The U.S. warns India against aligning with Russia. Fed officials have a plan to fight inflation. Canada wants to ban foreigners from buying homes. Here is what you need to know.

President Joe Biden's top economic adviser said the administration warned India against aligning itself with Russia. While the U.S., Europe, Australia and Japan have imposed sanctions on Russia in response to its war against Ukraine, India continues to import Russian oil. The U.S. imposed new sanctions on Russian banks and Putin's daughters. The war in Ukraine is covered here.

Federal Reserve officials laid out a plan to shrink their balance sheet by more than $1 trillion a year while raising interest rates to counter the hottest inflation in four decades. Treasuries fell across the curve and tech stocks sank the most in a month. The retreat on Wall Street is set to follow in Asia, with futures falling for Australia, Japan and Hong Kong.

China signaled it would loosen monetary policy at an appropriate time and explore new measures to boost consumption. America is being put to shame by China's $2.3 trillion infrastructure plan.

Canada will ban most foreigners from buying homes for two years in order to cool off a surging real estate market, according to a person familiar with the matter.

Home prices in Canada have risen more than 50% in the last year.

The source is CREA.

John Lee, a veteran Hong Kong law enforcement official, announced his plan to run for the city's top job, in a sign that Beijing is focused on further cracking down on dissent in the Asian financial hub. China's Liaison Office told local elites that Lee had the approval of the outgoing Chief Executive.

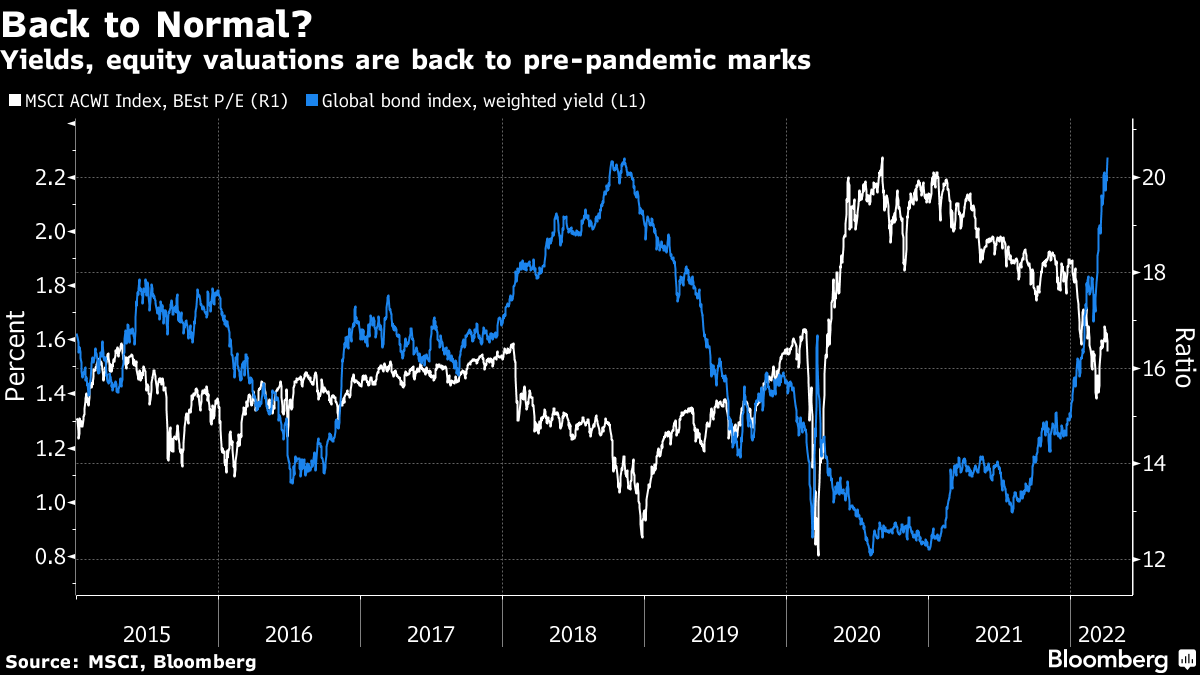

We are looking more normal across major assets as central banks look to end extraordinary stimuli. The average weighted yield for the Global Total Return Index of bonds has gone up toPukiWikiPukiWikiPukiWikis high of 2.27%. The 12-month forward price-to-earnings ratio for the All Country World Index fell below the early 2020 peak before bouncing back above it.

It could offer some encouragement for bonds and stocks to do better going forward. If the world calms down, that's all that's needed. When adjusted for inflation, the yields are still negative, even though they have gone down. The P/E ratio was 3 points below the last time nominal bond yields were this high.

Garfield Reynolds is the Chief Rates Correspondent for Bloomberg News in Asia.

With assistance by Garfield Clinton Reynolds.