Over the last three months, we've had a lot of conversations with private companies about what they're worth.

If their last valuation was set in the last year or two, private companies are often faced with lower valuations.

The public markets have trended downwards, investor priorities have shifted, and the IPO window is essentially shut, with Q1 IPOs (18 deals with $2.1 billion raised) at their slowest annualized rate in over 10 years.

High-growth tech companies and unprofitable high-growth tech firms are both affected by the recalibration of public stock valuations. Private companies are feeling the effects of this recalibration.

We need to answer the question of what you are worth now.

A large drop.

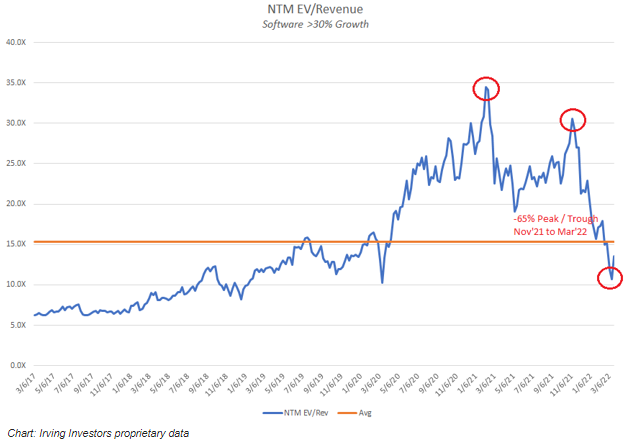

The EV/revenue multiple for a bucket of high-growth software names is shown in the chart. In the last five months, multiples declined from their peak to their trough. This is the first time in the last ten years that we have seen such a large percentage decline within a peak to trough.

A bucket of high-growth software companies have EV/revenue multiples. The image is from Irving Investors.

To find out what a company is worth, we need to identify public market comparables.

Every company is unique and the average sector revenue multiples don't tell the full story. We have to go deeper.

While the market has quickly turned to favor the buyers, the good news is that it isn’t broken.