My new column is focused on financial services. On March 27th, this column becomes a newsletter. If you want it to hit your inbox directly, sign up here.

fintechs were the largest recipients of funding worldwide last year, with 21% of all venture dollars going into them.

We all knew that this was likely not sustainable in the long term. It's not a good thing that investors seem to be backing some startups in part due to FOMO.

As the first quarter draws to a close, it is clear that investors are starting to put the brakes on fundraises. The conflict in Ukraine and disappointing performances by companies who went public in the last have caused the market to fall. Last year's rising star of venture is not immune.

A story on March 7 was published by my former colleague at the news website, who said that venture capitalists seem to be less enthusiastic about fintech. In the two weeks leading up to her post, a total of 51 fintech companies across the globe had raised $1.1 billion in seed through late-stage venture funding. The prior two-week period saw 80 companies raise just shy of $3 billion.

The market was truly a founders last year, meaning that terms were more founder-friendly. Many buzzy startups were presented with multiple term sheets when they had their pick of investors. In many cases, companies were raising money left and right at very early stages, with little more than a deck, idea and team established.

The founder of a very fast-growing fintech startup told me Friday that he saw a big difference when raising for a round in early 2022.

He recalls that last year it was like, "look at this pretty graph, we're growing so quickly."

There were more questions about margins, operations, revenue and contribution this year.

He told me that this raise feels very satisfying, because we went through the gauntlet in January and February.

He realized that they were experiencing the same things.

He said that the environment was different from last year in terms of the level of diligence and access to capital. It is not as easy to get dry powder on specific terms as it used to be.

That's not a bad thing, in his view.

He said that having to provide tangible evidence of a valid business model with real numbers makes more sense than it does. I need a check for that.

The Equity team predicted last year that this would happen. For the sake of my inbox, I'm all for investors being more discriminating when it comes to which companies they back. It should also be rewarding for the founder who is able to raise in a more challenging environment.

In this crazy startup world, things change week by week, and my friend and fellow fintech enthusiast, Nik Milanovic, shared in his own newsletter on Saturday that the companies raised over $2 billion. A record for the number of funding rounds and close to the record for most funding raised in a single week. Fundings being announced are likely to have been in the works for a while.

I don't want to write about Better.com as much as you do. The company's mass layoff of about 3,000 people was the subject of my breaking news last week. The digital mortgage lender messed up again after a December layoff that affected 900 people. Affected employees shared that when a severance check appeared in their payroll app, they were suddenly laid off. The company had planned to lay off workers one day, but changed their minds due to a leak, and then forgot to update the timing of the checks. If the company hadn't messed up its December mass layoff by conducting it coldly during a Zoom call, it might have been forgiven.

As a competitive reporter, I love getting scoops as much as the next journalist. scoops on mass layoffs are not fun to get. Many people have lost their jobs at this company in the past few months. It would be foolish to not think that the severe hit to its reputation has to be impacting Better.com's ability to win.

At some point, any company may have to lay off employees. Handling it in a way that offends not only the employees themselves, but even casual observers is different from handling it with compassion and respect. One can see the proof of the latter point in the comments on my posts on social media.

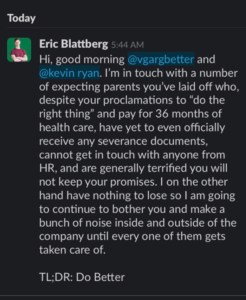

A Better.com employee was asked to resign a week early after publishing an internal communication from the company on social media, but after I wrote about it, I came across a post on LinkedIn from the employee. Senior product designer Eric Blattberg publicly pushed his employer to provide additional benefits to the expecting parents who were being laid off. The company will extend the benefits of these employees for a year.

Eric Blattberg has an image.

His experience shows Better's efforts to make itself look better, the disappointment that many of its former employees feel, and what accountability looks like. In this case, Better promised to do the right thing.

There were reports that the extended benefits did not last as long as promised. The following was posted on LinkedIn.

Better is adding to its string of corporate incompetence today with written agreements to expecting parents that differ from what a Better lawyer reading from a script promised them in a phone call, according to two of the expecting parents who noted the disparities to me earlier today. In the phone call with the laid-off employees, the Better lawyer promised four additional weeks of severance pay and 12 additional months of paid COBRA premiums on top of the standard package offered to all laid-off employees, bringing their health insurance coverage to the end of June 2023, the expecting parents told me. But in an email subsequently received by the expecting parents, the COBRA coverage was only nine additional months, bringing their coverage to March 2023, and there was no additional severance pay offered. In a subsequent communication with one of the expecting parents described to me this morning, the lawyer admitted to making a mistake, confusing the 20 days of extended severance offered to all fired employees as additional pay in their custom package, but declined to honor the prior commitment. This is, as usual, unacceptable. Better should #DoBetter.

I reached out to Better.com, but they wouldn't answer my questions about health insurance benefits, citing privacy concerns.

Via DMs, Eric told me: “On Tuesday morning I found myself in a unique position of privilege: still inside Better as it casually fumbled the layoffs it had spent months planning, causing an unfathomable amount of collateral damage, but not scared of losing my job, since I was sitting on an offer from Ergatta, where I’ll start as a senior product designer March 21… My only goal this whole time has been to help people. I don’t want to tear the company down, I want to shield the employees Vishal has tossed aside like they were just numbers on a balance sheet. They are not just a number. Every one of them has their own story, their own health care journey, their own reason for working at Better. And they deserve so much more respect, consideration, and support than they received this week. So I’m going to keep fighting on their behalf from the outside.”

On Equity Pod this week, Alex,Natasha and I dug into the increasing number of companies abandoning their SPACs and opting to raise money instead with the latest example being Acorn, which this week announced it raised $300M at a nearly $2B valuation. A currently unfavorable public market is one of the reasons why companies likeAcorn and Kin Insurance are doing this. I think companies and investors are realizing that anything that is too easy to come by is not worth having. Noah Kerner told me that when Acorn does decide to go public, it will do so via the traditional IPO route. We concluded that SPAC is a four-letter word.

Latin America raised a record amount of venture capital last year and we are seeing more signs of an increasingly maturing market. I wrote about two companies that were co-founded by people from the region. The first startup was Mara, a Sao Paolo-based startup that aims to make grocery shopping easier for the poor in Latin America. One of its co-founders is a mobility startup called 99. The second startup was Yuno, a two-month-old payments startup which raised $10 million in a seed round of funding.

The co-founders are Juan Pablo and Yuno.

The experience of the company's founders, which include Juan Pablo Ortega, the co-founder of on-demand delivery unicorn Rappi, speaks to the ability to raise a relatively large seed round so soon after inception.

As Latin America's startup scene continues to grow, we will only see more successful companies start new ones and invest in other early-stage companies that they see potential in.

There are many similarities between LatAm and Africa. Africa is starting to attract more global interest and dollars as it is a place where LatAm was a few years ago.

Uganda's multi-service and digital payment technology platform, SafeBoda, became the first startup on the continent to receive investment from the Google fund. The first startup in the country to get into YC is now joined by fintech. Dash raised a $32.8 million seed round led by Insight Partners, a New York-based private equity and venture capital firm.

There is a certain energy coming out of LatAm and Africa that is refreshing and exciting to cover and I can't wait to see what's next in both regions.

Dash is an image.

I was impressed with the number of global fundings published on the site over the past week, a testament to the team of reporters we have all over the world.

I can't include all the cool funding deals that took place this last week, so I'm going to narrow it down to a few from each continent along with some others that were announced, but didn't cover for one reason or another.

Nordic neobank Lunar raises $77 million at a $2 billion valuation.

CredAvenue received $137 million in funding.

Airwallex raises $100 million at a $5.5 billion valuation to expand its business banking and payments platform.

Milo secured $17 million in investment.

A new funding round led by SoftBank Vision Fund 2 valued roofing at $1.9 billion.

The US paytech Stax has a funding round of $245 million.

Every month, Propel raises $50 million to help Americans with low income make ends meet.

A $7 million seed was closed by CoFi to transform construction financing.

Acasa has US$38 million in fresh funds for those who want to move house.

Argyle raises $55M Series B to make fair credit decisioning possible for every lender and consumer through real-time, user-permissioned access to employment data.

Capchase closed an $80 million Series B as the company looks to expand its funding platform that offers non-dilutive financing alternatives. The new round was led by a group of people.

Mastercard on March 7 announced a 5-year global partnership with Zeta, a SoftBank backed provider of next-gen credit card processing to banks. The companies said they will go-to-market with each other on the same platform.

I was given a sneak peek at the launch of its new offering, which uses artificial intelligence and machine learning, to automatically assign individual. I wrote about a new startup called Glean AI, which claims to be anaccounts payable with a brain.

Numerous tech companies have joined the growing list of tech brands that are suspending their operations in Russia. Several notable names include financial services companies such as Mastercard, Visa and more.

The Indian telecom operator, backed by the internet giant, said on March 7 that it is launching a credit card, the latest attempt to make inroads with financial services as it looks to expand its offerings in the world's second-largest internet market.

Alex writes that the earnings tell us that the market continues to expand, with consumers happy to transact more and more with the spending model. They show us that growth in the land is not cheap and that the company's profitability is suffering.

Otis is a startup that allows consumers to buy and trade fractional shares in individual alternative assets.

The $616M close of its third fund is said to be one of the largest early-stage fintech funds worldwide.

Jerry jumped into the refi space. We covered the startup's last raise, a $75M round at a $450M valuation, last August.

I wrote about how Credit Karma, Betterment and Austin-based startup Chipper want to provide student loan borrowers with some relief options.

That is it for this week. There will be no column on March 20 because I will be out next week for spring break. If you haven't subscribed yet, now is the time because my newsletter officially launches on March 27.

Take care and be safe!