Russia's invasion of Ukraine could cause more pressure on chip manufacturing as a squeeze on the supply of rare gasses critical to the production process adds to pandemic-related disruptions.

Analysts have said that Ukraine supplies about 50 percent of the world's neon gas, a byproduct of Russia's steel industry that is indispensable in chip production.

Companies that rely on chips are facing production delays because of shortages of components, late deliveries and rising material costs.

Many companies, including US manufacturers Applied Materials and Intel, have said constraints would persist into the future. Techcet said that demand for raw materials is expected to rise by more than a third in the next four years, as businesses such as Taiwan Semiconductor Manufacturing Company increase production.

We are in trouble. "We don't have any rare gasses to sell," said Tsuneo Date, who runs Daito Medical Gas, a pressurized gas dealer north of Tokyo.

Neon prices went up by 600 percent when Russia invaded Crimea. The rush to find suppliers that are not in eastern Europe is causing shortages and price hikes, not only of neon, but also other industrial gasses.

Forty percent of the world's supply of krypton comes from Ukraine. By the end of January, the price of the gas had risen to over $8,000 per liter.

He said that the Russian invasion of Ukraine was making the situation worse and that he had recently been forced to turn down orders from new customers.

Companies along the supply chain developed new technologies, diversified sources of neon gas, and beefed up reserves after the Crimea crisis, which provided some breathing room. In 2016 a multinational industrial gas supplier invested $250 million in a neon production facility in Texas.

AdvertisementThe supply of neon, xenon and krypton is getting tighter because chipmakers and trading houses are making more orders in expectation that they won't be able to get it in the future.

The reaction has been immediate and I have heard that spot prices have jumped several-fold.

Neon is priced through long-term contracts with chipmakers and some gas is traded on the spot market. Several chipmakers and gas companies in Japan wouldn't comment on current prices.

He said that companies hope the conflict doesn't last and that they have the capacity to manage the disruption in the short term.

According to a research note byDeutsche Bank, inventory levels in the industry typically last around three to four weeks.

Kim Young-woo, a tech analyst at SK Securities, said that supply shortages could be serious for neon and krypton.

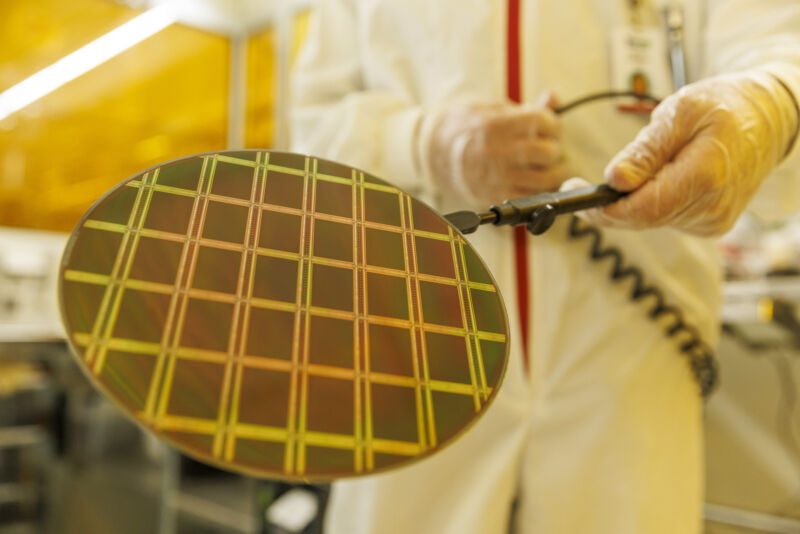

Neon is used to power lasers for etching patterns. Only a few companies around the world can do the complex process of refining it to a 99.99 percent purity, which is why it is difficult to move away from Ukraine.

The White House warned chipmakers to change their supply chains after Russia invaded. ASML is a Dutch company that makes machines used to make chips.

Renesas and Rohm said they had found supplies from other markets, such as China.

Kim said that the two largest memory chipmakers have plants in China so they will have little trouble getting gasses for chip production there. The companies said the war would have a minimal impact on their chip sales.

Even if alternative sources are secured, product certification will take several months or more than half a year, according to a note published shortly before the invasion.

The automotive industry, which requires large quantities of power management chips and power semiconductors, will face a new wave of material shortages.

Akira Minamikawa of market research firm Omdia said that all products using chips would be affected because only the most cutting-edge semiconductors did not require neon in their production. “It’s not like neon is used in chips for cars but not for smartphones.”

Reporting by Antoni Slodkowski and Eri Sugiura in Tokyo, Song Jung-a and Edward White in Seoul and Eleanor Olcott in London

The Financial Times is a division of The Financial Times. All rights are not to be redistributed, copied or modified.