Russia has a new commander. Le Pen is going to face off againstMacron in French elections. Americans are being urged to rethink their travel to China. Here is what you need to know.

In the re-run of the election, Marine Le Pen is going to face off against French PresidentEmmanuelMacron. The top two candidates will compete in a second round on April 24 to decide who will lead Europe's second-biggest economy. A late surge in support for Le Pen suggests she will be cementing her position as leader of the French far-right.

The euro gained on the first round of the French presidential election. A measure of bond market risk rose to the highest since March 2020 because of concerns that Le Pen, with longstanding sympathies for Russia, may take power in the middle of the Ukraine war.

Russia appointed a new commander as it refocused its war effort in the east of the country. Sources say that General Alexander Dvornikov, who oversaw Moscow's forces in Syria in 2015, will now lead Russian troops on the ground. Austrian Chancellor Karl Nehammer is going to meet President Putin on Monday. The World Bank predicts that the war will shrink the economy of Ukraine by 45%.

The four-year run as Pakistan's prime minister ended over the weekend after lawmakers ousted him in a no-confidence vote. Pakistan's military has ruled and now they're going to vote in opposition leader Shehbaz Sharif to succeed him.

Scott Morrison is fighting to keep his job in Australia. The Liberal National coalition has six weeks to win over voters who will head to the polls on May 21. Australia's next leader will face many challenges, from China to inflation.

The U.S. encouraged Americans to rethink their travel to China. The State Department recommended avoiding the area due to the fact that it has Covid restrictions and allowed non-emergency employees and their family members to leave.

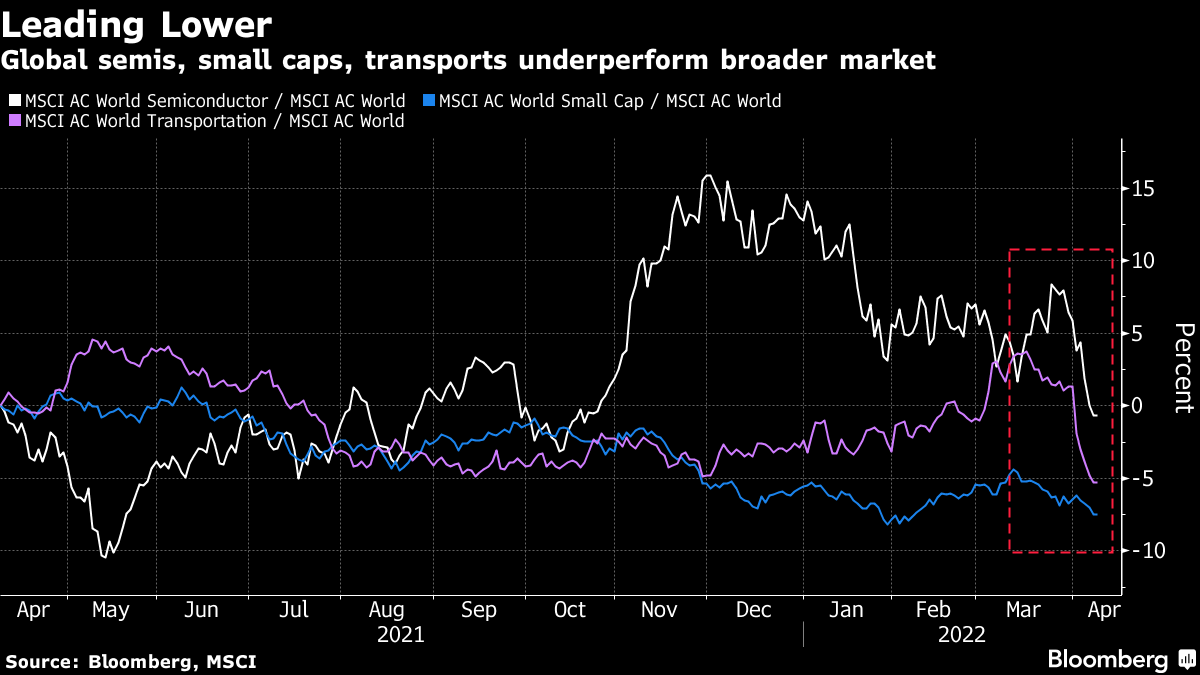

The engine of the global stock market rally is sputtering. Semiconductors, small caps and transport shares are all rolling over at the same time, which is not an encouraging sign for stock bulls. A gauge of global semi stocks has fallen to a near six-month relative low, while small cap and transport equivalents are close to the lowest since late 2020. The underlying economy makes it useful to gauge core strength in the stock market.

The risk of a recession in the world's largest economy should the Federal Reserve raise rates too much could cause the under performance. The impact of Russia's invasion of Ukraine on the European economy is weighing on global sentiment. The recent under performance of the world's bank stocks, which have slipped to a three-month relative low despite the push higher in global bond yields, may be an ominous sign for equity bulls.

Cormac is a deputy managing editor in the Markets team.

With assistance from Cormac Mullen.