The TechCrunch Exchange is a weekly startup-and-markets newsletter. It's inspired by the daily column on the website, where it gets its name. You can sign up here.

It's the weekend and welcome to it! We have a lot of ground to cover today, so pour some coffee and roll with me.

When Amplitude listed, it started to trade, and then ran into a wall. The scale of its repricing stood out, even though it was not alone among public tech companies in taking a haircut. It is similar to what Instacart is going through on the private markets.

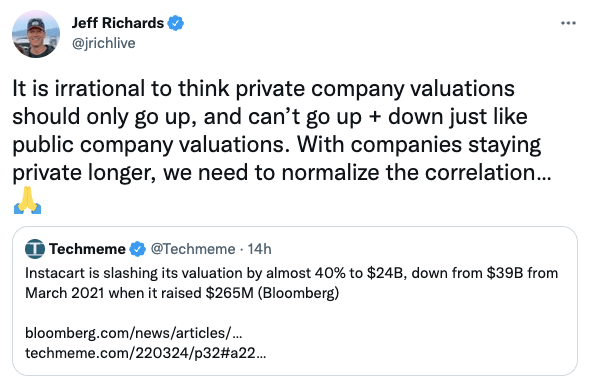

Should we expect more private companies to change how they value their share price to better incent new hires to join and current employees to stay? Maybe. GGV's Jeff Richards had some food for thought Friday.

Yes. There is no avoiding the market. If you raise venture capital and don't see a repricing until you raise again, you can put off reality. Yes. If you don't raise new funds, how do you figure out your market worth?

Flat could be the new up when it comes to startup valuations if Instacart is the start of a trend.

I went to school in Chicago and was in and around the city's tech scene as a baby journalist. I went to community events to better understand what was happening. I met Justyn Howard when I went to the launch dinner of the company that I was working for, and it was all black cars. I met my first reporter at that publication, who later helped me get a job at the publication.

There was a community effort called Technori, which hosted events that showed off local tech efforts. It was enjoyable.

Since then, Technori has evolved into a media play that helps startups raise capital via equity crowdfunding. Scott Kitun, the company's CEO, had me on the show. KingsCrowd is a service that vets and rates startup raising on online platforms, and it is being sold to Technori. The tie-up seems reasonable given that Technori evolved into a platform to help people raise money.

Kitun said the transaction was all-stock. KingsCrowd has a media strategy as well.

In an interview with The Exchange, Kitun said that he was excited about the deal because it would make it easier for startups to get equity funding. We will have to wait to see if the pair of companies can drive more capital into the startup market via the fundraising mechanism.

Public recently bought Otis, looking to add more investment variety to its platform. The Technori and KingsCrowd deal is similar in that the duo want to make one for newer investment into the hands of the regular person.

Kitun is a co-founder of SongFinch, a separate company, and this is likely not the last we hear of him.

The editor in chief position at TechCrunch+ was the reason for my change of roles this week. Readers of The Exchange's on-site posts and newsletter will know that most of my work in the past few years has been on the paid site. We are aggressively expanding the team and I am not stopping my writing entirely. If you aren't a member, strap in. It's going to be one hell of a year, so apply the discount code EICEXCHANGE at checkout for 25% off.

The Experts program has run for a few years and we are making some changes. An effort to create a database of startup servicing companies by activity was part of our general vibe of helping founders build. We are going to evolve the effort into pieces that are more targeted at squeezing insights from different operators in the market, more than creating a list of possible vendors.

This means that we are leaving a little fruit on the vine, so one last note from experts land about a participant. Growthcurve is the final company included in the old format. People wrote in endorsing the group. Mariam Danielova of ANNA Money says that they are reliable, results-oriented, and data-driven, which is all you can hope for from a growth-marketing team.

I spent time reading through older interview files and the like while clearing the TechCrunch+ decks of prior efforts, and learned something about the importance of search engine rankings. It came up in Growthcurve founder Mulenga Agley's notes, and I wonder if it will become more important in the new world of mobile devices. I suppose you should bully for the internet company.

Anna Heim of The Exchange will still be taking on how-tos with external operating experts. It will look a little different this year. Growthcurve was the final entrant in the ledger, thanks to everyone who took part in the past.

Onward!