Atlantic Money plans to be cheaper than other foreign exchange services. The company formerly known as TransferWise appeared on the startup scene with the same promise.

Atlantic Money doesn't think that Wise and Revolut are cheap. They end up charging customers for things they don't need because they try to do too many things at once.

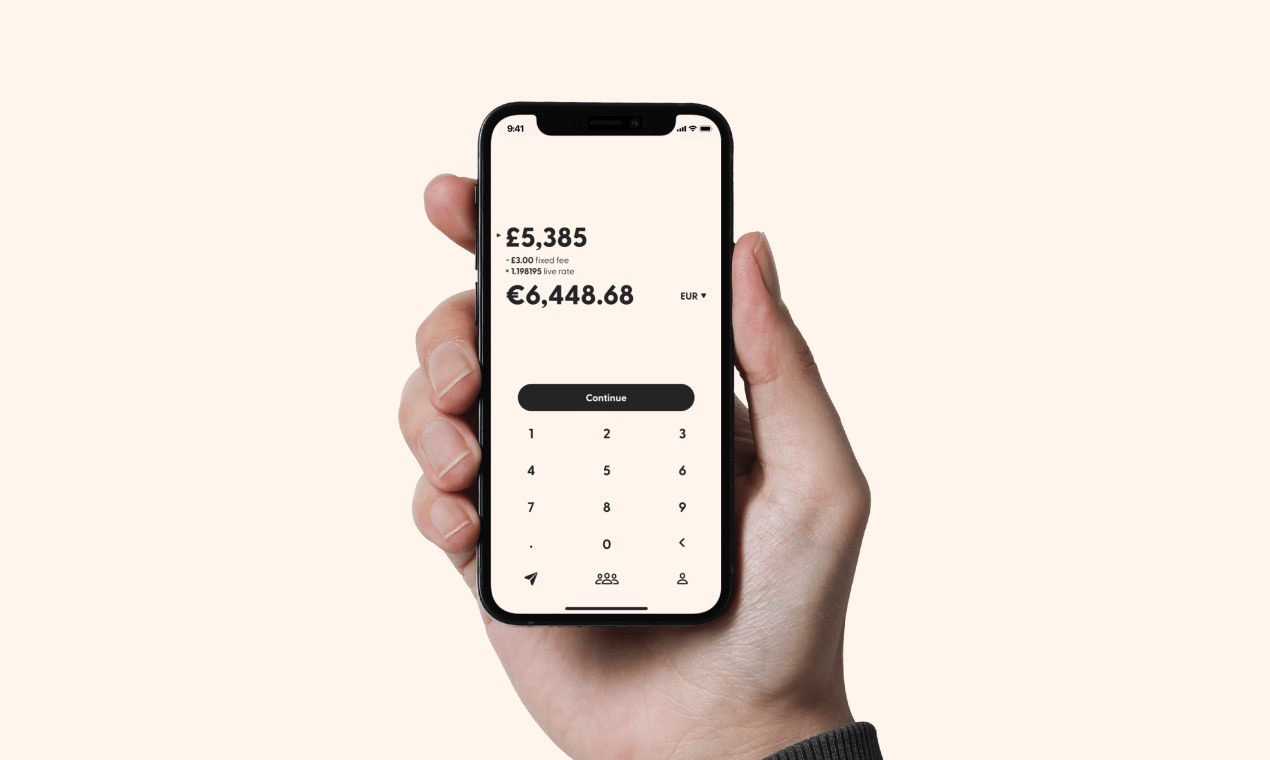

How much will you pay for international money transfers? The company will charge a flat fee. The exchange rate they can secure will not be marked up.

It's quite a lot for small transfers. Atlantic Money becomes more competitive when you transfer more than 1,000 dollars.

Atlantic Money's business model is based on this. The startup wants to charge a per transaction fee instead of progressive fees.

Atlantic Money is an image.

The pair met in their previous jobs and founded the company. Amplo and Ribbit Capital led a seed round for the startup. The company's founders invested in it. Anquan Wang is an investor as well.

A few corridors are being launched by the startup. Users who sign up today will be able to send money from the U.K. to other countries in nine different currencies. Atlantic Money focuses on local bank transfers when it comes to payment methods. Express transfers should arrive within a day.

The company partners with several large financial institutions that can provide a good foreign exchange rate. Atlantic Money doesn't charge a fee for picking the best rate. It will be interesting to see if Atlantic Money can provide better rates than its competitors.

When you try to transfer 5,000 dollars to the U.S., it costs you $17.89 in fees on Wise. You pay fees in addition to the amount you want to convert with a free account. The exchange rate is slightly better as you get around $6,700 in exchange for 5,020.96.

You can pay a fee for currency exchange if you choose a premium account. It's a 12-month plan, so you may end up paying more in subscription fees than in currency fees.

You can get paid in a country where you don't live with the help of Wise. 45% of Wise transfers arrive in less than 20 seconds.

There is room for more than one foreign exchange product. It is not a one-size-fits-all industry. Depending on the corridor they use most often, their average transfer size and the additional features they might need, customers will end up picking a service. If you want to move large amounts from the U.K. to Europe or Northern America, you could become an Atlantic Money user.

Atlantic Money is an image.