The company plans to continue operating in Russia as long as possible.

The Dvoinoye mine is in Northeast Russia.

Photo by Handout

A broad range of companies, from energy giant to Apple Inc., are pulling up stakes and cutting ties with Russia after its attack on Ukraine left billions of dollars in business behind.

Western countries, including Canada, the U.S. and much of Europe, have imposed sanctions on Russia in order to force it to end the invasion.

One Canadian company that operates a high-grade underground mine in the far east of Russia has not criticized Russia but indicated it will continue to operate there as long as possible.

The surge in gold's price in the past 30 days is attributed to the increase in tensions caused by the invasion.

Although it earned $1 billion in gross profit in 2021, it has always traded at lower multiples to other gold mining companies because many of its mines are located in high risk countries.

During the company's fourth quarter earnings call, the chief executive said that the company's Kupol mine had all the supplies and workers.

We have operated there successfully for many years with strong support from the Russian government. We pay our taxes. It has been a great place for us, and we think we're welcome there.

We're good in our communities. We pay our taxes. And we think we're quite welcome there, and it's been a great place for us

J. Paul Rollinson

The value of the ruble fell when sanctions were imposed on Russia, according to the same call.

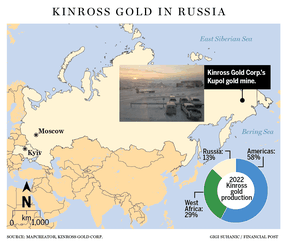

On February 23, when the U.S. announced sanctions against Russia, Kinross issued a four-paragraph press release saying it was monitoring the situation, but saw no disruptions. The company's Russian mine operations, known as Kupol and Dvoinoye, are 7,000 kilometres away from the fighting.

The company did not respond to the request for comment.

J. Paul Rollinson is the CEO of Kinross.

Matthew Staver is the photographer.

Eric Miller, president of Rideau-Potomac Strategy Group, said that the commodities story is underpinning the saga.

Miller noted that Europe and the U.S. import a lot of oil and gas, and that has caused prices to go up. Russia produces minerals that are critical to global supply chains.

Although gold is not as critical to supply chains as other commodity exports from Russia, he noted its role as a store of value typically causes gold prices to rise during a crisis.

Kupol and Dvoinoye are among the most profitable gold mining complexes in the world. In 2020, the mines produced 510,743 ounces of gold, which would be worth US$971 million at current gold prices.

13 per cent of Kupol's total production is expected to be lost in the year 2022.

The company has three mines in the U.S. and one in Brazil, which are expected to account for 1.53 million ounces of gold, or 58 per cent of its gold production in 2022, at a slightly higher cost of US$887 per ounce. The lowest cost of production in West Africa is US$770 per ounce.

The acquisition of Great Bear Resources is not expected to produce any revenue for a long time.

The impact of sanctions on the Kupol complex is an open question.

Miller said that Kinross was saying that they were staying because the sanctions hadn't told them to go.

Canadian sanction laws do not apply to foreign owned subsidiaries of Canadian companies according to a partner at the law firm.

He said that many companies are still looking at the sanctions and assessing whether there are considerations for companies that keep operating there.

That seems to be the reason why executives at Shell, Apple, and others have announced plans to leave Russia.

Ben van Beurden, chief executive officer of Shell, described Russia's attack on the Ukraine as a "senseless act of military aggression".

I have been shocked and sad by the situation in Ukraine, and my heart goes out to everyone affected, said the chief executive of the oil and gas company. It has caused us to rethink our position with the company.

A stake in the state-controlled oil company, which accounts for half of the company's oil and gas reserves, is held by British oil company, BP. British politicians took to social media to pressure the company about its operations in Russia.

Russia was able to continue to export oil and gas as well as other commodities because of the sanctions from Canada and many other countries.

Canada has restricted export permits to Russia but not to commodity imports from the country, according to Shatiryan.

He told analysts that his company is able to sell its gold in Russia, but not to the Russian central bank.

The government in Canada is expected to update its sanctions.

The recent developments in respect of the sanctions regimes will prompt financial institutions and other institutions and businesses to think about the compliance regime, not only from a technical legal standpoint, but also from a reputational standpoint.

Email: gfriedman@postmedia.com

You can listen to Down to Business wherever you get your podcasts, for in-depth discussions and insights into the latest in Canadian business. The latest episode can be found below.