Nick taught us how to cancel the Amex Platinum card, but should we?

The title of this post was Your Platinum card arrived. It has been updated several times. I added information about new credits and fixed information that was out of date.

Thanks to the almost unbelievably good welcome bonuses that have been available in recent times for both consumer and business Platinum cards, I expect that many readers have a Platinum card of one type or another.

See the posts for more information about Platinum cards.

Now that you have maximized value from your Platinum card, it's time to go back.

You have to enroll in each one of the elite status upgrades on the Platinum Amex cards.

Platinum cards offer many perks that make traveling easier, cheaper, and better…

You can get this benefit with all consumer Platinum cards, but not Business Platinum cards. You can add your hotel chain loyalty number in order to earn hotel points and receive elite benefits, which is very unusual for 3rd party hotel bookings.

If you book a 2-night or longer stay through The Hotel Collection, you will get $100 in hotel credits to spend on dining, spa, and resort activities.

Booking any Fine Hotels & Resorts stay, even a 1-night stay, will give you free breakfast, room upgrade upon arrival, and late check-out.

Find your own Fine Hotels and Resorts deals.

Many small purchases charged by your airline receive the credit, which is supposed to be for ancillary fees. For example, award booking fees can be included. You have to pick your preferred airline in order to get reimbursed.

The Amex Airline Fee Reimbursements can be found here. What works?

CLEAR is a service that uses your eyes or fingerprints to confirm your identity.

At airports supported by CLEAR, you can skip the long ID check lines by scanning your eyes or fingerprints.

If you use your Platinum card to pay for CLEAR, you can get up to $179 back each year.

This benefit is not available on Business Platinum cards. You don't have to pay with your Platinum card in order to use this benefit.

You can use these credits to order food through the app. If delivery is available in your area, enter your location in the website.

Those who ride or order through both of these companies often will have no problem getting full value from this perk. Adding your card to someone else's account is a better option if they are a frequent rider or eater of the app.

If you're new to the service, you can use our code at check-out to get $20 off your first order of $25 or more.

This benefit is not available on Business Platinum cards.

Up to $20 per month in credits can be earned for subscriptions to Disney+, The Disney bundle, and The New York Times. You do not get up to $20 per service if you enroll here and setup the service.

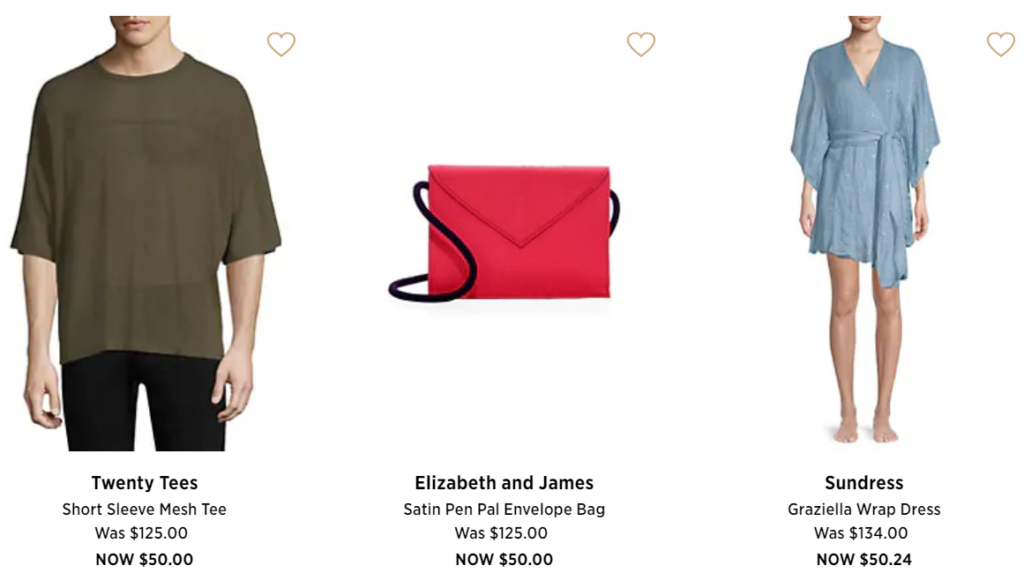

This benefit is not available with Business Platinum cards. Purchases made from January through June and from July through December will get you a $50 statement credit.

I have had good luck getting nice $50 items from the saksfifthavenue.com sale section.

You can get free shipping from a number of stores when you enroll in ShopRunner.

You can earn extra rewards by shopping on an online shopping portal.

When you first shop through the portal, you can get a sign up bonus, as well as spend bonuses throughout the year.

The benefit is available with all consumer Platinum cards, but not Business Platinum cards.

If you use your consumer Platinum card to pay for a Walmart+ membership, your entire charge will be returned each month.

It's not clear to me that we will earn anything from this, but if you sign up for Walmart+, you'll get an affiliate link.

This benefit is not available with Business Platinum cards.

Enroll here. You will receive $25 per month in rebates if you use your Platinum card to pay for monthly memberships.

5 points per dollar are earned for flights booked directly with airlines or with American Express Travel. The Business Platinum card can only be used for flights booked with American Express Travel.

5 points per dollar is an excellent rate of return for travel purchases. You won't earn hotel points with pre-bookings except for those booked through Fine Hotels & Resorts or The Hotel Collection.

Platinum cards offer good travel insurance, but you may get even better travel insurance with other cards you own. Credit card travel insurance is Ultra-Premium.

The Business Platinum card will give you 35% points back when you pay with American Express Travel points. When booking a first or business class ticket, cardholders will receive this benefit. Membership rewards points are worth 1.5 cents per point towards paid flights.

Consumer Platinum cards don't get this benefit, so using points to pay for flights results in poor value.

If you see an opportunity to get great value by transferring to an airline transfer partner such as Aeroplan or ANA for Star Alliance flights, then you should keep your Membership Reward points. There are some excellent sweet spot award opportunities.

You can see these posts for ideas.

Amex offers can be loaded to your Amex card and you can use them in a variety of ways.

Go through each one to make sure you are getting the most from your Platinum card.

| Benefit | How to access or enroll | Available to Platinum Authorized users? |

|---|---|---|

| 5X points at amextravel.com: Earn 5X points for prepaid hotel and airline bookings at Amextravel.com | This benefit is automatic. | Yes. Points and bonus points are added to the primary card holder's account. |

| $200 airline fee credit: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. | Log in and go to Benefit page and click “Select a Qualifying Airline”. For tips on using this benefit, please see: Amex airline fee reimbursements. What still works? | No. Spend on authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| Airport Lounge Access - Centurion Lounges, Airspace Lounges, Escape Lounges: Cardholder plus two guests are allowed free. Beginning 2/1/23, in most cases guests will be charged $50 each (details here). | No need to enroll. Simply show your Platinum card when visiting a Centurion Lounge. | Yes |

| Airport Lounge Access - Delta SkyClubs: Cardholder is allowed free when flying Delta same day. Extra charge for guests. | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Delta SkyClub. | Yes |

| Airport Lounge Access - Priority Pass Select Lounges: Priority Pass Select member plus two guests are allowed free entrance. Unfortunately, this membership does not include Priority Pass restaurants. | You must sign up for Priority Pass Select. Go to benefit page and click “Enroll in Priority Pass”. You will receive a membership card by mail. Present Priority Pass card and boarding pass at lounge entrance. | Yes. Each authorized user must sign up for Priority Pass Select. |

| Airport Lounge Access - select Lufthansa Lounges | Free access to Lufthansa Business Lounges (with confirmed ticket) or to Senator Lounges (with Business Class ticket) in the satellite building of Terminal 2 at Munich Airport and in Terminal 1, Departure Area B, at Frankfurt Airport. Valid only when flying Lufthansa, SWISS or Austrian Airlines. | Yes |

| Cell Phone Protection: Max $800 per claim, $50 deductible. | No need to enroll. Pay your cell phone bill with your Platinum card. | Yes |

| CLEAR credit: Get up to $179 per year reimbursed for CLEAR subscriptions. | No need to enroll. Pay for CLEAR with your Platinum card. See also: 5 ways to get CLEAR for less. | No. Spend on authorized user cards does count, but only $179 per year will be reimbursed altogether. |

| Global Entry or TSA Pre fee credit: Full reimbursement for signup fee once every 5 years, per card. Note: signup for Global Entry since that includes TSA Pre. | Sign up for Global Entry here. Pay with your Platinum card. Reimbursement should happen automatically. | Yes. Pay with the authorized user card in order to get reimbursed. Terms state “Additional Cards on eligible Consumer and Business accounts are also eligible for the $100 statement credit”. This works with no fee Green and Gold authorized user cards too. |

| Emergency Medical Transportation Assistance | Call the Premium Global Assist Hotline: 1-800-333-Amex (toll free), or 1-715-343-7977 (direct-dial collect) | Yes |

| Hilton HHonors Gold Status: Hilton Gold members receive free breakfast, room upgrades when available, and other perks at Hilton hotels. | Go to benefit page, find the Hilton HHonors Gold benefit, and click “Enroll Now”. | Yes. Authorized users may have to call Amex to enroll. |

| Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). | Go to benefit page, find the Marriott Gold benefit, and click “Enroll in Marriott Gold”. | Yes. Authorized users may have to call Amex to enroll. |

| International Airline Program: Save money when booking premium cabin international flights originating in the US or Canada. | Book your flight on amextravel.com. Make sure to log into your Amex account to see flight discounts. | Yes |

| Fine Hotels & Resorts: Book high-end hotels through Amex Fine Hotels & Resorts and get: room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity. Also: Earn 5X Membership Rewards for prepaid bookings. | Browse to www.americanexpressfhr.com and log into your Platinum account. | Yes |

| Preferred Hotels & Resorts Elite Status: Lifetime elite status offers perks such as extra points, welcome amenity | Click here to enroll | Yes |

| Fiesta Rewards Platinum Status | Use the Spanish language page: http://www.fiestarewards.com/inscripcion and enter code: AMEXPLATINUM | Yes |

| National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. | Enroll here. | Yes |

| Hertz Rental Car Privileges: Special elite-like benefits for Platinum cardholders, plus discounts, plus four hour grace period for rental car returns. | Details and enrollment form found here. | Yes |

| Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line | Participating cruise lines and other info can be found here. | Yes |

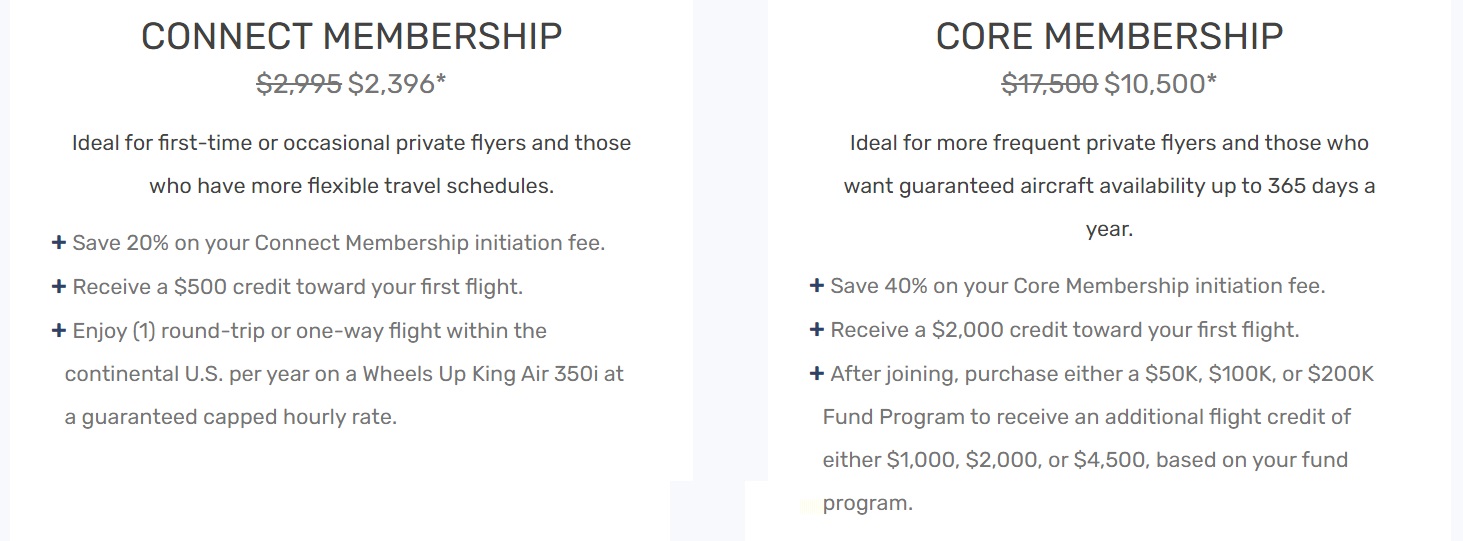

| Premium Private Jet Program: 20% off plus one time $500 credit towards Wheels Up Connect or 40% off plus one time $2K towards Wheels Up Core memberships. | Sign up here. | Yes |

| ShopRunner: Free shipping at a number of merchants. | Sign up here. | Yes |

| Neiman Marcus In-Circle | Call 1-800-525-3355 to enroll | Yes |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| $200 in Uber / Uber Eats Credits: Amex will reimburse $15 per month ($35 in December) for Uber charges. You will also get Uber VIP status. | Add your Platinum card number to your Uber account as a payment method. You do not have to pay with the Platinum card in order to get this benefit. Important: when requesting a ride, select Uber Cash for payment in order to use your credits. | No. Authorized user cards do not receive their own $200 in Uber credits or VIP status. |

| $200 Hotel Credit: Get $200 back per calendar year towards prepaid Fine Hotels + Resorts or The Hotel Collection bookings | No need to enroll. Book through Amex Travel and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| $240 Digital Entertainment Credit: Up to $20 per month rebate for select digital entertainment services (Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times ) | Enroll here. Enroll in any of the listed services and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $20 per month will be reimbursed altogether. |

| $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. | Enroll here. Pay with your consumer Platinum card at Saks Fifth Avenue online or at locations in the US and US Territories. | No. Spend on Authorized user cards does count, but only $50 per 6 months will be reimbursed altogether. |

| Free Walmart+ Subscription: Get back the full cost, including taxes, for a Walmart+ monthly subscription. | No need to enroll. Use your Platinum card to pay for a monthly Walmart+ subscription. | No. You can use an Authorized user card to pay, but you won't get more than one credit per month. |

| $300 Equinox Credit: Get $25 per month for select Equinox subscriptions. | Enroll here. Use your Platinum card to pay for monthly Equinox All Access, Destination, E by Equinox, or Equinox+ membership fees. | No. Spend on Authorized user cards does count, but only $25 per month will be reimbursed altogether. |

| $300 SoulCycle Rebate: Charge the full price of a SoulCycle at-home bike and get $300 back. | Must join Equinox first (see above) | Sort of: Each Platinum account can get $300 back on each of 15 bikes purchased per year. |

| 5X points on flights booked directly with airlines. With business cards you must book through Amex Travel to get 5X. | Automatic benefit | Yes. Points and bonus points are added to the primary card holder's account. |

| Active Military Fee Waiver: Amex will waive consumer card fees (including annual fees) for US active military personnel. | Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Military Lending Act (MLA) | Yes (primary user must call and can get fees waived for additional cardholders) |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| First authorized user free: Add one Platinum authorized user for free. Add up to 3 more for $175. | Simply add an authorized user to your account | N/A |

| Invest with rewards: Liquidate Membership Rewards points for 1 cent each when deposited to your Morgan Stanley brokerage account. | Log into your account to redeem points to your brokerage account. | No. |

| $500 anniversary spend award: Spend $100K in a cardmember year to get $500. If you spend exactly $100K per year, that amounts to a bonus of half of 1 cent per dollar spent. | This benefit is automatic | Not really. Authorized user card spend does contribute towards the required $100K spend, but authorized users do not get their own $500. |

| $695 Annual Engagement Bonus: Platinum CashPlus clients can get a $695 Annual Engagement Bonus. | Details here: Morgan Stanley Platinum Card Fee Free (how to earn the Annual Engagement Bonus) | No |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| Invest with Rewards: Liquidate Membership Rewards points for 1.1 cents each when deposited to your eligible Schwab account. | Log into your account to redeem points to your Schwab account. | No. |

| $100 to $200 statement credit | Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter. | No. |

| Benefit | How to access or enroll | Available to Platinum Employee Cards? |

|---|---|---|

| 1.5X points per dollar: Earn 1.5X on individual purchases of $5000 or more; and on select categories: Construction material & hardware, Electronic goods retailers and software & cloud system providers, and Shipping providers | Automatic | Yes. Points and bonus points are added to the primary card holder's account. |

| $400 in Dell Credits: Up to $200 in credits each year from January through June; and another $200 July through December. | Go to benefit page to enroll. | No. Employee cards do not receive their own Dell credits. |

| $120 in Wireless Credits: Up to $10 per month when you use your card to pay for wireless telephone service. | Go to benefit page to enroll. | No. Employee cards do not receive their own wireless credits. |

| $360 in Indeed Credits: Up to $90 per quarter for purchases with Indeed | Go to benefit page to enroll. | No. Employee cards do not receive their own Indeed credits. |

| $150 Adobe Credits: Up to $150 per year on annual prepaid plans for Creative Cloud for teams and Acrobat Pro DC with e-sign for teams | Go to benefit page to enroll. | No. Employee cards do not receive their own Adobe credits. |

| 35% points rebate on airfare: Pay with points for airfare on your selected airline or for business or first class with any airline and get 35% of your points back. | Book flights through AmexTravel.com and select to pay with points. | No. |