Canada's economy is firing on all cylinders, but inflation is not.

Macklem is the governor of the Bank of Canada.

Blair Gable took this photo.

The Bank of Canada made a mistake on the way into the recession. Policy-makers are scrambling to keep up with an economy that heated up faster than they anticipated.

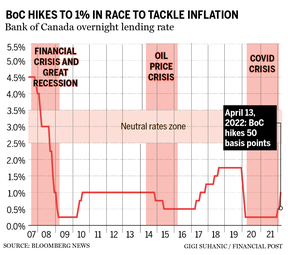

The benchmark interest rate was raised by half a percentage point on April 13 as central banks prefer to move in quarter-point increments.

The central bank will no longer be an active participant in the bond market as a result of the policy-makers' actions. During the recession, the Bank of Canada reinvested what it earned on bonds it purchased to put downward pressure on interest rates. The reinvesting will stop.

The central bank telegraphed that stronger-than-forecast inflation would force it to accelerate its march back to a more normal interest-rate setting, and the outsized increase in borrowing costs was widely anticipated.

The extent to which the economy is straining on the central bank's reins was less anticipated. The Bank of Canada predicts that gross domestic product will increase at an annual rate of six per cent in the second quarter, which is a rate of growth you would expect in the earliest days of a recovery.

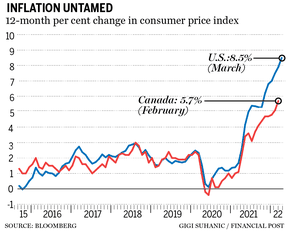

If it wasn't accompanied by equally strong inflation, it would be something to cheer about. The Bank of Canada underestimated how much the consumer price index would increase in the first quarter, and now predicts an average monthly gain of 5.6 per cent.

Policy-makers expect the average headline inflation to be 5.8 per cent in the second quarter, and expect prices to increase by one per cent to three per cent for the rest of the year.

The Bank of Canada underestimated inflation because of the war in Ukraine. Russia and Ukraine are major suppliers of oil, natural gas, wheat and other commodities, and prices for those inputs have gone up since the Russian invasion of Ukraine.

It's hard to criticize the Bank of Canada governor for not anticipating a war in Europe. He has to contend with an emergency program that worked so well that little of the scarring that occurs during a recession happened this time.

The economy came out of the downturn firing on all cylinders. Extra pressure on prices is put on by the fact that there is more demand than supply.

The Bank of Canada said that it is not finished. The economy is probably operating at a level that exceeds estimates of what it can produce without stoking inflation, according to a new forecast. The benchmark rate is still below its pre-pandemic level.

No one would be surprised by a second half-point increase in the policy rate on June 1.

Policy-makers are worried that households and businesses will absorb inflation as normal. The Bank of Canada relies on its credibility with the public to keep expectations anchored.

Every once in a while, you have to back up your words with actions. This is probably one of those times when the central bank of Canada is needed.

Email: kcarmichael@postmedia.com