Ben King is a business reporter.

Image source, Getty Images

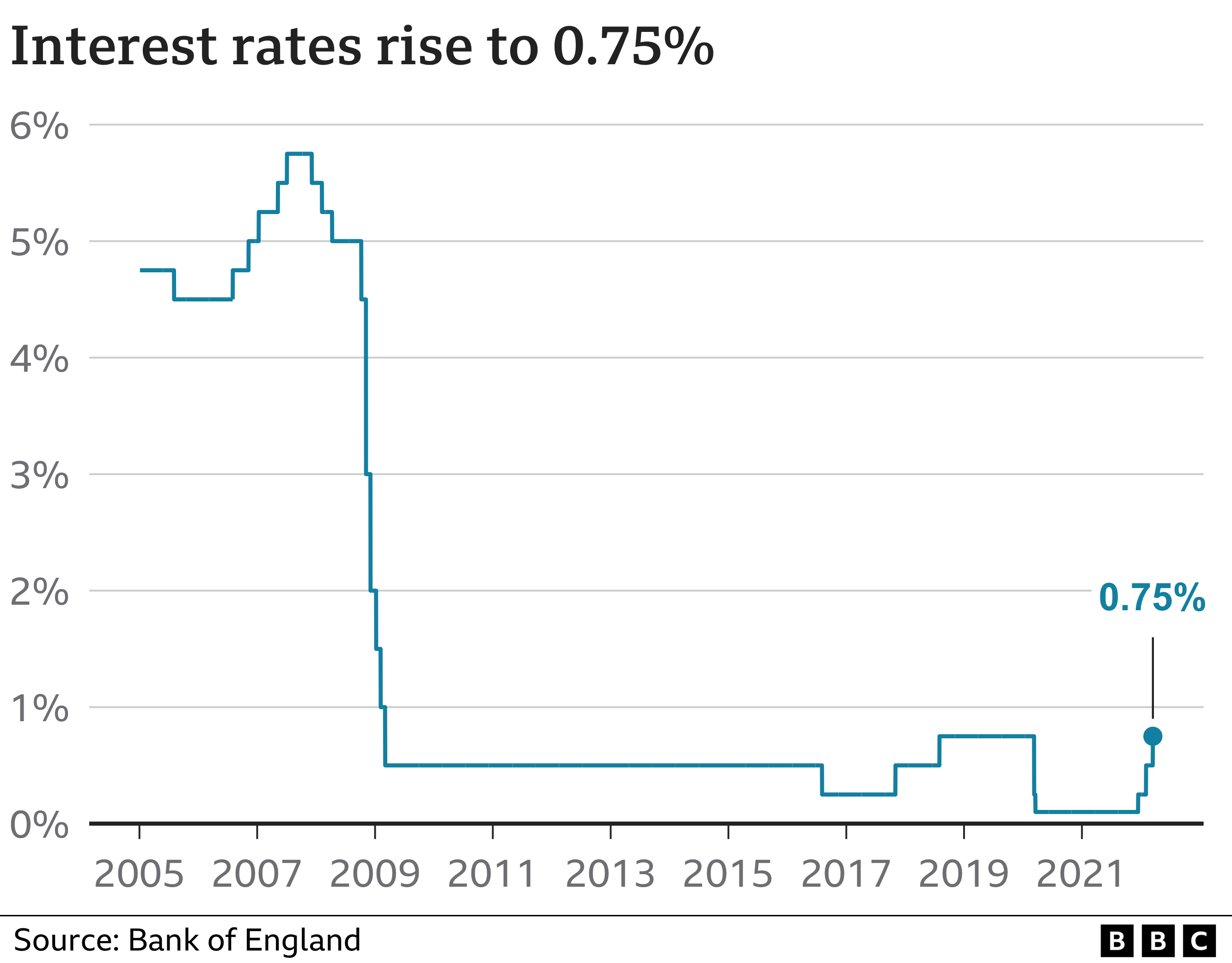

Image source, Getty ImagesThe interest rates have gone up since March 2020.

The Bank of England made its decision a day after the US raised interest rates.

The Bank tries to manage the UK economy by adjusting interest rates.

The UK has historically low interest rates. The rate was just 0.1% in March 2020.

To get the economy moving, the aim was to encourage firms and individuals to borrow or spend money.

There is a balancing act. The Bank wants to encourage spending and growth, but also to make sure that this doesn't lead to rising prices.

Raising interest rates to encourage people and firms to borrow and spend less is one of the tools it uses to limit inflation.

Prices are rising quickly in the UK and around the world because of Covid restrictions.

Many firms are having difficulty selling their goods. Prices have gone up because more buyers are chasing too few goods.

The rise in oil and gas costs was made worse by the invasion of Ukraine.

Inflation is expected to reach 7% this year, which would be the highest level in 22 years.

The UK interest rates were not expected to go up much this year.

The Office for Budgetary Responsibility looked at the impact of higher and more persistent inflation.

If people think price rises will continue, this can happen. Wage increases could be demanded by workers to maintain living standards.

Interest rates could reach 3.5% if this happens, according to the OBR.

It can make borrowing more expensive if interest rates go up.

Credit cards, bank loans, and car loans all have an influence on the Bank of England interest rates.

Changes in interest rates can still affect you even if you don't have a mortgage.

Image source, Getty Images

Image source, Getty ImagesThe interest rates people earn on their savings are affected by Bank of England decisions.

Savers get a higher return on their money when individual banks pass on interest rate increases.

The Monetary Policy Committee is made up of nine economists.

They meet eight times a year to look at the economy.

Their decisions are published on a Thursday.

Will your repayments go up now that you have a tracker mortgage? Are you concerned that rising rates might affect your finances? You can email haveyoursay@bbc.co.uk.

If you are willing to speak to a journalist, please include a contact number. You can get in touch with us in a number of ways.

If you cannot see the form on this page, you can email HaveYourSay@bbc.co.uk or use the mobile version of the website to submit your question or comment. Please include your name, age and location in your submission.