Pay Yourself Back was launched by Chase a year ago. It offers a way to cash out their Ultimate rewards points at a higher rate than they can for just standard cash back, which is 25%- 50% more. The Chase Pay Yourself back categories change a few times per year, and the catch is that it is only for certain categories. Some of those categories have been extended by Chase and it looks like others will be dropping off. Let's look at the categories for each card that is eligible.

As categories change, we will update this page frequently.

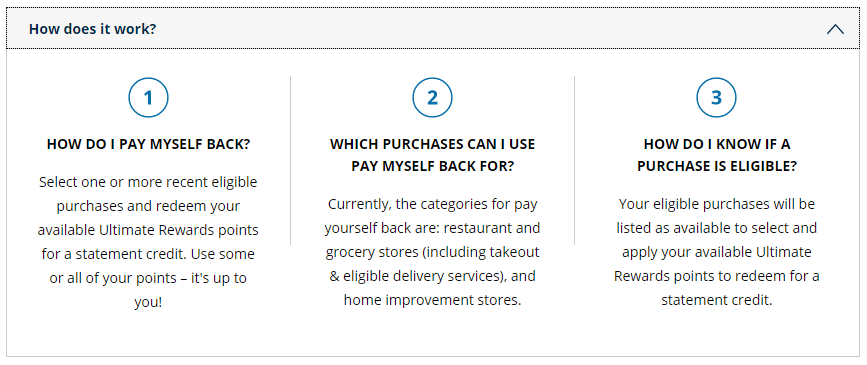

We should talk about how this works before we dive into the categories.

After making a purchase in an eligible category or donating to a charity, cardmembers can choose to redeem points for all or a portion of the purchase, and get paid back with a statement credit. Over time, redemption values will evolve to provide the most relevant and practical value for cardmembers.

To access the Pay Yourself Back feature, cardmembers can simply log into Ultimate rewards on their desktop or through the Chase mobile app. Check out Shawn's guide for more information.

You can get 50% more for your points with the Pay Yourself Back categories, and their end dates.

Here are the current Pay Yourself Back categories, and their end dates, for the Chase Sapphire Preferred where you get 25% more for your points.

The Chase Ink Business Preferred and Ink Plus categories give you 25% more for your points.

You can get 25% more for your points with the Chase Freedom Flex and Chase Freedom unlimited categories.

Pay yourself back charities include:

It appears Chase Pay Yourself back is here to stay, at least till the end of 2022 for sure. I like the extensions we have seen listed above and adding annual fees for the Sapphire Reserve is a nice addition. Although, as Benjy pointed out, you don’t earn points on that spend like you do for the other categories so max it out elsewhere first. It is sad to see office stores not extended on the Ink cards since that was an easy category to rack up the spend in with the card’s 5X earning and office store promotions.

Disclosure: Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers.

Disclosure: Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers. Capital One Spark Cash Plus is $3K.

Capital One has a welcome offer. It is giving up a $3K welcome offer right now and earning 2% back everywhere. You can get a welcome offer of $500 after $5K spend in the first 3 months. $3K is the total welcome offer.

There are additional card benefits.

You can learn more about this card.

The author's opinions, reviews, analyses, and recommendations have not been reviewed, endorsed or approved by any of these entities.