Capital One Venture X rewards credit card.

Capital One Venture X is a premium version of the product. I am amazed at how much they include at the price point. The limited-time introductory offer for this card ends on March 14.

This is going to be a strong card to consider for travel rewards fans, and it hits high marks for all of the reasons you may want to get and use a card.

The idea that Capital One would be releasing a Visa Infinite premium card in travel has been rumored for a long time. I'm glad they took the time to get it right and to align with the opening of their own airport lounge network and the launch of their new travel portal.

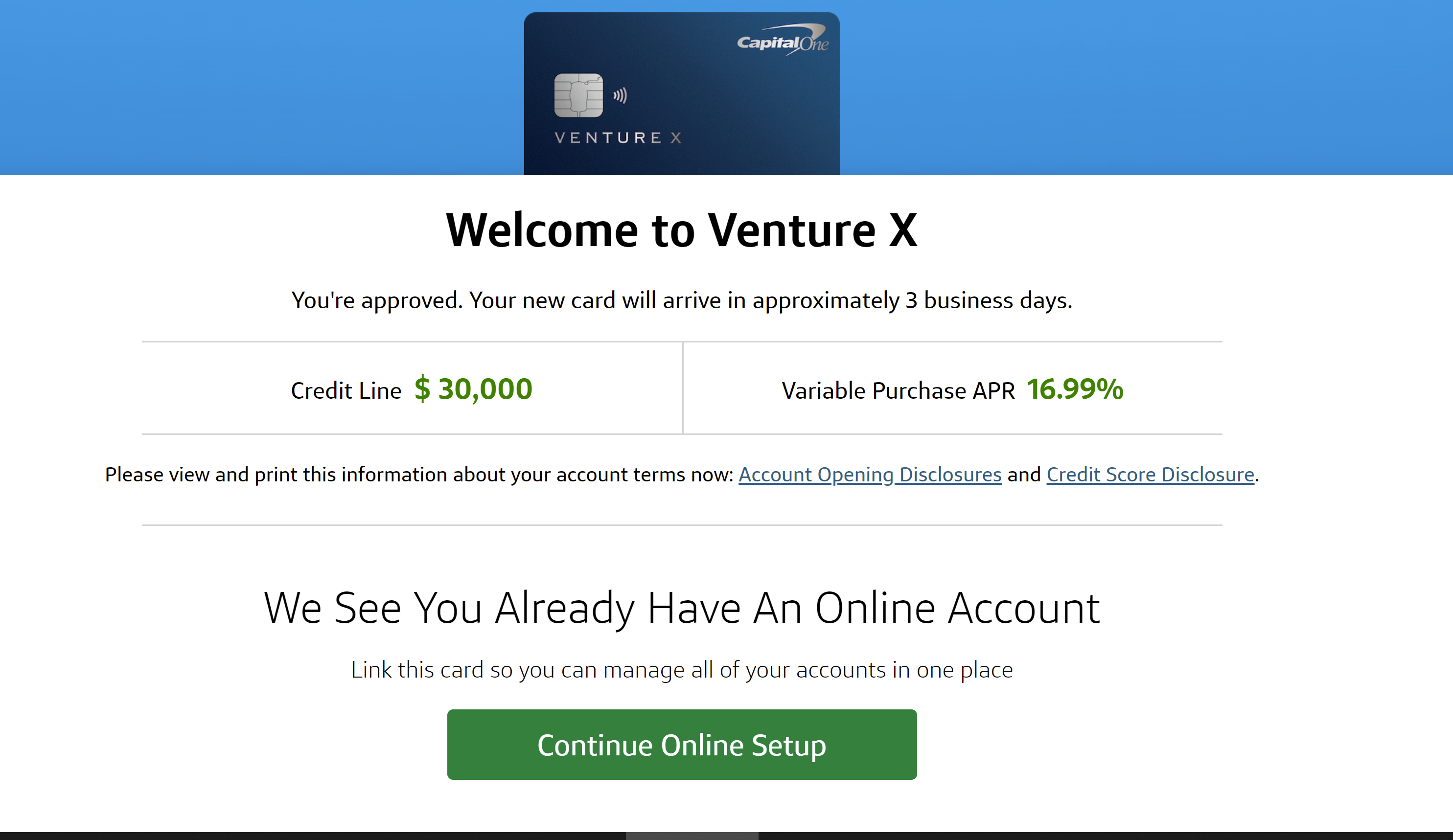

I am very excited about this card. I received an approval after applying. Several readers have told me that they received similar approvals as well. They shared the same credit line news.

For a limited time, Capital One Venture X is also offering up to $200 in statement credits for vacation rentals, and 100,000 bonus miles after spending $10,000 in the first 6 months.

The reward is generous and you have six months to meet the big spend requirement. The statement credit that is available at the beginning will allow you to earn money on the card's benefits more easily than the card's cost.

The Capital One Venture X has an annual fee. That is on the low end for premium travel cards. They clearly made a conscious decision to pack a lot of value into their card and charge less than American Express, Chase, or Citibank.

Even without statement credits, the card should be easy to use even with an initial bonus offer worth well over $1500, as they have set up benefits that make the card pay for itself quite easily. Read on.

2 miles per dollar is earned on every purchase, and 10 miles per dollar on hotels and rental cars booked at Capital One Travel, as well as 5 miles per dollar on flights booked via Capital One Travel.

The Capital One travel site is quite good. I would not hesitate to book air and rental car here. Booking hotels means giving up hotel loyalty points, credit towards earning elite status, and elite status benefits, so I'd only do that if you aren't chain-loyal or are booking outside of your preferred chain.

Capital One has the only consumer cards that give you 2x earning on everything and can be used to redeem other points. Capital One Venture X is a good single card solution for a lot of people.

You don't have to redeem points for paid travel through Capital One's travel portal, since you can also redeem against recent travel purchases on your statement. Transferring to other loyalty programs is my favorite use.

Capital One miles now transfer 2:1.

Capital One miles can be transferred into EVA Air. They transfer 2-to-1 into all Accor Live Limitless.

I like that they allow transfers in 100 mile intervals, rather than 1000 mile intervals, since I often find after a transfer I have more miles in an account. I would rather go closer to zero and not have that extra 1000 miles. Capital One does something for customers that other issuers don't.

Air Canada, Air France, and British Airways are some of the airlines you'll most likely use for a points transfer.

There is a limited time $200 statement credit offer for spend on vacation rentals as part of the initial bonus, and on an ongoing basis.

The $300 travel credit and 10,000 bonus miles are included in the card's annual fee.

The Capital One Venture X card gives you unlimited access to the Capital One airport lounges. Anyone can access the Capital One airport lounges for $65 per visit if they have a Venture and Spark Miles card.

The card comes with Priority Pass Select, which is in line with Capital One's approach of "simplicity".

The Capital One Venture X card gives you up to 4 no annual fee authorized users and lounge access, along with cell phone protection. Each authorized user gets a Priority Pass Select card, which entitles them to access Capital One airport lounges, and the ability to bring up to 2 guests.

The Capital One Venture X card has additional premium benefits.

Some United elites may be unhappy about losing their Hertz status, but this card has their top public tier status as a bonus. The benefit is for primary card holders. National Car Rental, Avis and Silver are offered by Capital One.

Car rental protection includes lost luggage reimbursement, trip delay, cancellation/interruption reimbursement, cell phone protection, and extended warranty protection.

Cardmembers can earn up to 100,000 miles per year for referring friends, and up to 4 referrals per year.

The premium travel rewards credit card space has been so crowded and expensive that it seems to me that there are only two strategies to use: do something really niche and provide value to a small number of cardmembers.

Chase said the rewards were more expensive than they had modeled. They were attracting a very affluent demographic. They spent a lot of money, and kept spending even more, and had mostly just interchange to cover their costs.

The only winning move is not to play if you want to take on a product like that.

Capital One has come up with a model that offers a lot of valuable points up front, continues offering valuable benefits to cardmembers going forward, and does this at an even lower annual fee than competitors. I don't know if that can make any money for the issuer, but the new Capital One Venture X is a great new option for consumers.

Capital One Venture X rewards credit card.

The best new credit card of the year was given by The Points Guy. I think the new Capital One Venture X is a good choice. The way they dismiss the best competition is interesting.

In credit cards.

The James Beard Foundation, Chef Andr, the MICHELIN Guide, and Capital One are partnering on a new dining portal that combines restaurant recommendations and tables set aside for Capital One rewards cardmembers.

In credit cards.

Capital One introduced the ability to transfer their miles to a variety of different airlines at the end of the year. The Capital One Venture Credit Card is now a double threat. When you spend money.

In credit cards.