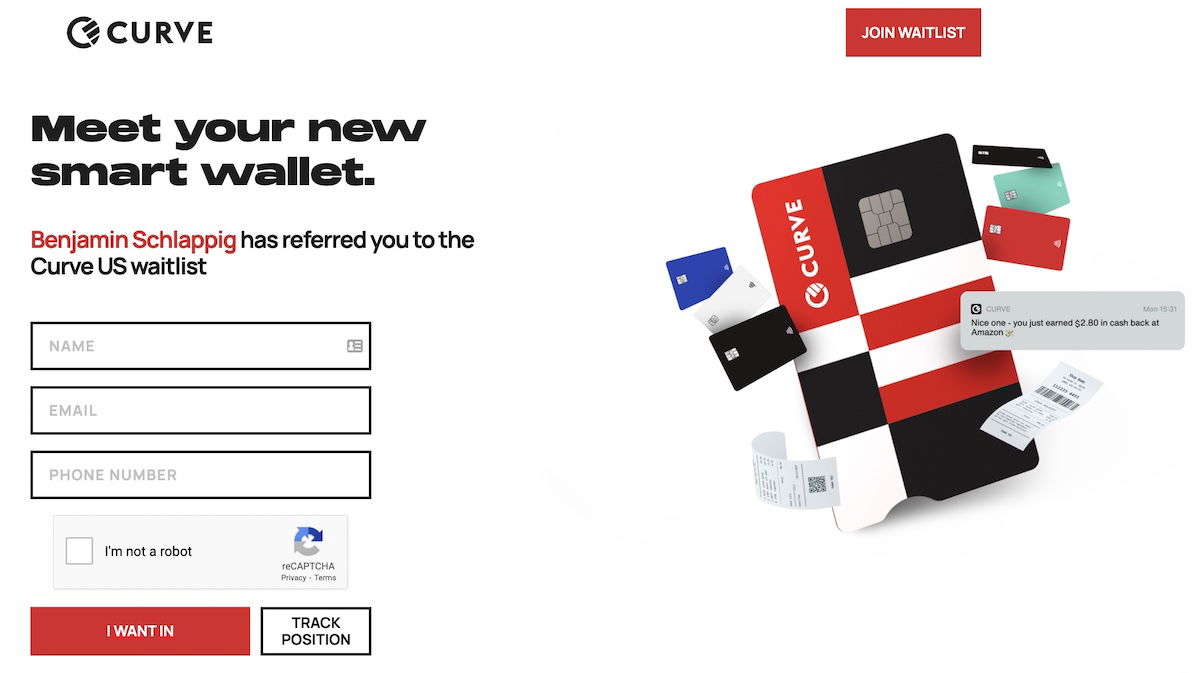

Curve is about to launch in the United States. There are some restrictions to be aware of, but this has the potential to be a game-changer for many people. I wrote about this in the summer of 2021, and now people are invited to apply for Curve, which is a sign that this product will become a reality.

If you're not eligible to apply, I recommend you join the Curve wait list. When the time comes to apply, there is no obligation to actually get the product.

Curve is a credit card that can be linked to your rewards credit card, and it is fascinating. The general idea is when you get Curve.

Curve has existed in the United Kingdom for a while, so this has been tried and tested elsewhere. It is coming to the United States.

I gave some examples of the basic features of Curve.

This sounds too good to be true, so what is the catch, and how does Curve make money?

Curve probably won't make money, or at least isn't looking to make money directly from consumers, like so many other companies nowadays. I think venture capital companies will be funding these rewards, and that this is a play for collecting data on consumers, market share, etc.

Curve is not yet open to the general public, but you can get on the Curve wait list. For the first six months after joining the waitlist, all users will receive an additional 1% cash back on every purchase, in addition to the credit card rewards that they earn. You will be invited to apply early. Paying taxes, buying insurance, or buying gift cards won't qualify you for the cash back bonus.

Those in the top 100 spots on the waiting list received 10% cash back on their purchases for the first six months, for a total of up to $1,000 in rewards. I received an email stating that I was in the top 100 spots, and was invited to apply, but I assume it doesn't count as a new product.

If you leave your referral codes in the comments section, others can use them, and I have already gotten my invite to apply.

Curve is in the process of launching in the United States, and some people are being invited to apply for the card. This could be useful for anyone who is collecting points. Curve allows you to use a single payment card and link several other cards so that you can maximize your rewards.

If you join the waitlist now, you will be able to earn 1% back on your purchases for the first six months, on top of the credit card rewards you usually earn. There is a lot of long-term value, like no foreign transaction fees, the chance to change which card you use for transactions after the fact, and more.

What do you think about Curve? Is it possible that you could use it?