China says it has a new variant of Covid. War crimes spur calls for harsher sanctions. Pakistan politics are in turmoil. Here is what you need to know.

A new variant of the Covid-19 has been reported in China, with state media reporting a case. The new iteration of the virus, isolated from a mild Covid-19 patient in a city near Shanghai, evolved from the BA. 1.1 branch of the omicron variant, according to Global Times. A man in Germany had 90 Covid shots so he could sell forged vaccination cards, and a Singapore minister said the city wouldn't tighten Covid rules again even if cases rise.

According to diplomats familiar with the discussions, some European Union governments are pushing for the bloc to quickly impose new sanctions in response to reports that Russian troops executed civilians in Ukrainian towns. An increasing number of Russian ships are changing their flags to other countries, the EU tells China it expects Beijing to help end the war, and India says it will continue to buy cheap Russian oil.

Pakistan was thrown into chaos when Prime Minister Imran Khan called for a new election after one of his political allies scrapped a no-confidence vote. The no-confidence motion was brought by the opposition and was canceled by the deputy speaker. The Supreme Court is reviewing the motion's dismissal.

Beijing's move to ease an audit dispute that threatens the U.S. listings of Chinese firms may give stocks a boost Monday. The U.S. Treasury yield curve is showing warnings that economic growth will slow. The price of crude oil fell.

Hong Kong's election season started on Sunday despite a delay due to the Covid crisis. The committee of 1,500 mostly pro-Beijing electors has two weeks to choose a candidate. The people are being watched.

The war in Ukraine has had a major impact on the markets. The way prices were rising helped obscure what could be the longer-term impact. At least 100 companies pulled more than $45 billion of financing deals because of the war and other uncertainties.

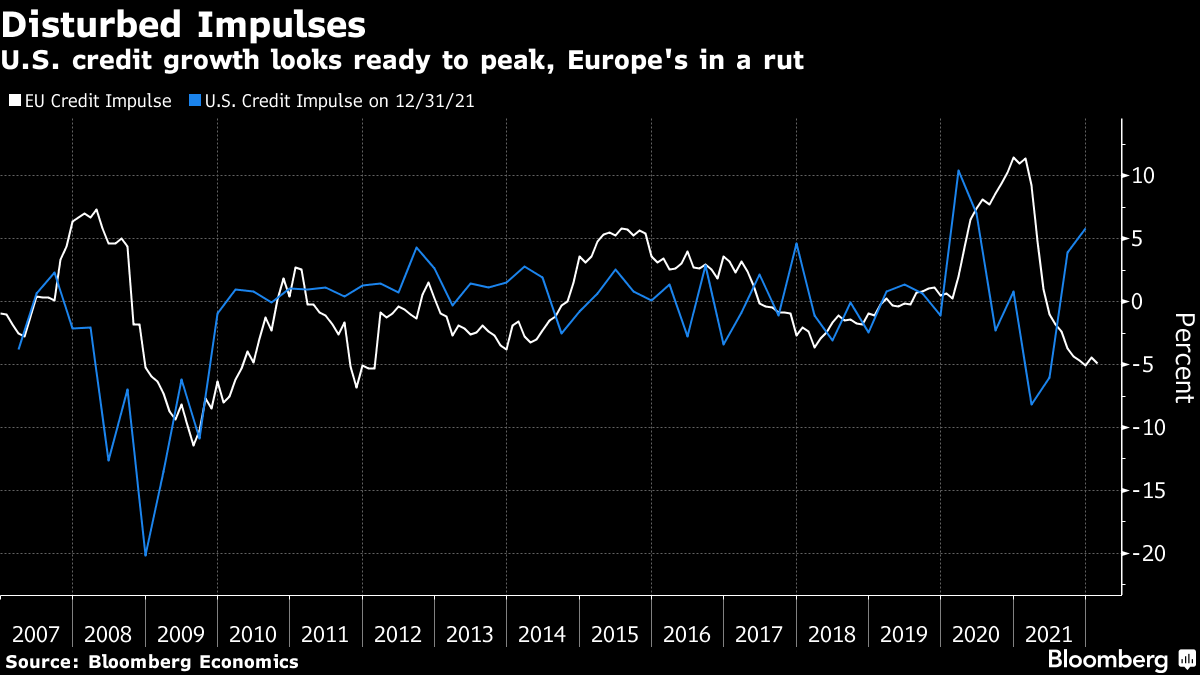

As central banks tighten policy, that could cause economies to go into recession. Europe and the U.S. have differing credit impulses, neither of which has fully recovered from the Pandemic. If Europe's impulse stays in its trough and credit growth in the U.S. cools from current levels, that offers a chilly outlook for the global economy.

Garfield Reynolds is the Chief Rates Correspondent for Bloomberg News in Asia.

With assistance by Garfield Clinton Reynolds.