After a day of consolidation, the market resumed its northward journey again and started off April series and financial year FY23 on a healthy note by reporting more a percent gains on April 1. Sentiment was lifted by a fall in oil prices as well as the approval of mega power policy by the cabinet.

The rally was led by banks, financial services, and auto stocks. The Nifty50 jumped 206 points to 17,670 and formed a bullish candle on the daily and weekly charts. The index gained 3 percent during the week.

Nifty50 seems to have resumed its up move as it registered a decent bullish candle on the weekly charts after a week of pause. It is looking like it is going to break above the minor consolidation zone on daily charts.

The indicator setup across the frame frames is slowly shifting in favor of bulls. There is a chance of testing 18,000 levels somewhere in the next week, but sustaining above 17,442 levels looks inevitable in the next two or three trading sessions.

According to Mazhar Mohammad, traders can stay long with a stop-loss below 17,400 levels and look for a target in the zone of 17,900 levels.

The markets joined rallies. The Nifty Midcap and Smallcap indices increased in value.

There are 15 data points that we have gathered to help you spot profitable trades.

The open interest and volume data of stocks given in this story are not the current month only data.

The Nifty has key support and resistance levels.

The key support level for the Nifty is 17,494. If the index goes up, the key resistance levels to watch out for are 17,775 and 17,880.

The bank is called Nifty Bank.

Bank Nifty surged by over 700 points or 2.1 percent to close at 37,148 on April 1. The important pivot level is 36,524 and will act as crucial support for the index. Key resistance levels are placed at 37,491 and 37,834 levels.

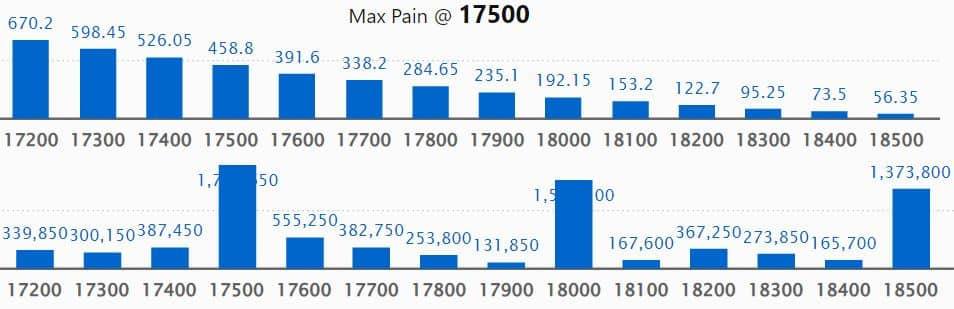

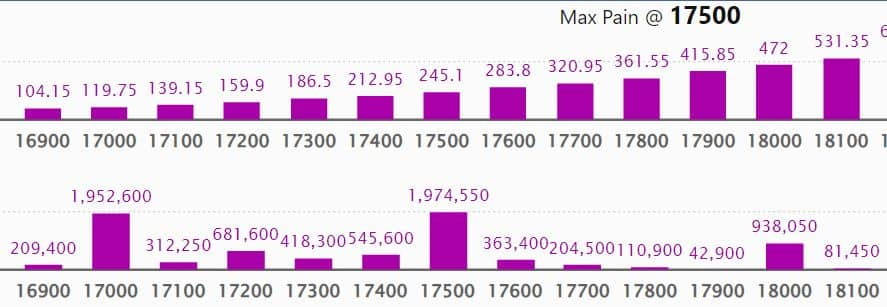

Call option data.

The maximum open interest was 17.66 lakh contracts. The 18,000 strike has accumulated over 13 million contracts.

Call writing was seen at 18,500 strike, which added 2.54 lakh contracts, followed by 17,500 strike, which added 2.11 lakh contracts, and 17,600 strike, which added 2.1 lakh contracts.

The 17,000 strike shed 1.62 lakh contracts, followed by 17,300 strike which shed 22,250 contracts and 16,800 strike which shed 15,750 contracts.

Put option data.

The maximum put open interest of 19.74 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which has over 20 million contracts, and 16,500 strike, which has over 16 million contracts.

Put writing was seen at 17,000 strike, followed by 17,500 strike, which added 2.07 lakh contracts, and 17,600 strike, which added 1.92 lakh contracts.

The 17,400 strike shed 58,900 contracts, followed by the 18,500 strike which shed 35,250 contracts, and the 18,400 strike which shed 7,550 contracts.

There are stocks with a high delivery percentage.

A high delivery percentage is indicative of investor interest. The highest delivery was seen in Persistent Systems.

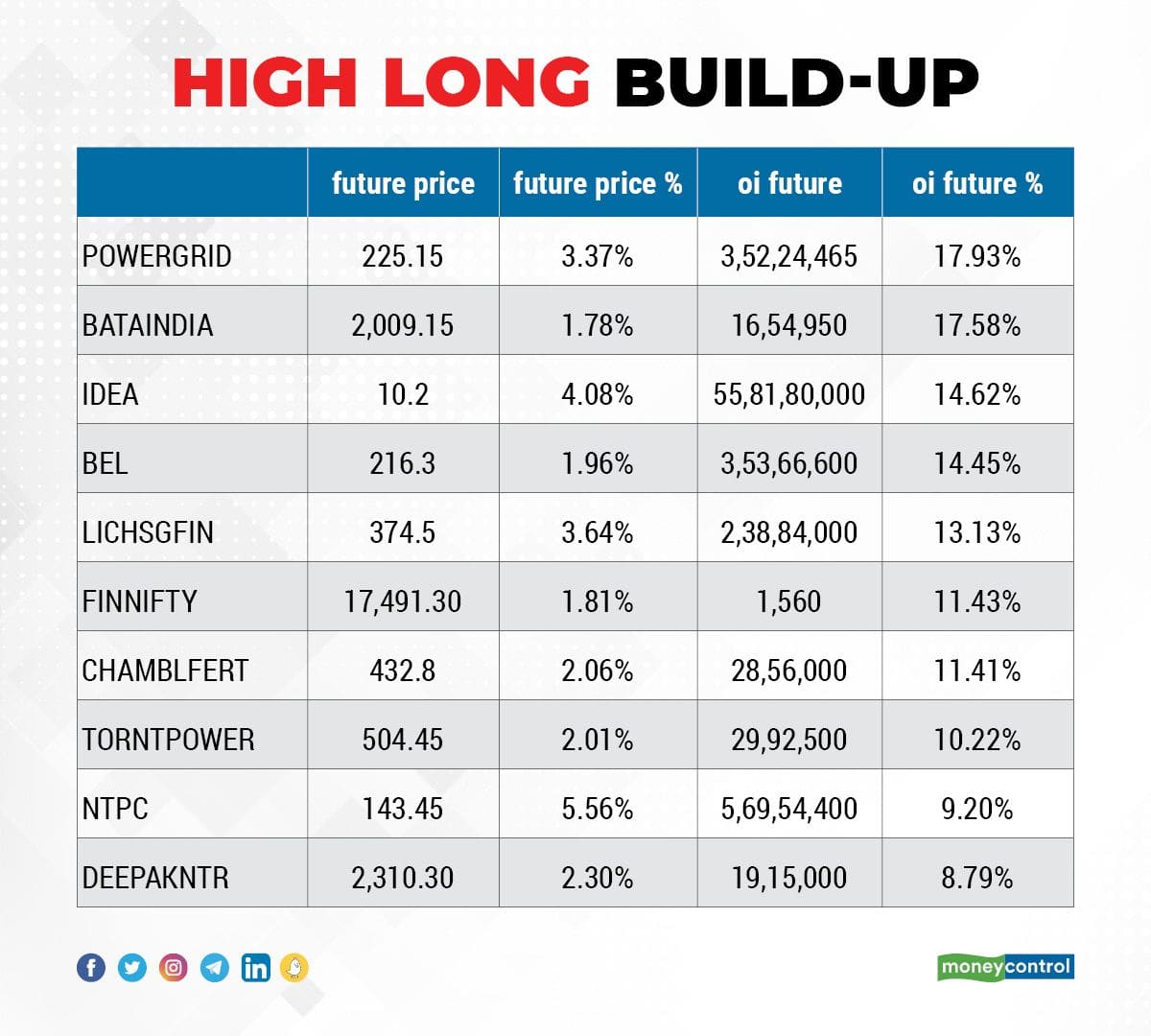

There were 98 stocks that saw long build-up.

A build-up of long positions is usually indicated by an increase in open interest and price. The top 10 stocks based on open interest future percentage are Power Grid Corporation of India, Bata India, Vodafone Idea, Bharat Electronics, and LIC Housing Finance.

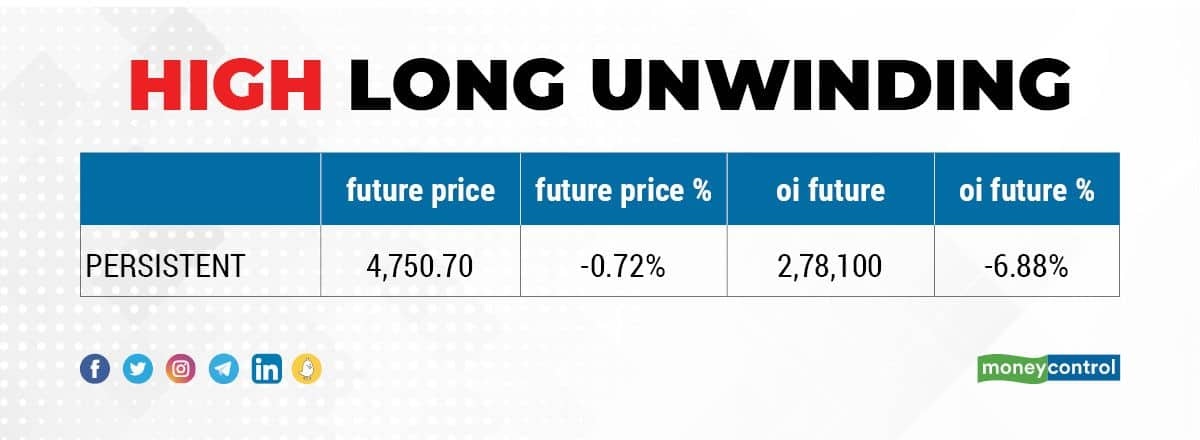

One stock saw a lot of selling.

A decline in open interest and a decrease in price is a sign of a long unwinding. The stock with the highest open interest future percentage is Persistent Systems.

There were 44 stocks that saw short build-up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. A short build-up was seen in the top 10 stocks based on the open interest future percentage.

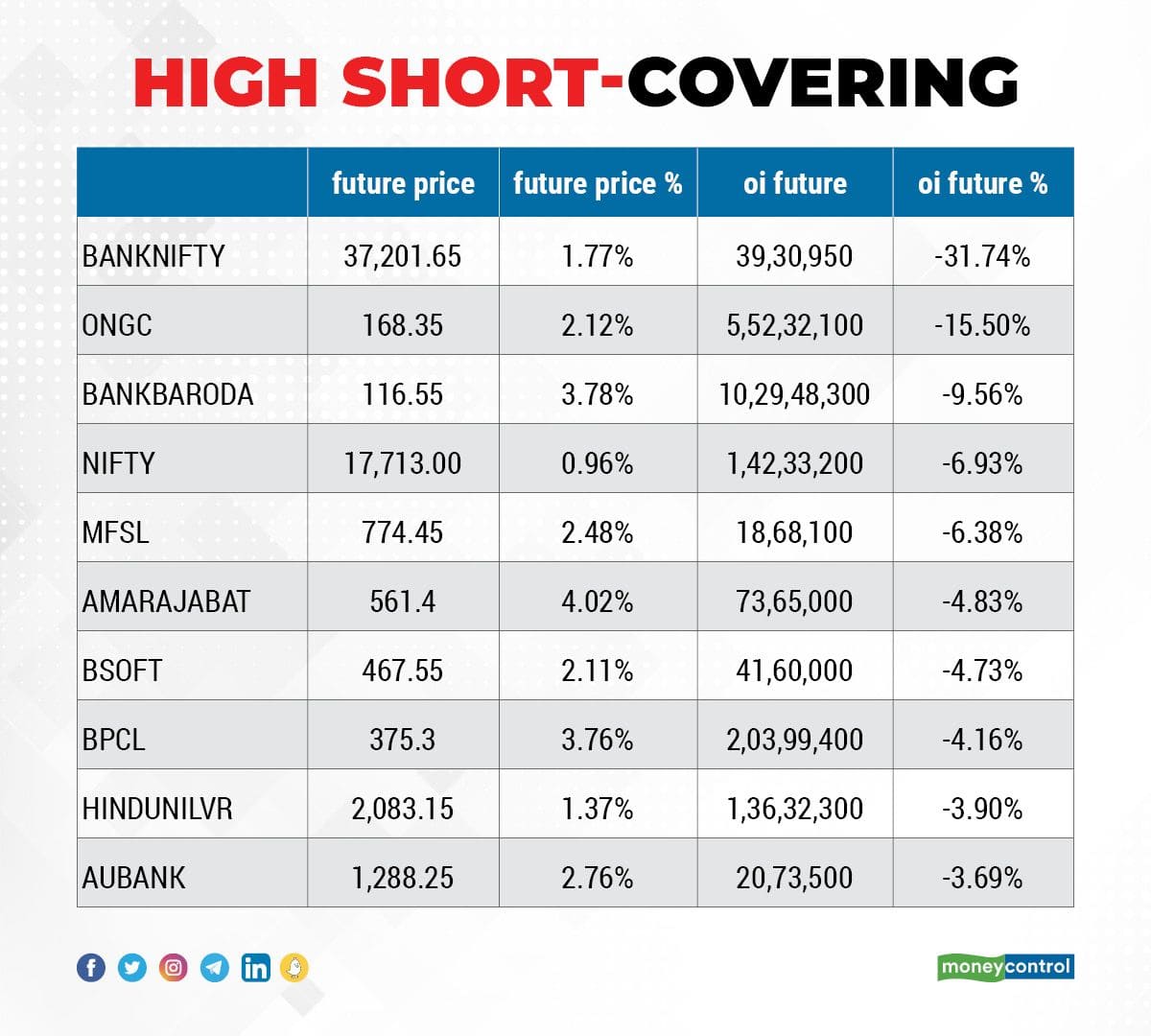

There were 58 stocks that witnessed short-covering.

A decrease in open interest along with an increase in price is a sign of a short-covering. Bank Nifty, ONGC, Bank of Baroda, Nifty and Max Financial Services are the top 10 stocks in which short-covering was seen based on the open interest future percentage.

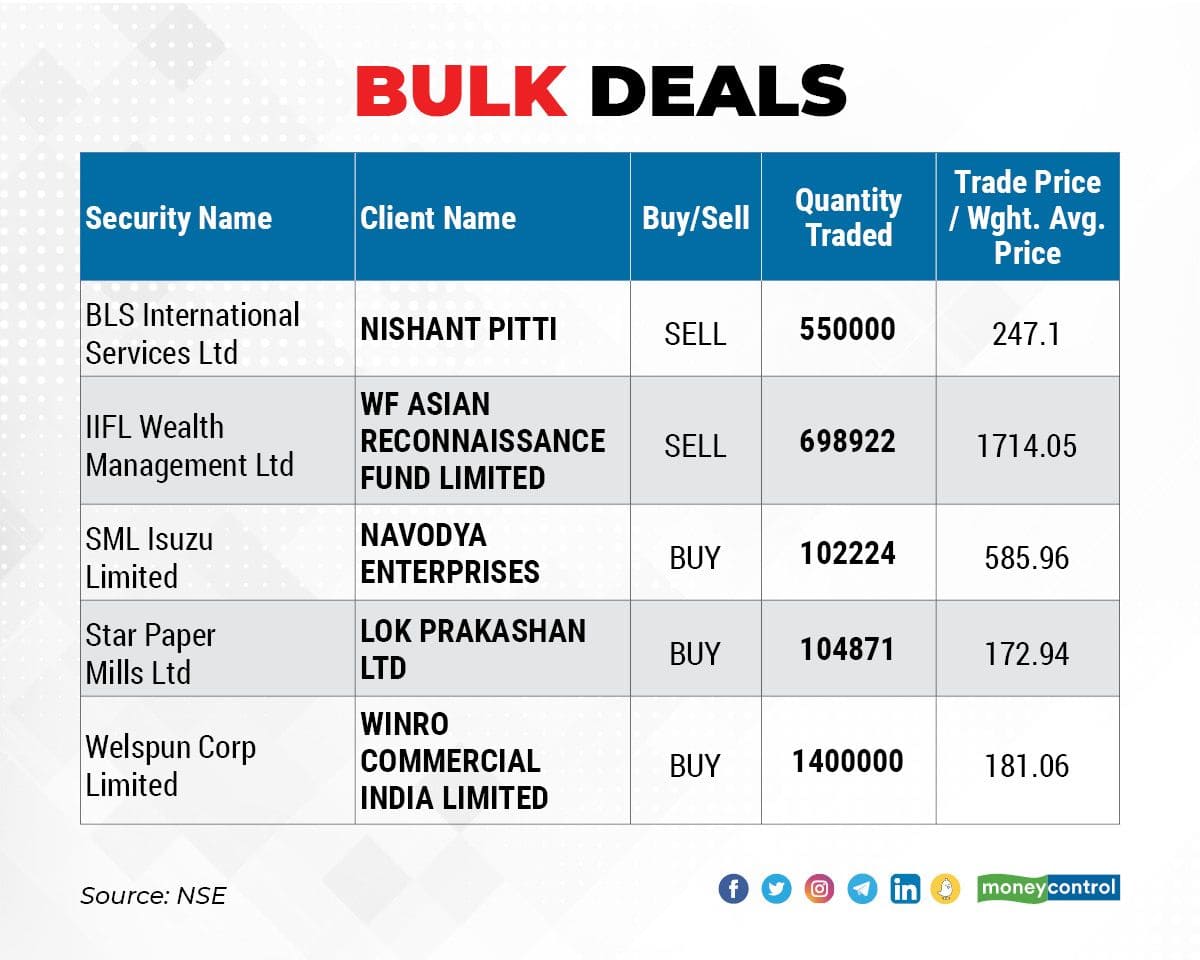

There are bulk deals.

Pitti sold his shares in the company through open market transactions. The shares were sold at an average price of Rs 247.1 per share.

The company's equity shares have been sold via open market transactions at an average price of Rs 1,714.05 per share.

The company's equity shares were acquired via open market transactions at an average price of Rs 585.96 per share.

Lok Prakashan bought over one million equity shares in the company at an average price of Rs 172.94 per share.

Welspun Corp: Winro Commercial India acquired 14 lakh equity shares in the company at an average price of Rs 181.06 per share.

Click here for more bulk deals.

There are analysts and investors meetings on April 4.

The company's officials will meet with a broker.

The officials of Som Distilleries and Breweries are going to meet.

The officials of the company will meet investors.

The company's officials will meet with VT Capital.

There are stocks in news.

TVS Motor (Singapore) is a subsidiary of TVS Motor Company. A 70 percent stake in the United Kingdom-based company was acquired by limited. EBCO provides smart connected mobility solutions in the city and mountain biking segments. Corratec e-bikes are the exclusive distributor of Corratec in the UK and the company has tie ups with most major dealers. TVS Motor sold 3.07 lakh units in March, which was down from 3.22 lakh units sold in the same month last year.

Hero MotoCorp sold 4.50 lakh units of motorcycles and scooters in March, down from 5.76 lakh units sold in the same month last year. In the financial year, sales dropped to 49.44 lakh units, compared to 57.91 lakh units sold in the previous year.

The company has received a notice of demand from the Income Tax Department. The Joint Development Agreement for the land at Kukatpally is related to assessment year 2013-14. The notice is not tenable in law.

The bank's core deposits grew by 6.27 percent to Rs 80,385 crore for the year ended March 2022, while gross advances grew by 9.5 percent to Rs 57,726 crore. At the end of March 2021, the share of CASA to total deposits was 31.5 percent. The lender expects a growth in deposits and gross advances of 17 and 12 percent, respectively.

A Memorandum of Understanding has been signed with the Government of Chhattisgarh for setting up a 1,000 MW hydro pumped storage project in the state.

During the month of March, the Public Health Institute of Chile conducted an inspection of the manufacturing facility at Daman, India. No observations critical to good manufacturing practices were found at the end of the inspection.

The company has signed an agreement to acquire a portfolio of brands. The company will have a stronger presence in vitamins, minerals and supplements.

The company has entered into an agreement to acquire a cardiovascular brand in India. The acquisition cost is more than $60 million. For heart failure patients with reduced ejection fraction, the Cidmus is indicated.

Fund flow.

DII data

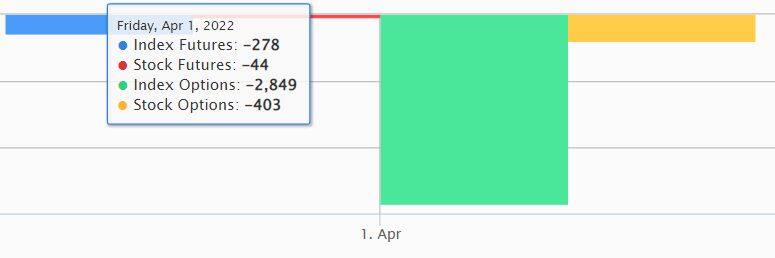

The data shows that foreign institutional investors have bought and sold shares in the same day.

The F&O ban on the stock exchange.

We don't have any stock under the F&O ban for April 4. The F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.