Musk made a final offer to buy the company and said he was the person to get it unlocked.

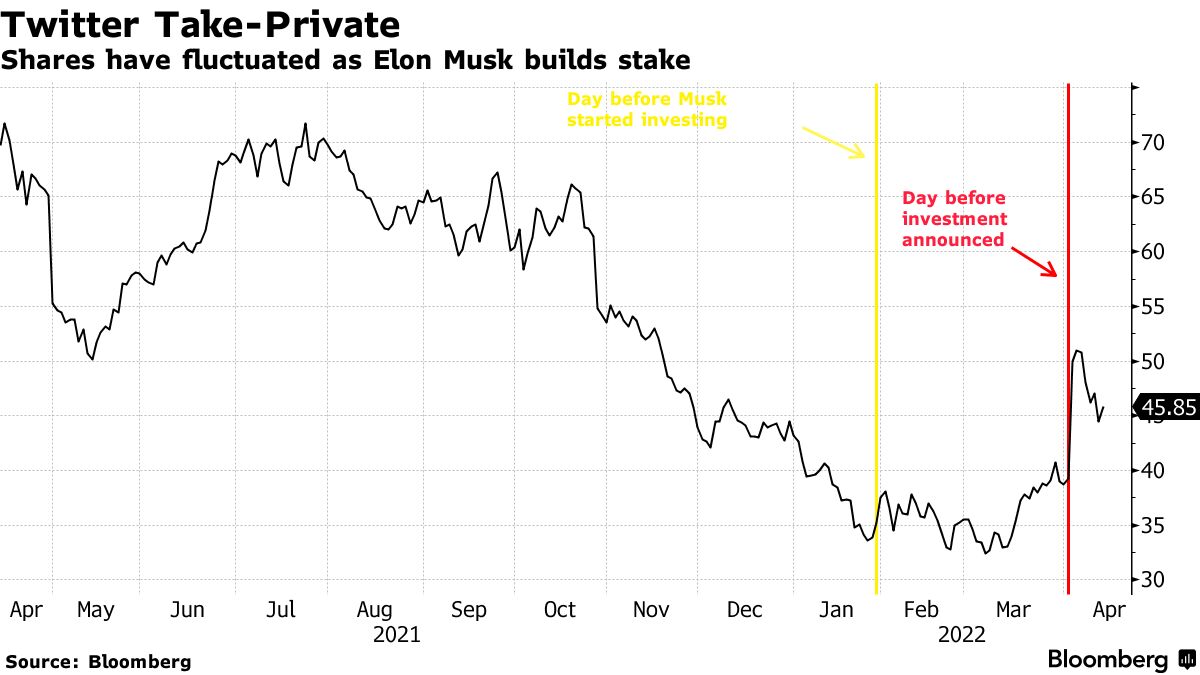

The richest person in the world will pay $54.20 per share in cash, a premium of over 50% over the Jan. 28 closing price and a valuation of $43 billion. The social media company's shares went up in pre-market trading.

Musk turned down a seat on the company's board after announcing the offer. The billionaire disclosed a stake of 9% on April 4. The shares fell in pre-market trading.

The proposal would be reviewed by the board and any response would be in the best interests of all stockholders.

Here's the message Musk is sending to make his $43 billion Twitter bid.

The latest saga in Musk's relationship is the bid. The executive is one of the most popular firebrands on the platform, and often uses his platform to make fun ofelonmusk, who has more than 80 million followers. He was the largest individual shareholder and the company offered him a seat on the board.

After his stake became public, Musk immediately began appealing to fellow users about prospective moves, such as turning San Francisco headquarters into a homeless shelter and adding an edit button to his account. Several celebrities with high numbers of followers rarely post on the social networking site.

He has launched a full takeover of the company, one of the few individuals who can afford it. He is currently worth $260 billion according to the Bloomberg Billionaire's Index, which is less than the market value of the micro-messaging service.

In a letter to the board of directors, Musk said that he does not believe that the company will thrive or serve free speech. It needs to be a private company.

If the deal doesn't work, I don't have confidence in management and I don't believe I can drive change in the public market.

According to today's statement, Musk told the board that he thought the company should be taken private.

The company's shares hit $70 less than the $54.20 per share offer, which is too low for shareholders or the board to accept, according to Vital Knowledge.

Although Musk is the world's richest person, how he will find $43 billion in cash has not been revealed.

Neil Campling, head of TMT research at Mirabaud Equity Research, said that the hostile takeover offer would cost a lot of cash.

Morgan Stanley is Musk's adviser. The offer price includes the number 420, which is a reference to marijuana. He picked $420 as the share price for taking the company private, a move that brought him scrutiny from the SEC.

There will be questions about financing, regulatory, and balancing Musk's time in the coming days.

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Elon Musk’s full letter to Twitter’s board

With help from Ryan Vlastelica and Zachary Fleming.

(Additional context throughout, Musk’s letter, Twitter’s statement.)