Sirona Medical has acquired Nines, a company that has developed FDA-cleared analysis. This acquisition happened during a shaky time in the field. Sirona is betting that this move will prove that we need to rebuild things from the ground up if we want to bring artificial intelligence into the clinical workflows.

Think of IT as a layer cake to understand where Sirona and Nines fit together. Medical image databases are the first layer of that cake. The second layer is software that is used by radiologists to interact with the software on a day-to-day basis. The third includes artificial intelligence that can help doctors make decisions.

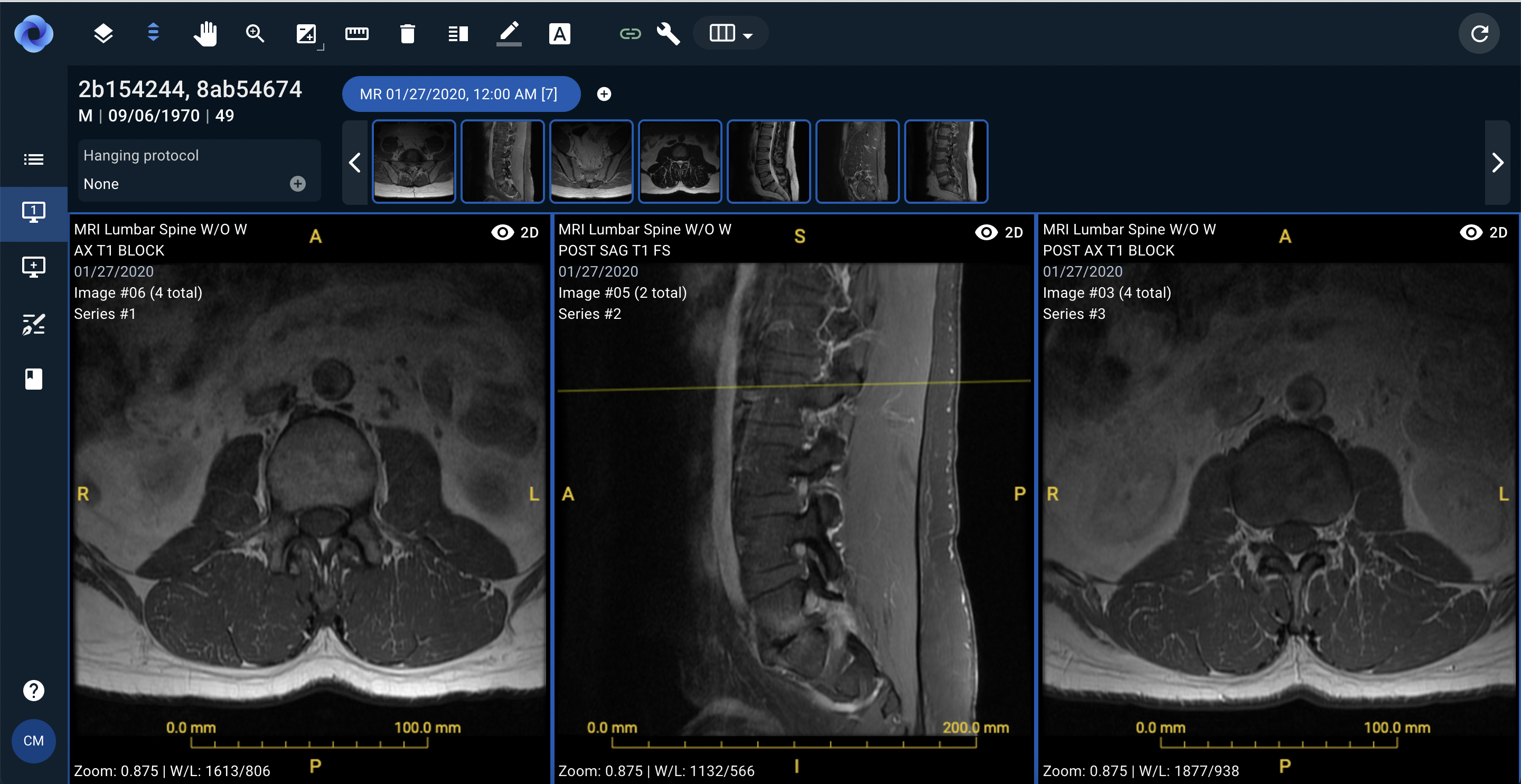

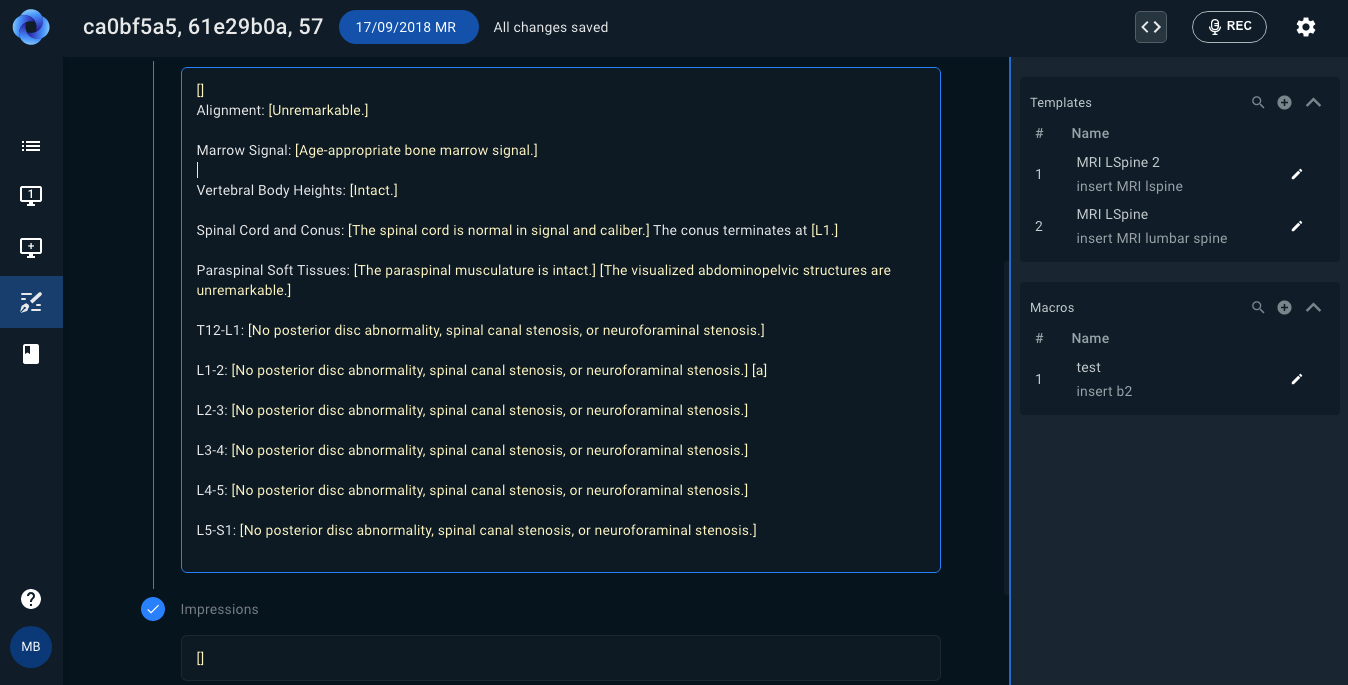

Sirona's core product is called "RADOS" and it aims to bring together the bottom two pieces and allow for artificial intelligence to be layers on top.

The company claims that it can help physicians make better decisions. Scientists can measure the size of lung nodules to help detect respiratory diseases. The other program looks at the brain images for signs of intracranial hemorrhage and mass effect. The goal is to help doctors. The FDA 510(k) clearance was received by both of them.

The platform is called RadOS.

The acquisition is happening because you need to unify layers one and two in order to truly integrate algorithms into clinicians' work. He said that the problem was going to be solved by RadOS.

It has been a mixed bag when it comes to artificial intelligence in healthcare. On the other hand, you have the spinoff of IBM's health business in January. It isn't enough to stop enthusiasm. In the same month, the largest outpatient diagnostic provider in the country acquired two companies that were invested in artificial intelligence.

There is an elephant in the room, that the anticipated Artificial Intelligence revolution has yet to arrive. A survey of members of the American College of Radiology found that only 30 percent of them use artificial intelligence. 20 percent of those who didn't use artificial intelligence planned to buy new tools in the next five years.

Sirona believes that the issues that have stymied the use of artificial intelligence in radiology are baked into the industry's legacy tech. All thoselayers aren't designed to work together.

Even before you add on clinical support software, radiologists are already working with many different pieces of software. If you want to add on a new software program that uses artificial intelligence, you have to add another bundle. The installation of vendor-specific software on individual workstations is required for robust artificial intelligence software. The paper notes that this process can add complexity when it comes to adopting new technology.

The underlying radiology IT stack is unable to handle both the tasks that radiologists have, and the tasks that third party software vendors are going to be demanding of it in the next decade.

Sirona's acquisition of Nines will bring those top-layer algorithms into the same operating system. What does that mean for doctors? They will be able to move from an annotated image to a report. A doctor can now click on a lung nodule, have it measured using Nines, and then insert that measurement into a report.

This seems very simple. It was impossible to achieve despite that.

The application is powered by the platform.

The ability to correlate the words with the images is represented by artificial intelligence and computer vision. They are completely separate from the algorithms.

Sirona only acquired Nines, its clinical data pipeline, its two FDA-cleared algorithms, and its machine learning engines. The company has not acquired the teleradiology arm. Nines also employs remote radiologists who work for hospitals and clinics.

The teleradiology arm wasn't a good fit for Sirona because he wasn't in the radiology services business. He wouldn't discuss the details of the deal.

The deal came about because of investor overlap and mutual connections. Sirona has connections with an investor in Nines. Sirona has raised over $60 million.