On March 28, management of the company announced at an annual shareholder meeting that it intends to seek shareholder approval for a stock split. When the stock split in 2020, it was 5-for-1. A similar split would mean each share would be valued at around $200.

The mechanism works by cutting how much each share is worth by a fifth and then paying a dividend of four additional shares, so stock owners are made whole. Between the announcement of the last split and the actual split in August 2020, the stock price ran up 80%.

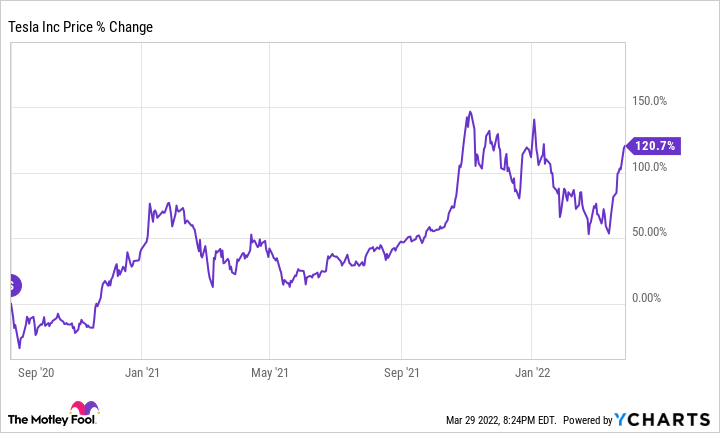

YCharts has TSLA data. The stock split occurred on August 31, 2020.

Anyone who purchased the stock prior to the announcement and held on through the split made an 80% return in less than a month. The stock is up an additional 120% since August 31, 2020, including the price correction that occurred after the last split.

YCharts has TSLA data.

The business performance is what has propelled shares further over the past year and a half, even though the split may have been a positive catalyst in the short term. With the positive direction of the business, investors should be excited about the execution and plans.

Many people have doubted the existence ofTesla. Regardless of what your opinion is of CEO and founder Musk or the company's business practices,Tesla has brought electric vehicles into the mainstream. In the fourth quarter, the company delivered over 300,000 EV. In the fourth quarter, General GM delivered 26 electric vehicles, while Ford Motor Company delivered 27,410 mustang Mach-Es.

The image is fromTesla.

The US EV race is currently being led byTesla. Although it will be late to the electric truck party behind Rivian and Ford, there will be another catalyst to boost sales with the long-awaited Cybertruck.

The global competition is much more stiff than in the US.

| Manufacturer | 2021 Total EV Production | Market Share |

|---|---|---|

| Tesla | 936,712 | 14.4% |

| Volkswagen (Germany) | 757,994 | 11.7% |

| SAIC Motor (China) | 683,086 | 10.5% |

| BYD (China) | 593,878 | 9.1% |

The source is InsideEVs.

EV's are not a winner-take-all industry, which makes sense as there are some capable competitors overseas. In its factories in California and China, the company can produce over 1 million vehicles annually. It has factories in Berlin and Texas that will increase its capacity as demand increases. Management expects 50% annual growth in vehicle deliveries over a multi-year horizon.

With increased production, investors should be excited about the future.

The company nearly declared bankruptcy on Christmas Eve 2008. As of December 31, the company had $18.6 billion in cash and $5.2 billion in debt. In the year 2021,Tesla produced $5 billion in free cash flow, showing its ability to survive without outside funding.

Many people thought that the company was not profitable and that it was selling energy credits to make up for it. The company generated $314 million from credits in the fourth quarter, down 22% from a year ago. It also generated a 14.7% operating margin, which is nearly triple Ford's 5.4% and GM's 4.5% operating margins. The increase in operating efficiency allowed the company to increase its earnings per share. Those bearish on the stock are being delivered a crushing defeat because of the fact that the business is profitable and growing quickly.

The extreme valuation of the stock is a point for the bears. The P/E ratio of the stock is 347 times free cash flow. Ford and GM have P/Es of 3.8 and 6.4, respectively.

However, the company is not a legacy one. The direct-to-consumer business model gives it margin advantages and it has other ambitions. With Musk steering the company, it is unclear what venture will be next. Some may consider this a bad characteristic, but others embrace it.

The image is fromTesla.

The primary investment risk right now is the valuation of the business. Buying a great business at the wrong price can lead to poor investment returns.

As time goes on, the stock's valuation will come down due to the rising profit margin and growing revenue.

With an excellent business in a growing market, it makes a great investment. It is smart to ease into the stock over time because of the high valuation. There have been several corrections to the current high valuation ofTesla stock. Waiting may not be the best decision for investors if the stock reacts as it did during the 2020 stock split. The stock ran up 80% in 2020 and I think it can do it again.

The writer of this article may disagree with the recommendation position of a premium advisory service. We are motley! Asking an investing thesis helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.