The stock price of Coinbase, the American trading giant, plummeted as much as 9% after it reported its Q4 2021 earnings today, but investors quickly sold off the stock after the initial surge.

The company beat investor expectations. According to the company, retail monthly transacting users and total trading volume are expected to decline in the first quarter.

In the fourth quarter of the year, the company's total revenue was up from the year-ago quarter. In the final three months of 2020, the company had a net income of $178.6 million, but in the fourth quarter of 2021, it had a net income of $840.2 million. The company reported GAAP earnings per share of $3.92 in the final quarter of last year.

The company was expected to report earnings per share of $1.85. According to data provided by Yahoo Finance, the revenue and profit estimates for the company ranged from $1.19 billion to $2.44 billion.

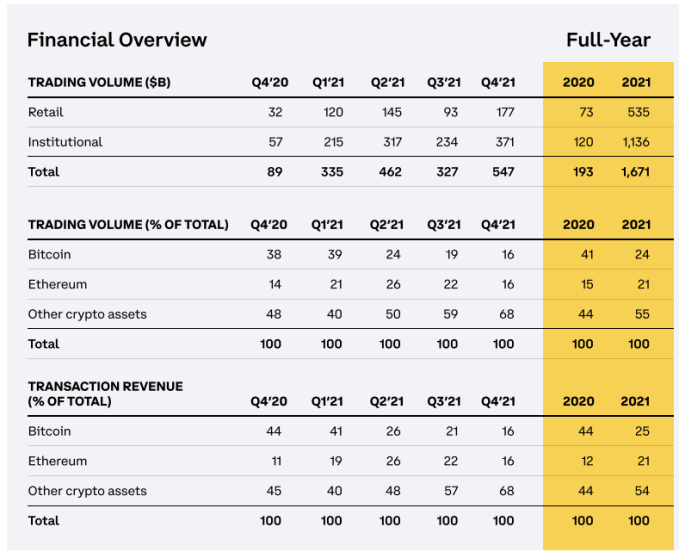

What can we glean from the Coinbase quarter as it relates to the world ofCryptocurrencies? Lots. The chart has a lot of information.

Retail trading activity in volume terms is a fraction of institutional volume, but it is also the majority of its total top line. Retail trades were worth more than $2 billion in revenue in Q4 2021, while institutional trades only generated $90.8 million.

The era of dominance in terms of trading volume and trading revenue generation is over. It was tied to the ether for trading volume and revenue. The rise of other cryptocurrencies in terms of trading volumes and incomes is something to chew on, while the revenue story of the company is a very different one.

The company posted huge profits and grew from the year-ago quarter. The stock is down. The market cares more about what you do than what you have done. Guidance can trump strong trailing results.

The market had expected the company to make $1.69 billion in revenues and earnings per share of $1.55. Did the company's forecasts indicate that it wouldn't hit those marks?

Here is what the company has told investors so far.

According to the company, it expects annual average retail MTU to be between five million and fifteen million. The average transaction revenue per user is expected to decline.

We will have more from the company's earnings call.