Less than seven months after closing on a Series B, a fast-growing fintech named Jeeves has raised $180 million in a Series C round that values the company at $2.1 billion.

Financial technology companies raising multiple rounds in a short period of time has become the norm. Growth and increase in valuation are impressive.

When it was raised in September, it was valued at $500 million. It has doubled in value in six months. It's also noteworthy that Jeeves only publicly launched in March of 2021, and emerged from stealth last June with over 100 million dollars in debt and $32 million in equity financing. In the summer of 2020, Jeeves was a participant in Y Combinator.

It is an example of how competitive the corporate card and expense management category has become. Since its Series B was announced in September, it has seen its revenue increase by 900% and it has doubled its client base to more than 3000 companies. It is expected to reach $4 billion by the end of the year, with an annual gross transaction volume of about $1.3 billion.

When I made the rough Series C deck in December, I realized we had more than doubled revenue compared to the entire month of November.

The family offices of two FAANG were involved in the latest raise. The company has raised more than $380 million in the last year.

We ended up with five term sheets, which was a validation during a time when we are seeing more due diligence than we had previously and a more challenging fundraising environment.

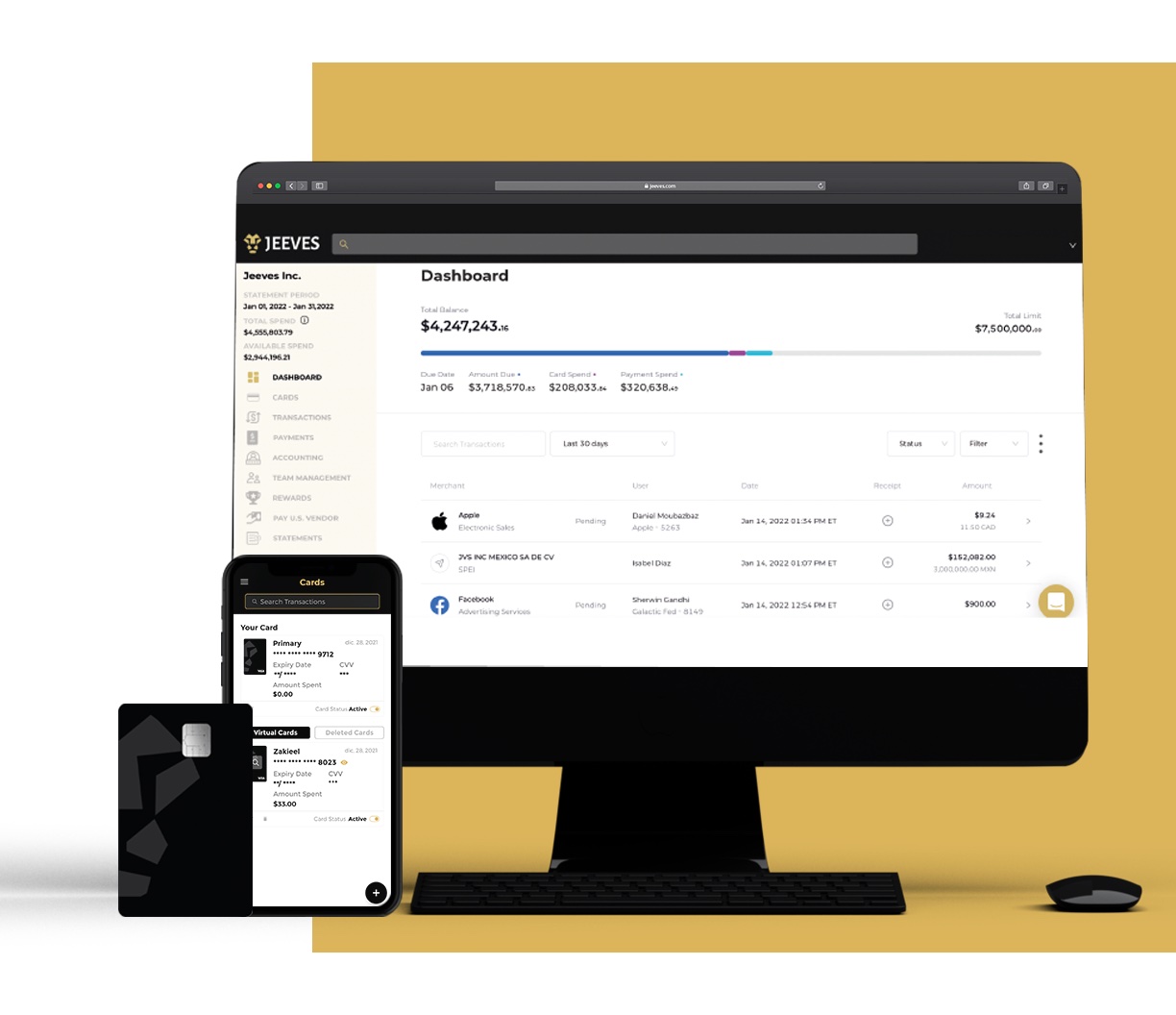

What does Jeeves do? For any business spend across countries and currencies, the company provides the credit in local currency and the payment rails.

In order for a startup to be successful, they have to rely on financial infrastructure that is local and country specific. A company with employees in Mexico and Colombia would require multiple vendors to cover their finance function in each country, with a corporate card in Mexico and another vendor for cross-border payments.

The startup claims that by using its proprietary banking-as-a-service infrastructure, any company can spin up their finance function in minutes and get access to 30 days of credit on a corporate card. Customers can pay back in multiple currencies.

A growing business can use a Jeeves card in Barcelona and pay it back in euros and use the same card in Mexico and pay it back in pesos, reducing any foreign exchange fees and providing instant spend reconciliation across currencies.

The biggest thing the company is building out is its own global BaaS layer, which sits across different banking entities in each country, and onto which the end user customer-facing Jeeves app plugs into.

The way we look at it is that we own the full payment stack.

Fintech startup Jeeves raises $57M, goes from YC to $500M valuation in one year

Over time, Jeeves has expanded its scope. Corporate cards, which make up 45% of the company's business, remains its marquee product.

We have other channels that are equally important, and growing quicker, including B2B payments, working capital loans and Jeeves Growth, which is a revenue-based financing product.

The number of startups tackling corporate spend and expense management continues to grow. On Monday, we reported on Ramp raising $200 million and securing $550 million in debt at an $8.1 billion valuation.

The space is growing and companies need spend management.

He thinks that the winners are the companies that compete on who can give you cash faster.

I think it's when you compete on infrastructure that you start winning, and then you own the stack, and you can start making more money.

There will one day be a bifurcation of sorts between startup that are focused on credit and those that are building up the infrastructure, according to Thazhmon.

We're trying to build a relationship with the end user so that we can make payments if needed. We can lend if you need it. We can give you deposits if you need them. If you want to start a company, you can open an account with us and go to any country with any currency you need.

The image is called Jeeves.

He believes there will be many different players in the market.

Thazhmon doesn't think this is a space where you're going to have one company that owns everything.

The company plans to use its new capital to expand across Latin America, Canada and Europe and to hire more people. In the short term, it is looking at Southeast Asia and possibly Saudi Arabia and Africa.

In addition to offices in Mexico City, London, Toronto and Sao Paolo, the company has 150 employees working across 10 countries. It has recently hired a number of new executives, including: Trent Beckley, who was previously lead of strategic partnerships at Google, to serve as its director.

After leading its Series A and investing in its Series B, A16Z tripled down on the company, which continues to execute extremely well.

Jeeves is building a premium financial operating system for global businesses. The company has quickly scaled into local payments, multi-currency reconciliation and working capital loans.

My weekly newsletter is going to launch on March 27. You can get it in your inbox if you sign up here.

Fintech Roundup: Corporate spend just can’t be a winner-takes-all space