If you use our link, you will get the best publicly available offer for the Capital One Venture X rewards credit card.

The Capital One Venture X rewards credit card was launched in late 2021. On launch day, I applied for the card and was approved. I wanted to share my experience, and also share some trends I am observing based on all the application data points provided by OMAAT readers since the card opened for applications.

I wanted to explain everything you need to know about getting approved for the Capital One Venture X.

The Capital One Venture X is simple to apply for. The card has an annual fee of $385.

This is an unbelievably rewarding card, and competes favorably with the best premium cards out there.

The Capital One Venture X may be the first Capital One product that people in the travel space apply for. There are a lot of rumors about Capital One's application restrictions. Overall, it's good news and it's easier to get approved for than other Capital One cards.

Capital One doesn't have any restrictions on being approved for new cards.

You can only be approved for one Capital One card every six months, according to many. There are several data points of people being instantly approved despite having picked up another Capital One card. I was approved for the Venture X several weeks before I was approved for the Capital One Spark Cash Plus.

There is a rumor that you can have more than two Capital One personal credit cards at the same time. There are many data points suggesting that this is no longer a policy, so I wouldn't put a lot of weight on that.

It doesn't seem like there are any hard-and-fast rules around Capital One card approvals.

I would recommend having a credit score in the good range to be approved for the Capital One Venture X.

If my credit score was under 700, I wouldn't apply, but I would hope to have a credit score of 740 or higher. Some people have scores that are lower than the report being approved, and some people have scores that are higher than the report being rejected. There are a lot of factors that go into approval, such as your income, credit history, and Capital One's extended credit.

You can. Even if you have another version of the Capital One Venture, you are eligible for the Capital One Venture X. If you apply for the card, you will be approved. You wouldn't be eligible for the new cardmember bonus if you changed your product.

There is a rumor out there that Capital One denies many people with excellent credit because they want their customers to carry a balance and finance charges.

I can't speak to that personally. I have excellent credit and don't carry a balance, and both of the Capital One cards I have applied for have been approved.

The data points we have seen suggest that a lot of people are receiving an instant approval, including people who had previously been rejected for the Venture.

I'm starting to think that the Venture X might be easier to get approved for than other Capital One cards, especially for those with excellent credit. Overall people who have excellent credit and don't carry a balance are reporting that they are being approved.

It does seem that people are being approved at a higher rate than we were expecting, and that's not to say that some people won't be denied. That is great news.

Capital One is one of only a few card issuers that pulls credit from all three credit bureaus when you apply for a card. I don't think this is a big deal at all. When you apply for a card, your score will be dinged a few points, and it really shouldn't matter how many bureaus your credit is pulled from. This restriction has never bothered me, though I know others feel differently.

Some people choose to freeze their credit reports as a way of preventing identity theft. If you unfreeze your credit with just one or two of the three bureaus, you will not be able to apply for a card.

If you plan on applying for the Venture X, I recommend unfreezing your credit with all three bureaus.

Visa Infinite products have a minimum credit line of $10,000 and the Venture X is a Visa Infinite Card.

I haven't seen reports of credit lines of over $30,000. If anyone has a higher credit line, please report it.

It really depends. Some people report getting instant approvals on the Venture X, while others may have their application status go to pending.

Should you be worried about getting denied if you are not sure if you will be approved for the Venture X? Getting denied for a credit card isn't a big deal. You can apply again in the future, and it's not like a denial is reported on your credit report. You will see the inquiry on your credit report, but it won't affect your credit score.

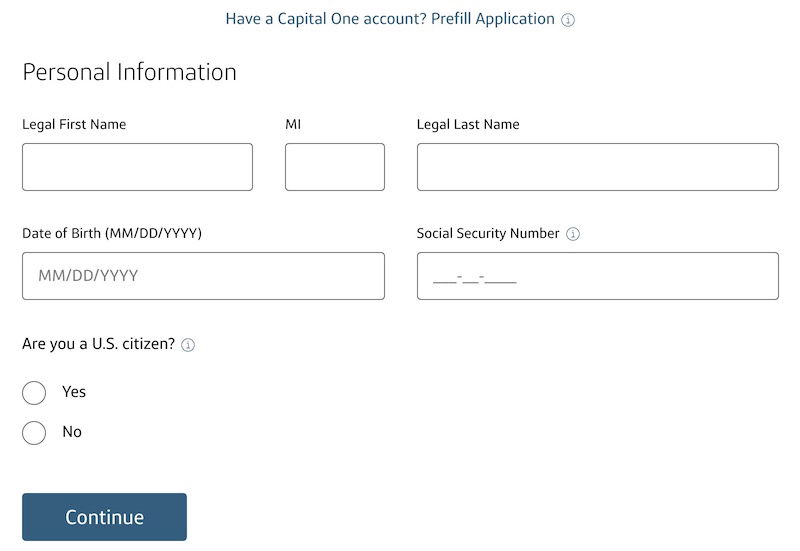

I applied for the Capital One Venture X and wanted to share my experience. The application took two minutes to complete. I was asked for my 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299

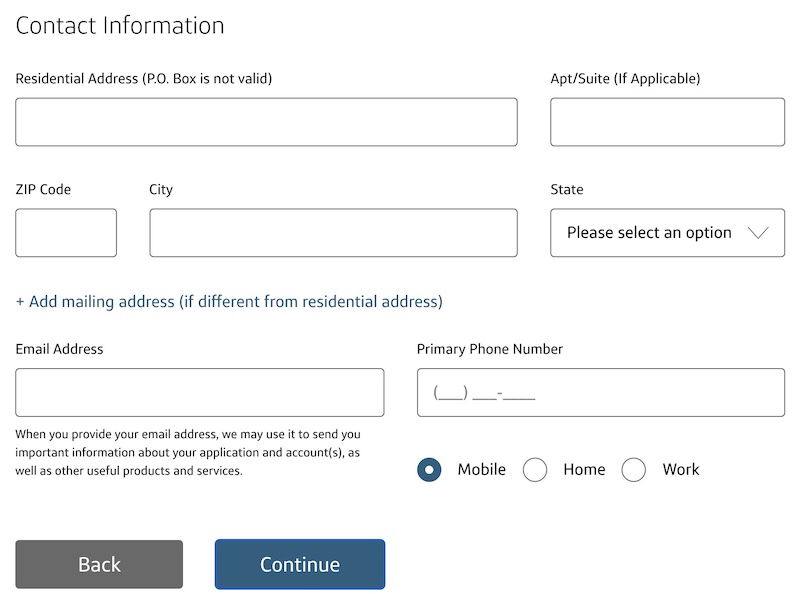

My email address and phone number were asked for on the next page.

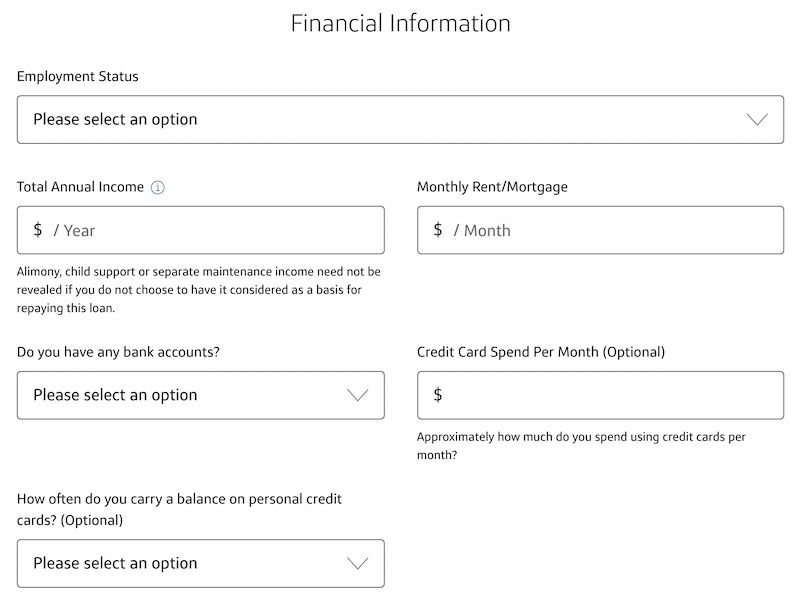

I left 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299

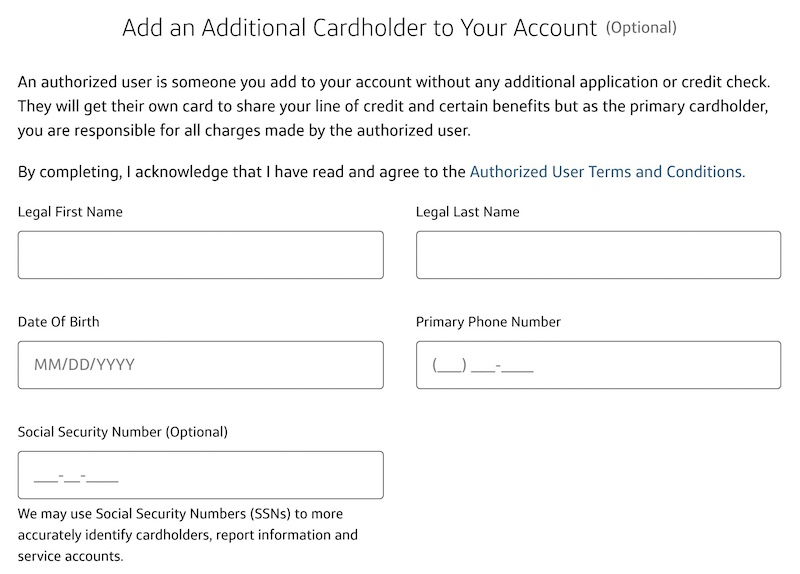

I was asked if I wanted to add more cardmembers after I was approved.

I was immediately approved with a huge credit line, after I was asked to confirm that all the information I provided was accurate. Ford also got an instant approval. Wow!

The Capital One Venture X is open to applicants as of late 2021, and I was instantly approved. This is a new card that has both a welcome bonus and ongoing perks.

The card offers annual benefits that are more than justify the annual fee, and on top of that the card offers awesome lounge access perks, rental car status, a great return on everyday spending, and more.

If you applied for the Venture X, what data points did you have? What is the difference between instant approval and denial? The more information OMAAT readers can give, the better!