If you have ever taken out a mortgage, you know how hard it can be.

A pair of former Blend employees have joined forces to build mortgage loan origination software that will connect banks, credit unions, mortgage bankers and brokers. They want to make it easier for financial institutions to make the whole lending process easier and more transparent for customers.

The need for more efficient loan origination systems is demonstrated by the sheer volume of loan originations. The Mortgage Bankers Association predicts that there will be more than $2.59 trillion in loan originations in the year 2022. There was a big jump in new home purchases due to historically low interest rates, but that is still a lot of loans. It is common knowledge that inefficiencies in the process lead to longer closing times and higher associated fees.

The pace of change in more digitally native industries has not kept up with the current mortgage infrastructure. This is a common refrain in the industry, which is why we are seeing an increasing number of startup popping up in the space. Polly this week announced it has raised $37 million in a round of funding.

The new company, San Francisco-based Vesta, is announcing it has raised $30 million in Series A financing with participation from new investor Zigg Capital. The company has raised $35 million since it was founded in November 2020. Vesta's technology aims to provide a platform for mortgage origination, support approval, and funding of home loans.

The image is from the book, "Vea."

The mortgage industry still lacks a consistent engine to orchestrate and standardize loan origination, according to a general partner of A16z.

Change management is more important than anything else because replacing the existing process is hard. It requires technical and financial know-how to develop and implement a new backbone in a highly regulated industry. The infrastructure they are creating will be a core driver to automation and adoption in the industry.

Blend's first engineering hire was Yang, who led all platforms and integrations. Yu was heavily involved in the company's product launches.

With their new capital, the duo hopes to advance on their mission to enable a seamless, transparent experience for financial institutions and their customers through an intelligent, opinionated and intuitive platform.

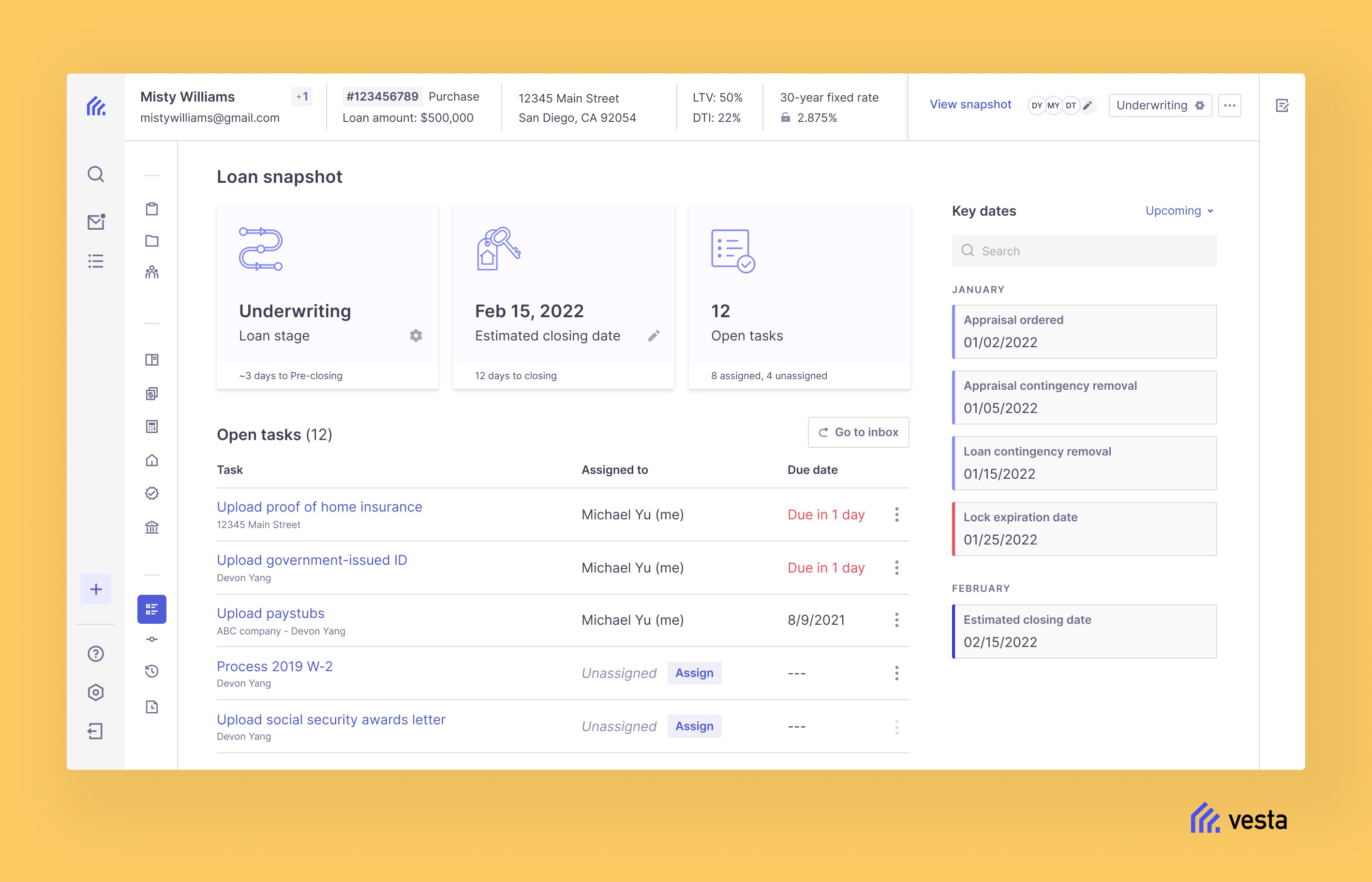

The model of the software as a service is designed to eliminate redundantness, reduce compliance risk and help lenders better understand, measure and improve their origination processes. That includes the aim of serving as a system of record for loan origination data and documents, a customization engine that organizes the process across the various parties involved, and an open platform that allows for the creation of point solutions.

Once focused on mortgage banking, Blend is now going after the broader fintech market

The company's biggest difference is that it is focused on only being the core platform, and that it offers developer tools and APIs to enable other point solutions to integrate with it.

The future of mortgage infrastructure and financial services infrastructure will be a modular system where banks and lenders choose the various point solutions.

Christian Lawless, managing partner at Conversion Capital, said that the challenge was tackling a massive opportunity in a highly fragmented industry.

He wrote via email that the mortgage market has been built atop antiquated technology from the 1980s which has slowed progress, hindered innovation, and stifled competition. It's long and painful because it's built to lock customers in with high break fees and costly integrations. This has forced a growing divide between the modern, digitally native mortgage companies with more efficient and profitable workflow engines and their antiquated peers which continue to lose market share.

Polly snags $37M in Menlo-led Series B to automate workflows for mortgage lenders