The Bank will play catch-up and raise its rate by half a point in April according to Kevin.

Kevin Carmichael is a person.

15 hours ago,,,,,,,,,,,,,,,,,,,,,,,,,,,

Food and gasoline prices went up in February.

The photo was taken by Peter J. Thompson.

The pressure on the governor of the Bank of Canada to raise interest rates went up in February when inflation accelerated from a rate that was already too fast.

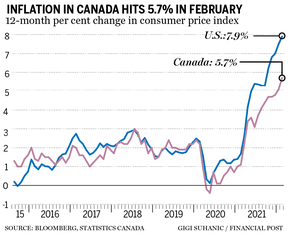

The agency said on March 16 that the consumer price index increased 5.7 per cent in February, the most since August 1991 and a big jump from the January rate of 5.1 per cent.

In January, the central bank predicted that the consumer price index would increase by 5.1 per cent in the first quarter. The country had grown used to inflation being a non-story and the average over the first two months was 5.4 per cent.

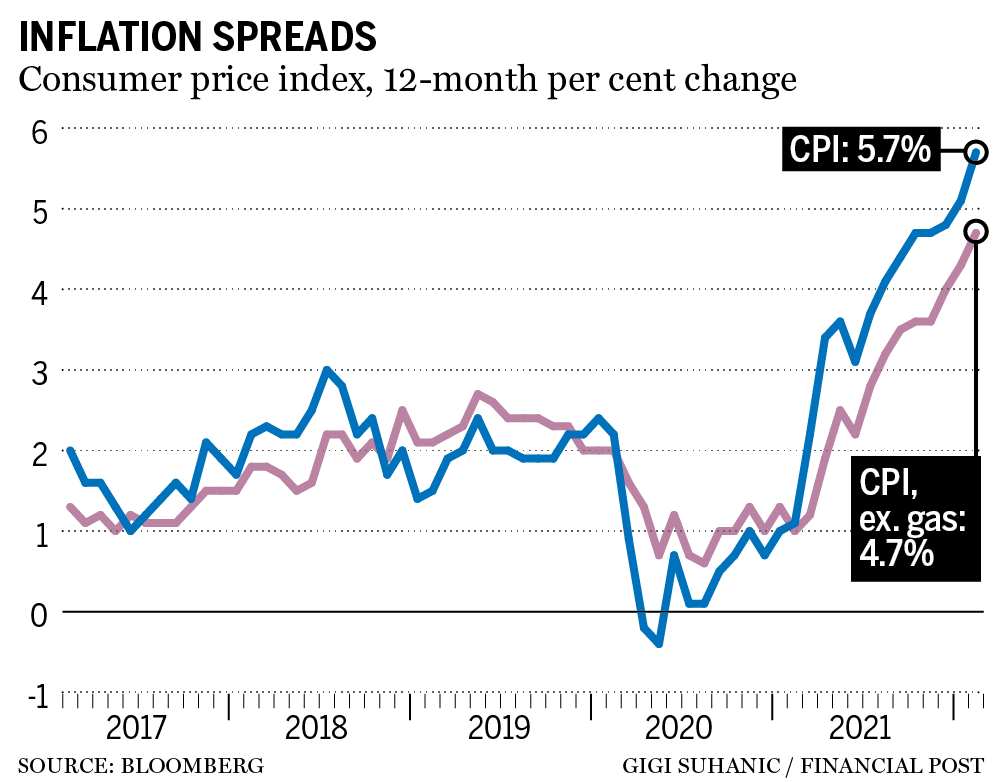

In February, the heat came from familiar places. Statistics Canada's measure of shelter costs rose at its fastest year-over-year pace since August 1983, as gasoline and food prices surged again.

Statistics Canada's measure of inflation, which excludes gasoline, went up by the most since it was created in 1999. The previous record was set a month earlier.

The Bank of Canada wants the index to advance at an annual rate of two per cent, which is in line with the comfort zone of one per cent to three per cent. Since April, inflation has been outside the high end of the Bank of Canada's range, an unusual stretch of time.

Most of the inflation is the result of factors that the central bank has little control over. The global economy recovered quicker than expected, causing a mismatch between supply and demand. The cost of food went up due to poor yields in major agricultural regions. War in Europe is stoking oil and other commodity prices again.

Higher interest rates won't change anything. They should cool demand, which is a strong driver of inflation. The unemployment rate fell to one of the lowest on record last month as employment recovered from the recession. The Bank of Canada estimates that the gross domestic product will return to the level it was in the early 2000s.

Macklem said in a speech on March 3 that the economy is now in a place where interest rates are appropriate.

The benchmark interest rate is still very low. The former Finance official who now leads the economics department at the Bank of Nova Scotia thinks that the central bank is in danger of losing its grip on inflation.

The Bank of Canada is expected to raise the benchmark rate a half-point in April, instead of the usual quarter-point move, because of the latest acceleration in inflation. The Canadian dollar was trading around 78 cents U.S., the highest since the beginning of the month.

Veronica Clark, an economist at Citigroup Global Markets Inc., said in a note to clients that it was hard to find data that would support rates rising slowly back towards neutral.

The Bank of Canada has a problem with inflation. According to Statistics Canada's latest Labour Force Survey, year-over-year increases in average hourly wages are only three per cent.

The province ofAlberta pledged to cut gasoline taxes. The finance minister of the province told a group of reporters on March 15 that some of his counterparts are contributing to inflation by spending too much.

Toews said during an editorial board meeting with the National Post that the best thing the government can do at a time of inflation is not add to inflationary pressures. I think that is problematic.

If the economy is too strong for low interest rates, it's also too strong for fiscal stimulation.

It's easy for Toews to make observations of that sort since his province's economy is getting a boost from triple-digit oil prices. The only way central bankers and finance ministers can bring prices down is through demand destruction, Bay Street economist David Rosenberg told the Financial Post.

Policy-makers will not want to do that.

Email: kcarmichael@postmedia.com

You can listen to Down to Business wherever you get your podcasts, for in-depth discussions and insights into the latest in Canadian business. The latest episode can be found below.