You can't swing an ethicallysourced, locally produced, sustainable raised dead fish without hitting a set of Environmental, Social, and Governance (ESG) goals in a company's board meetings or annual reports. It is difficult to measure and track how companies are performing against their goals, even though it is easy to get the PR for it. Tired of hot air and empty promises, and eager to make it easier to actually implement the goals that are set, ESGgo comes along. The company created a software suite to help change that, and it just raised $7 million to strap on some running shoes.

The target customers are corporations or any company that is considering becoming public.

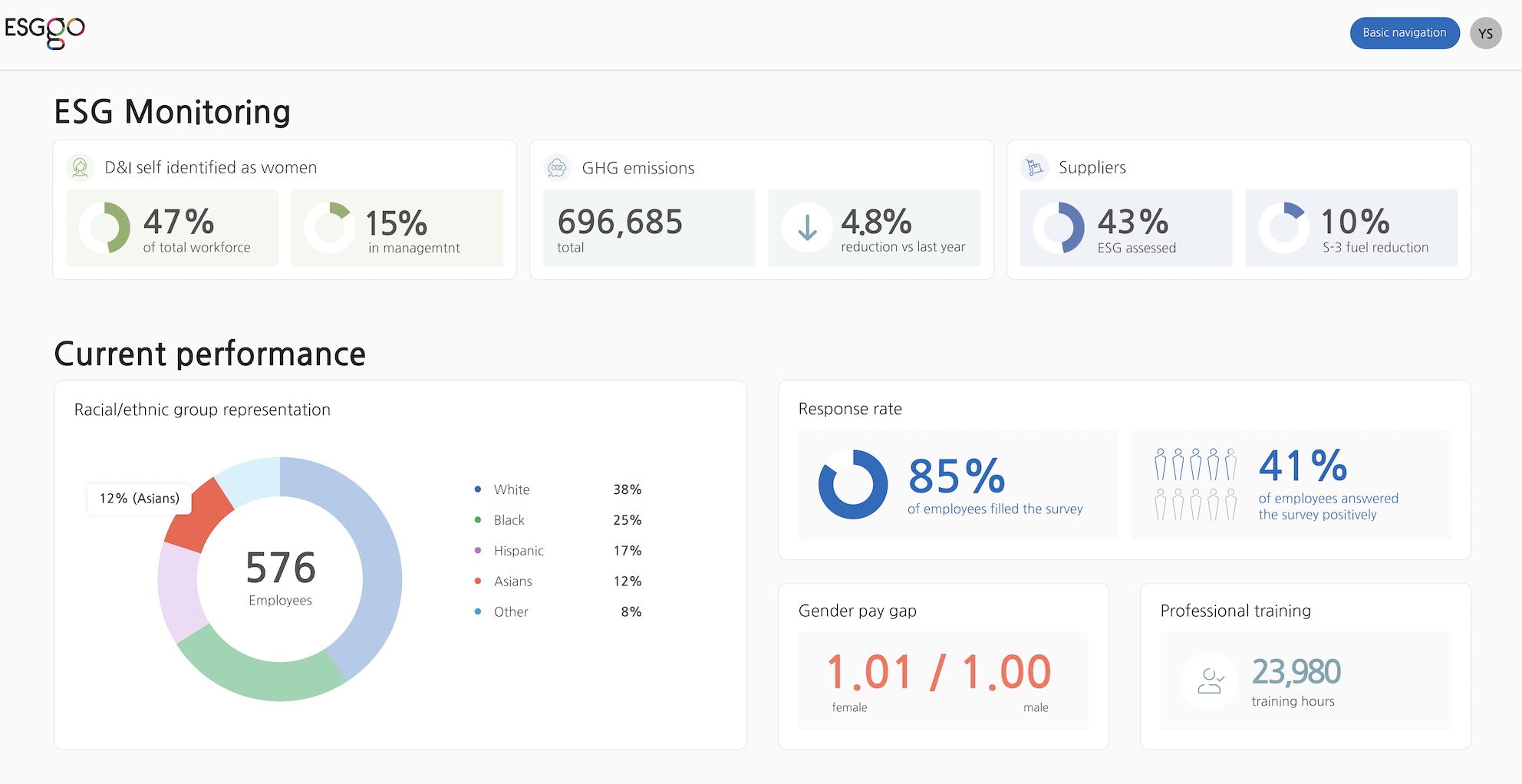

The product is focused on data collection, but there are no tools available. The company learned that most ESG tracking is done in spreadsheets or collaborative databases. External rating agencies have their own tools, but for internal use it's slim pickings.

There are hundreds of executives who promote the importance of ESG, but we don't have a universal measuring stick for clearly understanding ESG performance.

European VC funds are building community around ESG initiatives

Tracking hundreds of data points across the organization is suggested by the SASB standards. Data collection is important, as well as collecting information from various data sources before analyzing and reporting on it. The space where ESGgo operates is where this data and measuring it against the company's goals are combined.

It's not fun to have to go knocking on people's doors in order to get information. Our tool does more than just the data. The current situation of the company in their ESG is compared with historical performance. benchmarking versus the industry to see how we can become better. The latter will be an artificial intelligence improvement.

The company raised $7 million from Israeli firm Glilot Capital.

There is a dashboard for the ESGgo app.

Gillot is one of the top funds in Israel and an excellent global fund. They are real mensches because of their operational experience. They promote women and have a great value-creation team.

Glick leads a team of 10 or so people. She co-founded the company with Ido Green, who was previously an engineer at Facebook.

We are excited to be an early supporter of ESGgo. Orly has a brilliant vision for using technology to improve ESG reporting. It is the perfect time for this disruptive solution because of the changing way businesses and investors evaluate risk and opportunity.

The seed funding will allow ESGgo to accelerate its recruiting, starting with an Israel-based engineering team.

4 signs to look for when evaluating ESG investments