Historically, only institutions have been able to be part of REITs, which are made up of companies that own or finance income- producing real estate across a range of property sectors.

A startup called Flock Homes wants to give landlords the ability to own shares of a portfolio that is made up of multiple properties and it just raised a $26 million Series A funding round.

The financing included participation from 1Sharpe and Human Capital, as well as existing backers Susa Venture, Primary Venture Partners and Box Group.

Ari Rubin dropped out of business school to pursue his idea for the startup, which went live in May 2021. A typical user is a landlord of single-family homes with one to four units that doesn't necessarily want to be rid of their investment but also doesn't want to deal with managing it anymore.

Rubin explained that Flock buys the property from the landlord, who then gets shares in the partnership which owns a bunch of houses.

The company owns and operates the assets after the properties come in. Rubin said that landlords get shares in a diversified portfolio similar to a real estate investment trust.

Someone who owns a $500,000 house can sell it to Flock and get $500,000 worth of shares in the fund. The shares and portfolio both appreciate in value.

Rubin said that they collect and hold back a portion of the rental income for maintenance, property taxes and insurance.

Some people decide to invest their money while others decide to use the money to redeem their shares over time.

Rubin said that it can be used as an estate planning tool. They can either put their ownership on pilot or live off of diversified income.

The company makes money by acting as an asset manager of the fund and charging management fees, which is 1% of the value of someone's account. If the landlord had sold the home traditionally, it would save them money in taxes and other things.

In its portfolio, Flock has over 100 homes in Denver, Austin, Texas and Kansas City. The company plans to launch in Seattle and a few other markets this year.

Institutions have been doing this for a long time via a mechanism called a 721 Exchange and it takes an army of lawyers and tax professionals to make it work. Rubin said that they are building technology to streamline that process.

A $25 million mansion outside of Palo Alto won't be included in a standardized portfolio of homes the company aims to build. It uses third-party valuation models to come up with a fair market value.

The way it works is that a landlord submits information about a house to the website. The Flock team uses a proprietary valuation system to derive a headline valuation, and then makes adjustments to the final price based on the amount of repairs and deferred maintenance found in the house. Rubin said that the company never profits off a house value.

He said that they were focused on making sure the system was fair and transparent.

If homes depreciate in value, what do you do? Rubin said the aim is to only include homes with more upside potential.

Rubin said that they look for homes that will add value to other landlords and owners. It might keep going up and down. We only take homes that we feel confident we can operate efficiently and provide good returns to owners and good experiences for the residents who are living there.

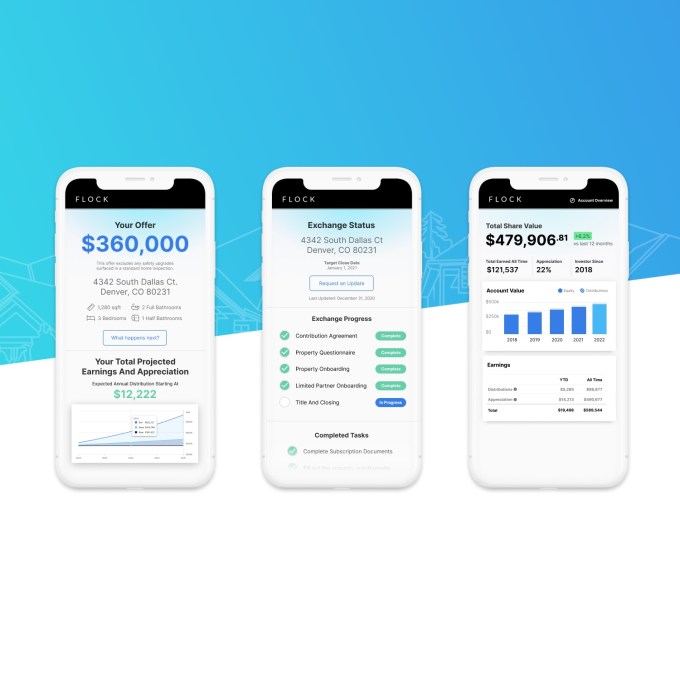

The image is from Flock homes.

The latest financing brings the total equity raised to $32.50 million. It has dual headquarters in Denver and San Francisco with 17 employees.

The capital from this raise will be used to build out its technology and hire more people. Rubin said that the company doesn't need cash to buy homes and instead uses money from when people roll their equity from their homes.

Alex Rampell believes that it can be difficult to just retire as a landlord.

He said that being a landlord means you need to fix toilets, worry about vacancies, find tenants, and more.

He was drawn to the fact that any landlord could roll their properties into the portfolio it has created, while still providing the former landlord with the same income stream with no immediate tax consequences.

In the process, it is assembling a powerful machine to aggregate many properties, democratizing investor access and improving resident experiences with technology.

10 proptech investors see better era for residential and retail after pandemic