Business reporter in New York.

Image source, Getty Images

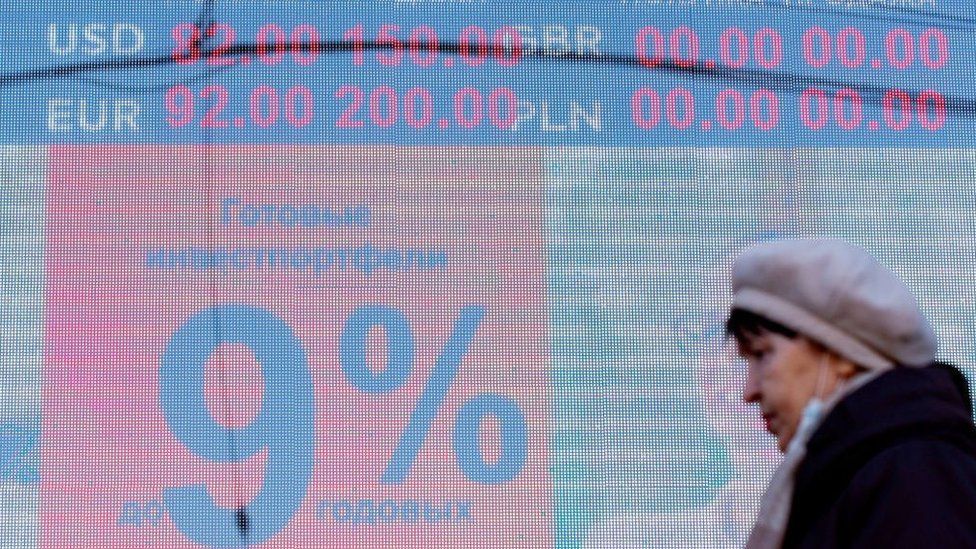

Image source, Getty ImagesA raft of actions by the West is meant to choke Russia's economy and banking system. They could impose more sanctions.

The US, UK, EU and more than two dozen other nations retaliated with economic measures that hurt state-owned firms and caused the Russian rouble to plummet.

The US says it hit 80% of banking assets in Russia. The allies have taken steps to limit Russia's access to key technology, such as microchips and lasers.

They are the toughest sanctions Russia has ever faced.

Policymakers are expected to tighten by adding more technology and new companies to the blacklist. On Wednesday, the US took action against oil refining equipment.

Emily Kilcrease, senior fellow and director of the Energy, Economics and Security Program at the Washington think tank, the Center for New American Security, said that they are at a seven or eight out of 10 on the escalation ladder.

Many Western companies have responded to the situation by stopping services or leaving the country.

Russia is a major global supplier of oil and gas, so trade can still flow.

Europe, which relies on Russia for 40% of its gas imports and 30% of its oil imports, has been reluctant to hit energy due to the fear of causing economic damage at home.

There is growing pressure on the US and Europe to act as the violence in Ukraine escalates.

Image source, EPA

Image source, EPAChristopher Miller, a professor at Tufts University's Fletcher School and an expert on the Russian economy, says that it will become politically unsustainable to keep paying Russia for oil, gas and coal.

It has become politically difficult for Western leaders to stand by and I think it will get harder as the Russian military escalates its use of force.

While oil and gas transactions are important to preventing the Russian economy from going off a cliff, cutting off that lifeline risks provoking more extreme reaction by Russia.

The level of economic pressure is very high. If you go for the economic jugular, Putin may respond with cyber and military action that will only make the suffering worse.

Half of the 60m barrels of oil that will be released from strategic national reserves will come from the US, which will act to ease a temporary spike in prices.

If Russia can sell less on the global markets at a higher price, it may be able to survive the loss of Western buyers.

I think people want to see something there, but you have to think about the effect of cutting off those sales. Will it hurt Russia? She says it is not clear.

The sanctions have had a negative impact on the Russian economy.

The two major Moscow stock indexes fell more than 20% before closing this week. The falling of the rouble against the dollar is hurting the purchasing power of Russian families at a time when rising prices and a poor standard of living are already concerns.

Image source, EPA

Image source, EPACapital Economics estimated that the sanctions could shrink Russia's economy by 15%.

The pain has not been limited to Russia.

Since the beginning of February, global oil prices have risen more than 10%, and analysts expect them to remain elevated due to uncertainty from the conflict. Almost 30% of the world's wheat, 18% of its corn and 80% of its oil is supplied by Russia and Ukraine.

The currencies of countries with close ties to Russia have been hit.

The problem with sanctions is that they never end up targeting only one place.

It is not clear how the economic destabilisation will affect Mr Putin's standing at home or if they will make him willing to negotiate a political end to the violence in Ukraine.

Russians have experienced economic isolation before and the ability to afford international travel and imported cheese may not matter to his base.

As long as pensions keep getting paid, people can enjoy a reasonable standard of living. Prof Ironside thinks there is some wiggle room. I don't know.

Prof Miller doesn't think the sanctions will force Mr Putin to negotiate. He says they may curb his power if sustained.

Prof Miller says that anything that touches the financial system is going to get more complicated and expensive.

It will make Russia's economic outlook substantially dimmer over the next couple of years and make it harder for the Russian government to keep its domestic political situation under control.

The goal is to create a medium to long term degradation of Russia's abilities.