Most of the locations of the short-term rental startup were shuttered in the middle of 2020.

The San Francisco company was out to help people decide between staying in a hotel or an apartment, but it wasn't ready to go down without a fight. The software side of the business is being spun out and has raised $16 million in funding.

The round for Wheelhouse was co-led by Highgate and NEA.

The remote work environment precipitated by the COVID-19 Pandemic led to more people seeking longer-term rentals, so much of the core team regrouped and decided to focus on building out what is now Wheelhouse.

A number of the company's investors stuck with the team.

Over its lifetime, the company had secured more than $170 million in debt and equity. Dick Costolo and Adam Bain are two of the investors.

Wheelhouse founder and CEO Andrew Kitchell shared details of the company's pivot, its new funding and plans for the future in an interview with TechCrunch.

The software called Wheelhouse Pro was part of the larger tech stack. The property that it says became the #1 rated hotel in New York City was designed and managed by Lyric.

It was a venture-backed company focused on corporate travelers with urban exposure that was the worst place to be in a Pandemic. From March 1st we started having people cancel and theOccupancy dropped to 10% globally.

The company's executives didn't think they were in a good position to survive the Pandemic, so they reduced their workforce from 150 to 15. Joe Fraiman left the company in May to pursue other opportunities. The people who remained focused on building out the underlying technology.

When Covid hit, we shut down our operating company and shifted our focus to Wheelhouse.

In February of 2021, the team launched Wheelhouse Pro, its software designed for large portfolios. He said that the company is spinning out the software from Lyric.

Lyric raises $160 million in debt and equity to power the next generation of hospitality

When COVID hit, we made the decision to say that.

It went from being a B2C company to a B2B one.

Kitchell describes Wheelhouse as a fintech platform for the $500 billion-plus flex rental space. Think of professional rentals. The company says it has been in use for over two years, but only recently separated from Lyric.

The revenue management system we built at Lyric was basically automated. We built an entire suite of tools that our team has been using to do revenue management.

What benefit can Wheelhouse bring to short and mid-length stay providers? According to Kitchell, the providers may make 20% more money from their rental properties and can manage huge, spread portfolios with the company's technology. Mint House, Blackswan, Jurny and Sextant Stays are some of the companies that used to be competitors of Lyric.

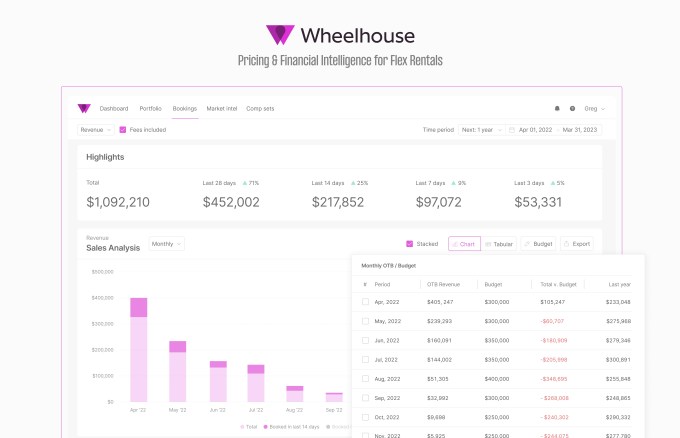

The image is called Wheelhouse.

Kitchell said that they still have individual hosts and entrepreneurs with a few listings who build their business on top of our technology.

People are embracing flexible living. The total addressable market has been expanded by working with a number of companies focused on mid-length stays.

Wheelhouse says it has experienced 100% growth over the past nine months and 45% growth in the first quarter. Its B2B business has seen 500% to 600% growth over the past nine months and is now the majority of its business. The company plans to roll out a pricing engine methodology from 42 countries to worldwide.

The company plans to use its capital to finalize its core technology, price mid-length stays and do some underwriting.

As larger teams continue to adopt Wheelhouse Pro, we are focused on adding features that make it easier for teams to adjust, track and communicate about revenue strategies. We invest in data science research to improve the pricing engine.

Rick Yang, the general partner of NEA, first invested in the company in mid-2017 and has remained in close contact with the company throughout its evolution and current spinout.

Kitchell recalls that Yang was supportive from the beginning of the epidemic and immediately got on the phone with the executive team to help plan.

It's interesting to see how quickly this company understood the severity of the situation and was able to navigate out of it, which is an interesting and much stronger position.

Zeus Living, which raised $55 million last year, is a company that is focused on corporate flexible rental space. It was initially focused on business travelers but is now also offering flexible rentals to the general population by partnering with homeowners. That startup was also invested in by Airbnb.