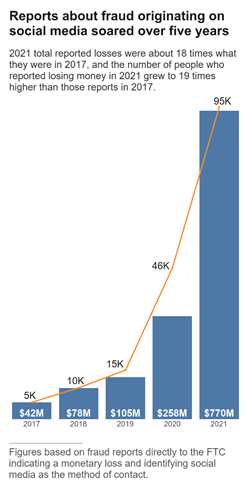

According to a new report by the Federal Trade Commission, consumers lost $770 million to social media scam in the year 2021, accounting for about one-fourth of all fraud. The FTC said that the number of social media fraud has increased 18 times from the $42 million reported in the year before. The rate of fraud losses for adults ages 18 to 39 is 2.4 times higher than for adults 40 and over.

Social media has been found to be one of the most profitable places to commit fraud. More than 95,000 fraud victims said they were first contacted on social media.

The FTC has an image.

More than one in four individuals who reported losing money to fraud to the FTC last year said they first saw a post, message, or ad on social media which had prompted the scam. Social media scam accounted for 26% of the losses attributed to fraud in 2021, followed by websites and apps at 19% and phone calls at 18%. The highest individual losses were for phone fraud at $1,110 and social media fraud at $468

The data indicated that most of the social media scam took place on Facebook.

In the case of online romance scam, more than a third of users reported that the first outreach they had from the scam was on social media. The two most popular websites for romance scam are Facebook andInstagram. The report explained that the scam began with a seemingly innocent friend request, followed by sweet talk and then a request for money.

More than half of the investment scam began with social media platforms, where they would promote bogus investment opportunities or connect with people directly to encourage them to invest. In this area, the messaging app Telegram was the most popular with scam artists, accounting for 7%.

The report found that a large majority of the investment scam involve cryptocurrencies. More than half of social media investment scams reported to the FTC used the payment method of cryptocurrencies. Payment apps and services were used in 13% of cases, followed by bank transfers or bank payments in 9%.

The FTC has an image.

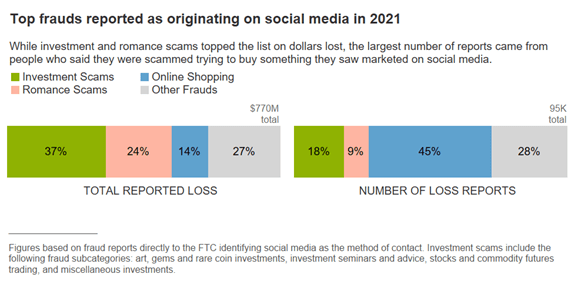

Although romance and investment scam losses continued to account for the largest losses by dollar amounts, even reaching record highs, the scam with the largest number of reports to the FTC involve consumers trying to purchase something they first saw on social media. Most of the time, people were trying to purchase something they saw advertised on social media.

45% of reports sent to the FTC were related to online shopping. Almost 70% of those involved people who placed an order after seeing an ad on social media, but never received the merchandise. The ads were designed to fool them into thinking they were buying from a real online store. 9 out of 10 of these scam were done on Facebook andInstagram.

The increase in online shopping scam isn't just an issue for the consumers losing money, it's also a determinant of the overall e- commerce and social media companies. In recent years, Facebook and Instagram have invested heavily in making online shopping a core part of their services, promising to connect advertisers with targeted customers. Consumers can browse goods and check out directly from the Shop section of the Meta-owned apps. If consumers become wary of the legitimacy of online retailers featured on these platforms, they may hesitate to shop from social media in the future.

The company's larger ad business has been impacted by Apple's privacy changes on iOS which let consumers opt out of tracking, so a change in consumer shopping behavior is more important than it has been in the past. Meta has diversified its revenue by creating in-app shops where it can capture more first-party data based on consumer shopping inside its own platform, anticipating the market shift that would result from this reduced ability to personalize ads. New revenue streams from the creator economy include subscriptions and tipping.

Investment, romance, and e-commerce are the most common types of social media scam, according to the FTC. The report didn't break them down by category.