The last couple years of hardship have made it more difficult to pay bills. Promise works with utilities and government agencies to give flexibility in payments for people who can't cover their entire bill at once. The company just raised a $25M B round to keep growing.

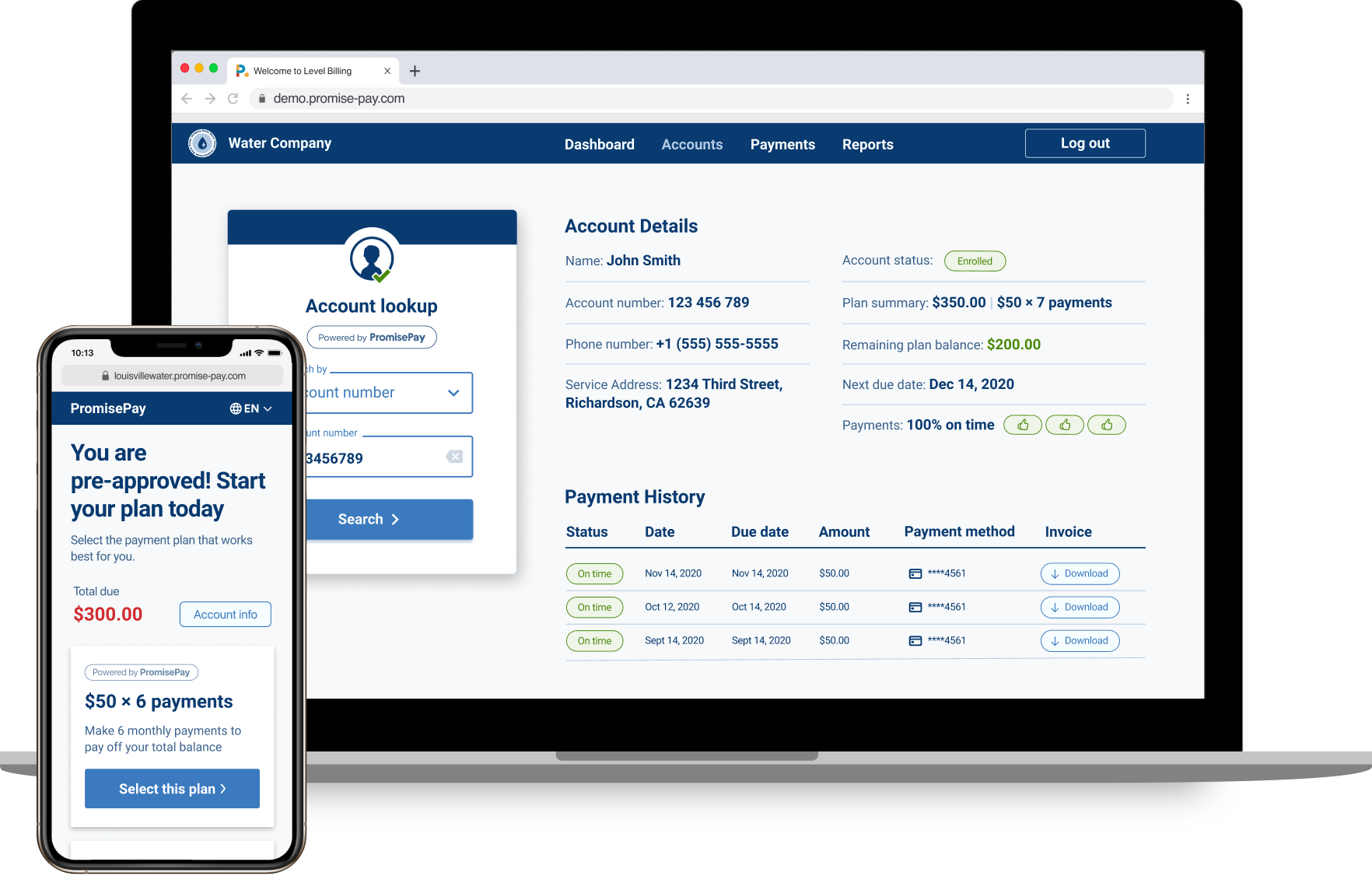

Promise works with government agencies and related organizations to collect money. Normally payment processes for these are very rigid and don't account for fluctuations in income or free cash; Promise provides a plug-and-play interest-free installment payment plan for something like an electric bill.

For people with money, we want systems with as much flexibility as possible, but not for poor people. "If you don't pay by the 5th, you don't get the service, and you face the consequences," said Phaedra Ellis-Lamkins, CEO and founder of Promise. If you don't pay your commercial drivers license fee on time, you can't work to get the money to pay for the license, or your gas bill, so you have late fees. In a time of enormous fiscal uncertainty, inflexibility doesn't make sense.

Ellis-Lamkins said that the old systems were based on the idea that if someone doesn't pay, they will be punished with fees and interest. Promise has a different position.

They can pay if you build a system that works for people.

The data supports the idea that places where a majority of people lived with rolling government debt were suddenly paying it at rates above 90 percent. It makes sense to subscribe to a service that makes it more likely that income will come in.

With $20M A round, Promise brings financial flexibility to outdated government and utility payment systems

We talked to Promise a year ago when it raised$15 million to expand operations. The company's revenues and customers increased by 45 and 32x respectively. It said that it has already booked multiples in the first few weeks of the new year.

I asked what that growth looked like. We have gotten good at getting money in, but we also want to get good at getting money out.

She explained that Promise's direct interface with a utility gives them insight into things like government subsidies. Getting some money or discount that has been officially allotted to them means filling out paper forms, providing tax records, and visiting a place in person, which is not convenient even outside of Pandemic conditions. Government agencies know which people qualify but don't alert them.

The image is called Promise.

This is money that local and state governments want to give away, budget items or federal money that might be lost if not awarded. Speed and communication are not their strong points. Promise gave out 10 times what the local authorities had more or less by texting eligible people and saying "come and get it."

Promise's work puts pressure on predatory lending and collection agencies that made their living off the poor. Few will be sad to see these business models reduced to desperation.

As it becomes clear that you catch more flies and bills with honey, more local governments are signing up and paying the subscription fees that provide Promise with revenue. Ellis-Lamkins declined to go into detail, but he did say that the funding would cover the hiring of all the new customers and that the company would do payments work for the Feds. Promise is a big fish to land, and we can expect it to keep growing.

The General Partnership led the B round with participation from Kapor Capital, Bronze Investments, First Round Capital, Y Combinator and others.