The buying interest came back to the market on April 8 after three straight sessions of selling pressure. The market sentiment was supported by keeping policy rates unchanged with increasing inflation forecast and lowering growth estimates by the Reserve Bank of India.

The Nifty50 formed a bullish candle on the daily charts as the closing levels were higher than opening levels, while the BSE Sensex jumped more than 400 points. There was a Doji kind of pattern formation on the weekly charts. During the week, the index gained six-tenths of percent.

Technical trends were sending mixed signals as the daily chart is suggesting a short-term bottom but on the weekly scale, an indecisive Doji had been formed, raising questions about the up move which is in progress from the lows of 15,671 over a period of five weeks.

If the Nifty sustains above 17,600, the bulls can retest recent highs of 18,100, but a close above 18,115 will result in a fresh breakout, paving the way for a sustainable up move with much bigger targets.

For the time, high risk-taking traders with a stop-loss below 17,600 levels can consider long-side bets.

The markets were supported by bulls during the week. The Nifty Midcap index gained 1 percent on Friday and 3.6 percent for the week.

There are 15 data points that we have gathered to help you spot profitable trades.

The open interest and volume data of stocks given in this story are not the current month only data.

The Nifty has key support and resistance levels.

The key support level for the Nifty is 17,642, followed by 17,500. The key resistance levels to watch out for are 17,884 and 17,985.

The bank is called Nifty Bank.

The Bank Nifty went up 195 points to close at 37,752. The pivot level is crucial to the support of the index. Key resistance levels are placed at 37,956 and 38,158 levels.

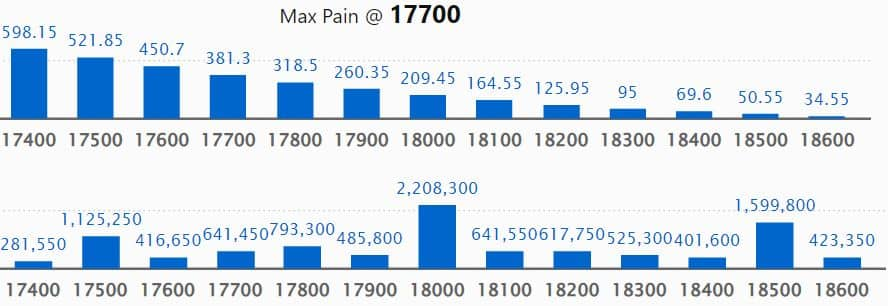

Call option data.

The maximum call open interest of 22.08 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

There are two strikes, which hold 21.6 lakh contracts and 18,500 contracts.

Call writing was seen at 19,000 strike, which added 1.06 lakh contracts, followed by 18,200 strike, which added 70,450 contracts, and 18,900 strike, which added 67,100 contracts.

The 18,000 strike shed 78,950 contracts, followed by the 17,800 strike which shed 72,750 contracts and the 18,800 strike which shed 64,950 contracts.

Put option data.

The maximum put open interest was seen at 17,500 strike, which will act as a crucial support level in the April series.

This strike has accumulated 20.68 lakh contracts, followed by 17,000 strike which has 20.81 lakh contracts.

Put writing was seen at 16,500 strike, which added 1.32 lakh contracts, followed by 18,000 strike, which added 1.07 lakh contracts, and 17,000 strike, which added 93,800 contracts.

The 17,900 strike shed 43,600 contracts, followed by 18,500 strike which shed 17,550 contracts, and 16,900 strike which shed 11,000 contracts.

There are stocks with a high delivery percentage.

A high delivery percentage is indicative of investor interest. Marico, Max Financial Services, Ipca Laboratories, Tech Mahindra, and Colgate Palmolive were some of the companies that had the highest delivery.

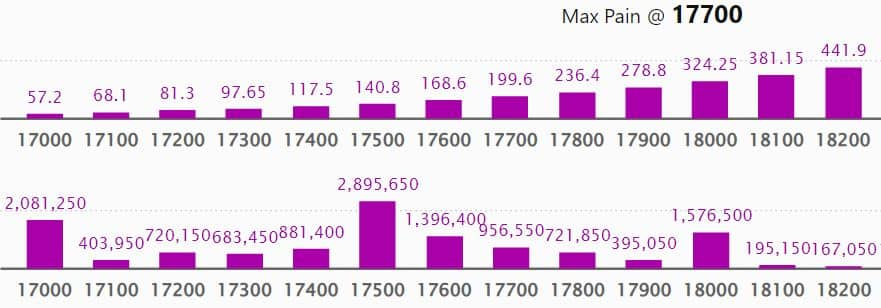

There were 90 stocks that saw long build-up.

A build-up of long positions is usually indicated by an increase in open interest and price. The top 10 stocks based on the open interest future percentage include Syngene International, Cholamandalam Investment, Persistent Systems, Polycab India, and Vodafone Idea.

14 stocks had long unwindings.

A decline in open interest and a decrease in price is a sign of a long unwinding. NBCC, Colgate Palmolive, Gujarat State Petronet, PFC, and Atul are the top 10 stocks in which long unwinding was seen.

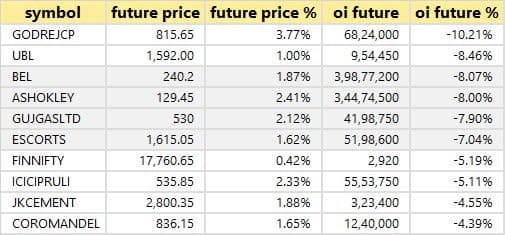

There were 31 stocks that saw short build-up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. A short build-up was seen in the top 10 stocks, which include RBL Bank, HDFC Bank, Oberoi Realty, Astral, and Nippon Life India Asset Management.

There were 64 stocks that witnessed short-covering.

A decrease in open interest along with an increase in price is a sign of a short-covering. Here are the top 10 stocks with the highest open interest future percentage, in which short-covering was seen.

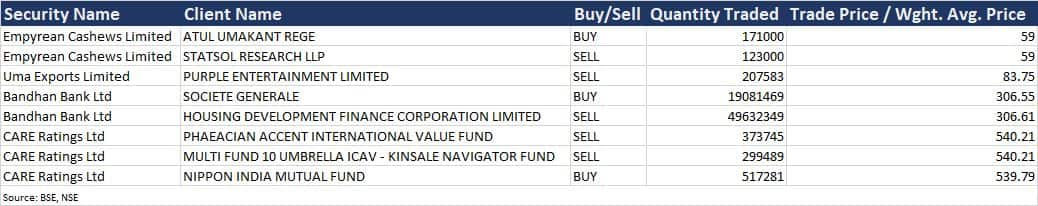

There are bulk deals.

Bandhan Bank, a private sector lender in Kolkata, was acquired by the European financial services group, Societe Generale. The shares were bought for an average price of Rs 306.55. The HDFC sold more than 5 million equity shares in the bank at an average price of Rs 306.61 per share.

The equity shares of the company were acquired by the fund at an average price of Rs 509 per share. The Multi Fund 10 Umbrella ICAV - Kinsale Navigator Fund and the Accent International Value Fund were sellers in the deal.

The equity shares were sold at an average price of Rs 83.75 per share. After a strong debut on Thursday, the stock was locked in a 5 percent upper circuit on Friday.

Click here for more bulk deals.

Results on April 11.

The earnings of several companies will be released on April 11.

There are stocks in news.

The company will make its debut on April 11.

The digital cable TV and broadband service provider's profit after tax for the March quarter declined 4.3 percent to Rs 54.5 crore, and revenue fell 17 percent to Rs 617.3 crore, compared to the year-ago period. The stock has gained in the past week and month.

The National Company Law Tribunal approved the resolution plan submitted by the subsidiary of the company.

The company has completed the sale of more than 20% of its stake in Crossword Bookstores. The company's equity stake in Crossword has been reduced. Shoppers Stop sold its stake in Crossword. The stock has risen 40 percent in the past month but has not budged in the past week.

The United States Food and Drug Administration completed an inspection of the company's manufacturing facility without any observations. The inspection ended on April 8.

The company along with its partner has entered into an understanding with a major infrastructure company. The work will be done through the deployment of a vessel and associated work. The contract value is $101 million. The stock has gained 31 percent in the past month and is currently trading flat.

Jaguar Land Rover's retail sales fell by 36 percent year-on-year to 78,008 vehicles in the fourth quarter of FY22 and the sequential decline was just 1.4 percent. Land Rover reported sales of 64,434 units for the March quarter, a decrease of 35.6% compared to the year-ago period. Despite the impact of the shortage on production and sales, the company said it continued to see strong demand for its products with global retail orders over 1,68,000 units.

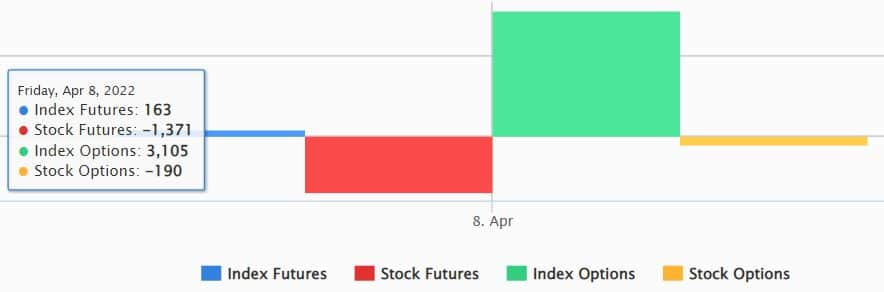

Fund flow.

DII data

Foreign institutional investors have sold shares worth over half a billion dollars, while domestic institutional investors have sold shares worth over a million dollars.

The F&O ban on the stock exchange.

RBL Bank is under the F&O ban. The stock has fallen in the last four sessions. The F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.You can download your money calendar here and keep your dates with your moneybox.