The Double Cash Card will be changed as of this spring. The implications for most people shouldn't be that big, but I still think these are positive developments.

The Citi Double Cash Card changes are live as of today. Let's go over the details of the changes to how the account looks.

The Citi Double Cash Card is a no annual fee card that has historically offered 1% cash back when you make a purchase, and 1% cash back when you pay for that purchase.

Cash back rewards could be converted into ThankYou points with this card. You could earn 2x Citi ThankYou points per dollar spent if you converted at the rate of one cent per point. It's one of the best cards for everyday spending because of its 3.4% return.

This card now earns ThankYou points. This is noteworthy, but not as consequential as you might think.

Changes have been made to the Citi Double Cash Card.

The implications for maximizing rewards are limited.

Many people were skeptical about the changes to the Citi Double Cash Card when I posted about them earlier this year. One reader commented.

I have now read FOUR articles on this change, and I believe every single one of them is an unadvertised-as-such paid-for promotion. Because let’s look at what they’re really doing. They are TAKING AWAY the actual U.S. dollar money you got back in exchange for … NOTHING. Nothing you couldn’t already CHOOSE to do IF YOU WANTED TO. They are TAKING AWAY an option in exchange for NOTHING.

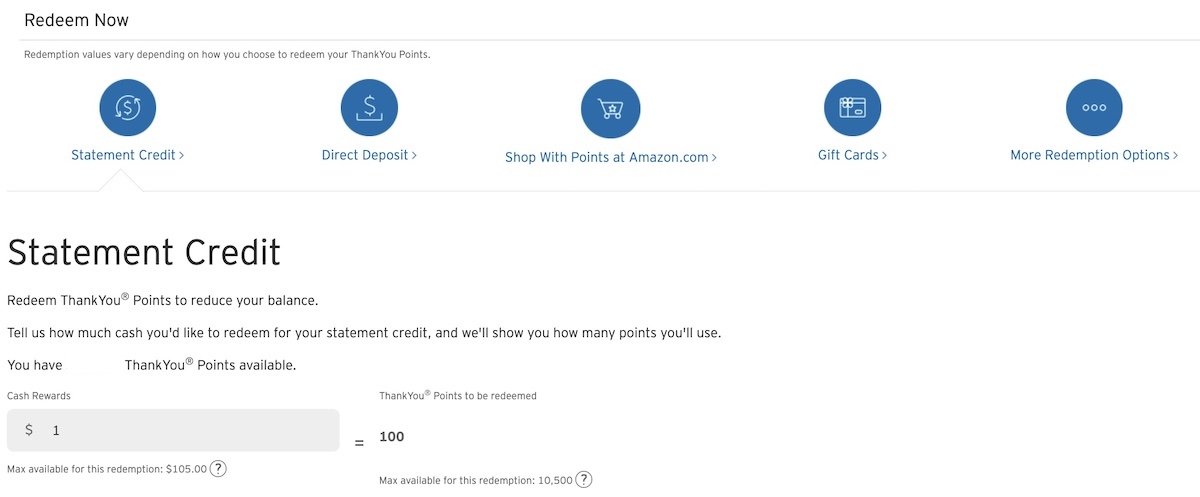

Hopefully people will believe once and for all that this wasn't a devaluation with these changes now live. You can still cash out your rewards even though nothing is being taken away. What has changed?

I see my total ThankYou points when I log into my account, rather than the total cash back. The marketing has been updated to reflect that you can earn ThankYou Points twice.

When it comes time to redeem, you are in a better spot than before. You can convert your ThankYou points into cash back at a rate of one cent per point. 100 ThankYou points could be converted into $1 cash back.

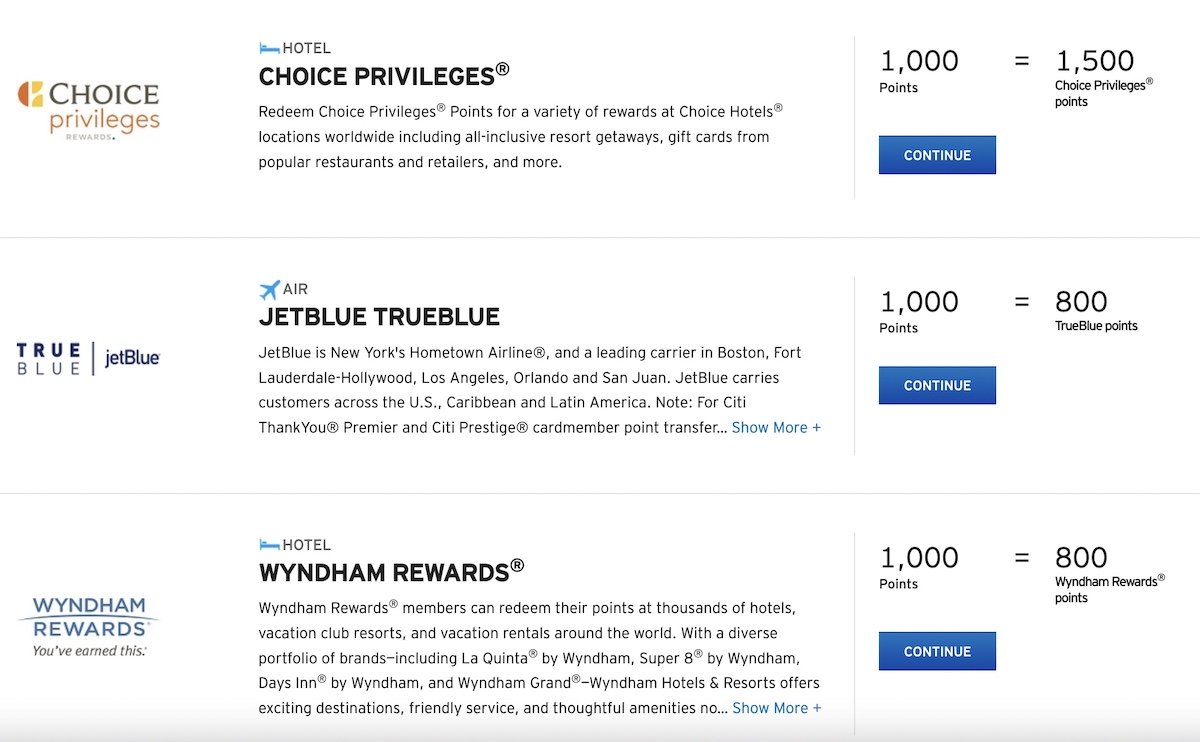

It is now possible to convert ThankYou points into three airline and hotel currencies.

You will get a better transfer ratio if you have the card in conjunction with the Citi Premier Card.

The changes to the Citi Double Cash Card are as expected. I think these adjustments are more about marketing than anything else. The ThankYou points can be redeemed at the same rate as before for statement credits, cash back, etc., though the card now earns ThankYou points rather than cash rewards.

The goal is to make this a more versatile card that can earn travel and other rewards, rather than just a cash back card. You can't transfer points to ThankYou partners unless you also have another premium card that earns ThankYou points.

If you're looking to earn cash back, these changes aren't negative. Nothing has changed for the worse. You can accrue cash back at the same rate, and you can even cash out without a minimum.

What do you think about the changes to the Citi Double Cash Card?