Chris Morris is the Global Trade Correspondent.

Image source, Reuters

Image source, ReutersRussia has been preparing for this moment for a long time.

The annexation of part of Ukraine by Russia provoked a first round of international sanctions. Moscow was taught an important lesson by that.

Since then, it has been setting up defences, moving away from relying on the dollar, and trying to sanction the Russian economy.

The West assumes that President Putin can tolerate sanctions for a long time.

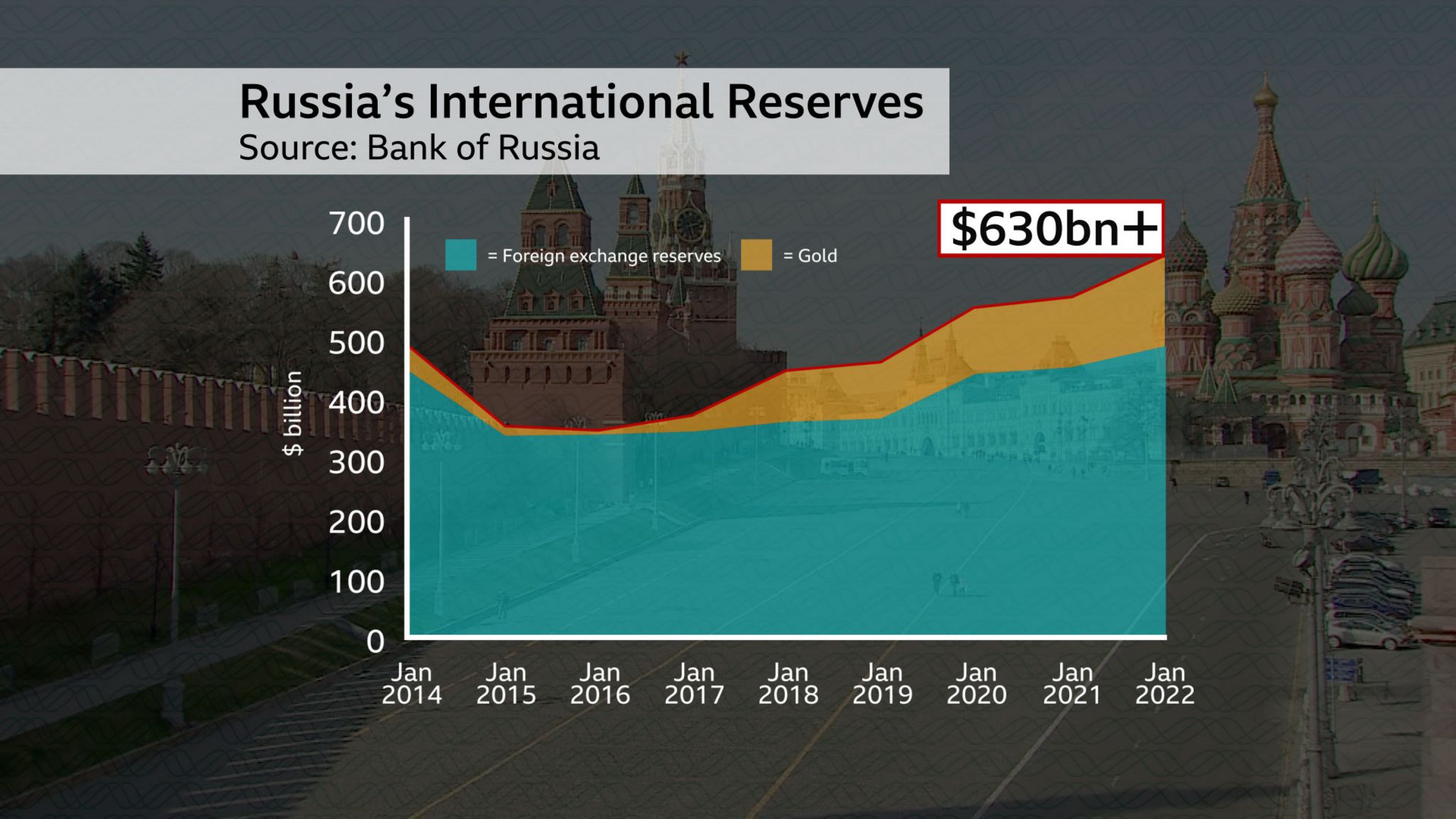

The government's international reserves, in foreign exchange and gold, were worth more than $630 billion by January this year.

That is the fourth highest amount of reserves in the world, and it could be used to prop up the rouble for a long time.

Only a small amount of Russia's foreign exchange is actually held in dollars. The Chinese renminbi is now held by about 13% of the population.

The goal is to protect Russia from American sanctions.

The structure of the Russian economy has changed.

Over time it has reduced its reliance on foreign loans and investments, and has been looking for new trade opportunities outside of Western markets.

China is part of the strategy.

In case Swift is cut off, the government in Moscow has taken initial steps to create its own system of international payments.

The budget has been cut because it prioritised stability over growth.

Over the past decade, the Russian economy has grown at an average of less than 1% a year. It may have become more self-reliant in the process.

Russia is building an alternative financial system so that it can tolerate some of the sanctions that the West might impose.

There will be some short-term pain in all of this, and the vulnerabilities in the Russian system are that they have a web spread very thinly across the globe.

It could be dangerous for Moscow. Sanctions on Russian banks would hurt.

The US, the UK and the EU may have different strategic interests to consider.

Image source, EPA

Image source, EPASome countries are more likely to impose sanctions on the Russian oil and gas industry than others. 40% of the EU's natural gas supplies come from Russia. The UK gets a small amount of money.

The decision by Germany to put the Nord Stream 2 gas line on hold will have a direct impact on energy prices in western Europe.

Can targeting high net worth individuals have a bigger impact than sanctions on the economy?

For obvious reasons, President Putin doesn't have money or assets in his own name. Ultra-rich supporters do it for him.

There have been some sanctions against oligarchs, but they have not gone far enough. Prof Tomila Lankina of the London School of Economics says that change will only happen if they are more targeted against them.

Image source, EPA

Image source, EPALondon has a long-established network of front companies, property portfolios and political influence.

The UK government has announced new sanctions against individuals, but an anti-corruption group says there is a lot of Russian money invested in London property.

Western governments are failing both the Russian people and their own people by allowing this to happen.

The sanctions announced in the last few days are only the first of several steps. The pressure can be raised a lot.

Will it be enough to force Russia to change course?

There is no question that sanctions can have an impact, but a package as broad as this has never been imposed on an economy as large as Russia.

To make it effective, the West would have to be involved for a long time.