Dragoneer Investment Group and Tiger Global are backing Bazaar, a startup that is attempting to digitize Pakistan's retail with e-commerce, fintech and last-mile supply chain solutions, they said today, joining a growing list of high-profile investors making large bets in the South.

Bazaar is leading a $70 million Series B funding. The new round brought in existing backers including Indus Valley Capital, Defy Partners, Acrew Capital, Wavemaker Partners, B&Y Venture Partners and Zayn Capital.

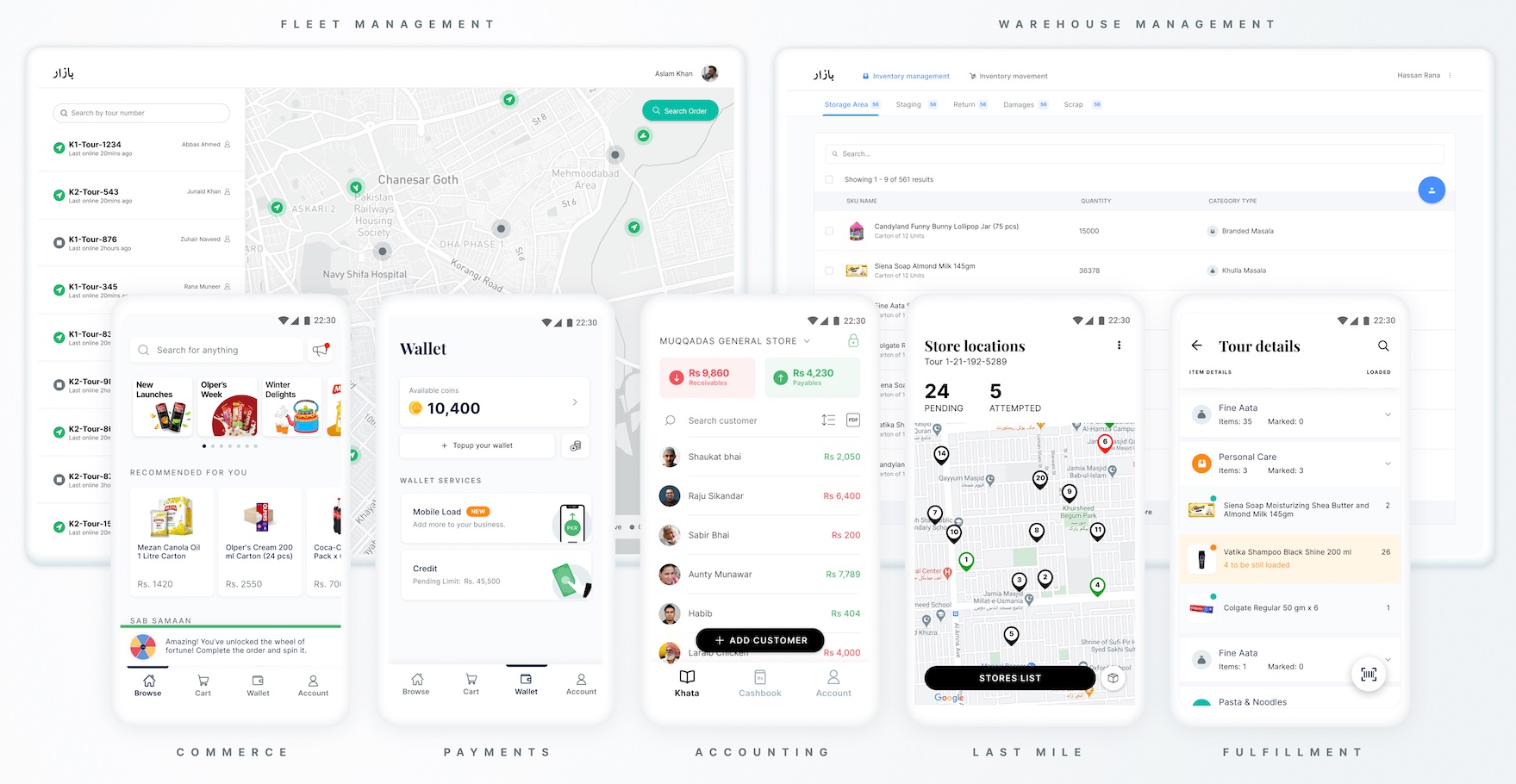

Bazaar is trying to build an operating system for traditional retail in Pakistan. There are 5 million small, medium-sized and enterprises in the country.

Today, these merchants are largely unbanked. Merchants who don't have a credit score don't get credit from banks or other financial institutions. Many shop operators have taken loans from shark loan providers.

The challenge will sound familiar to those following the South Asia coverage.

Scores of startups and giants, including Reliance and Amazon, are helping solve the same problem in India as Udaan, ElasticRun, and Dukaan.

Many of these offerings are being combined by Bazaar.

Merchants in 21 towns and cities across Pakistan are being helped by the startup's B2B e-commerce marketplace, thanks to its network of a dozen fulfillment facilities.

The Easy Khata app helps these merchants keep track of their finances. Bazaar Credit is offering short-term working capital financing to merchants who operate neighborhood stores.

Bazaar has a suite of products.

The co-founder of Bazaar said in an interview that Piecing together many of its services makes sense for a startup like Bazaar in Pakistan as it enables the startup to offer a more comprehensive set of values to a merchant.

He said that they had just started piloting their credit product and that it was developed in-house. Bazaar does everything from order generation to credit disbursement to cash collection.

He said that the startup has issued thousands of loans in recent months, and that it acquires customers through Easy Khata, funnel them through commerce, and then builds a credit product atop of it.

Easy Khata is a core system of records and is helping us launch in new cities.

The startup said that merchants have recorded over $10 billion in transactions on Easy Khata.

The startup's last mile network, which was only operational in two cities in August of last year, is now adding three to four cities each month.

The goal is to keep building for Pakistan. We want to build the largest network in the country so that we can move any category of goods from point A to point B whenever and wherever is needed.

The startup plans to use the capital to expand to more cities and launch new categories. It is exploring new product lines and scaling its lending offerings.

Childhood friends were in the same place a few years ago. At the time, Jawaid was working for McKinsey and Jangda was working for Careem. Bazaar was built because of the opportunities they saw in their home nation.

Christian Jensen, a partner at Dragoneer Investment Group, said they are thrilled to support Bazaar's vision of building an end-to-end commerce and fintech platform for millions of unbanked and offline merchants in Pakistan.