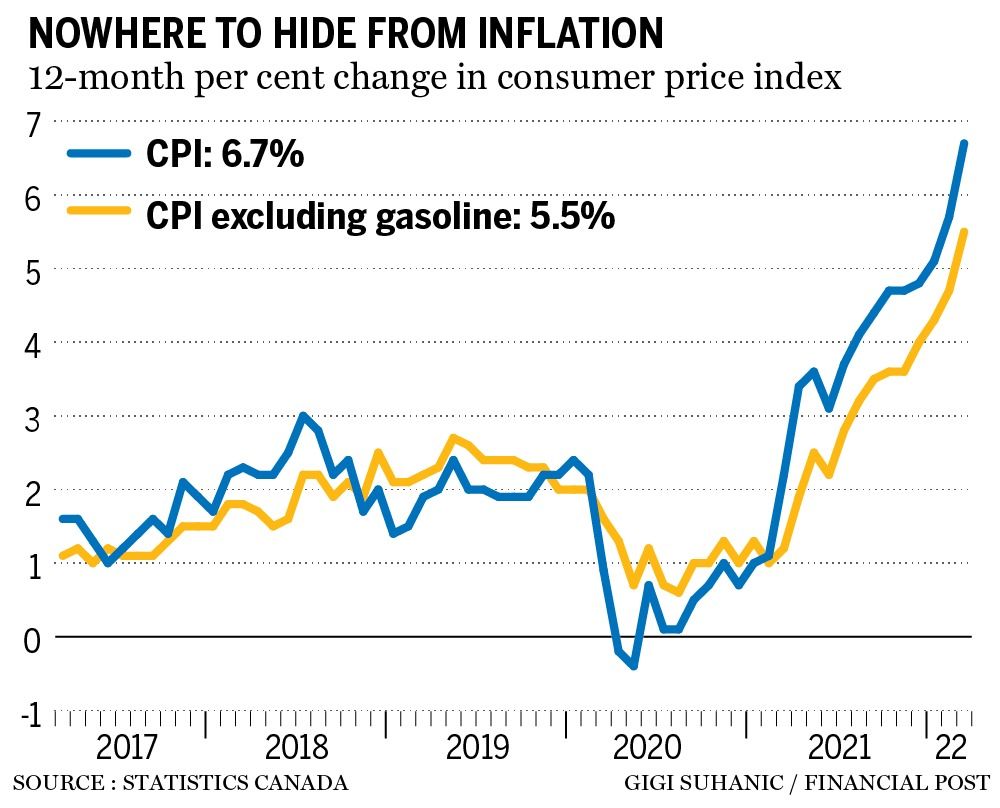

It is difficult to keep expectations anchored at two per cent. The cost of almost everything was more expensive last month than it was in March.

According to Statistics Canada, gasoline was the major driver of the year-over-year increase. The other factor is costs related to housing. The consumer price index increased from March to March, the most since the agency introduced that aggregate in 1999. In February, the figure was almost 5 per cent, suggesting that inflationary pressures grew more intense.

Globalization has helped central bankers contain inflationary pressure. With remarkably little inflation, freer trade and finely tailored supply lines between the lowest-cost producers and the most avaricious buyers helped generate impressive growth rates. The Great Recession was caused by the central banks in advanced economies keeping interest rates low. The episode raised questions about financial stability.

Much of the pain is caused by global interdependencies. It is unusual that supply is constrained. Production and transportation are being worked on. Some of the world's major farming regions, including the Prairies, were hurt by extreme weather last year. A bad situation has been made worse by the war in Ukraine.

Demand is stronger than many thought it would be after the recession. Unemployment in Canada is at a record low and households have plenty of money to spend after the recession. The economy is strong enough to handle higher borrowing costs even though the COVIDStim is mostly gone.

The central banks need to take it down another notch, according to Tom O'Gorman, director of fixed income at Franklin Templeton Canada.

Macklem is trying to do that. He has been fighting the idea that the Bank of Canada is behind the curve on inflation. He intended to run the economy hot to help bring about a faster recovery from the recession. The central bank will have to continue to be aggressive in the months to come. It has no choice.

Email: kcarmichael@postmedia.com