NALA, a cross-border payments company that recently pivoted from local to international money transfers, said Thursday it has raised $10 million.

NALA secured a seven-figure pre-seed round led by Accel three years ago. In that time, NALA built a mobile money service in East Africa. NALA started testing international money transfers in 2020 after some users expressed interest in moving money from the U.K. to East African countries.

Digital lenders compete for less than 20% of the international money market, but the business opportunity is lucrative.

Digital senders like NALA pitch themselves to customers as platforms with the best rates and lowest prices because Africa is the most expensive region to send money to.

The players in the space facilitate the transfer from the U.K. to African countries. Their collective bet is that their market will grow and eat into traditional incumbents. It remains to be seen whether that will happen.

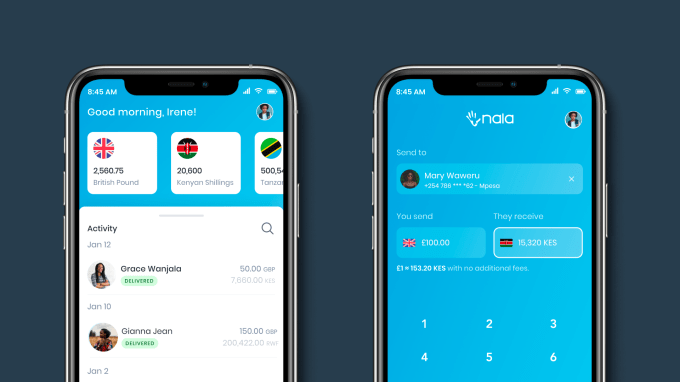

Since testing out the product last year, NALA has achieved considerable growth. Payments can be made from the U.K. to other countries on the platform. In the past six months, more than 8,000 customers have moved over $10 million in transaction volume to Africa.

The core customer base is the diaspora who live in the U.K., according to the founder and CEO.

The chief executive said that NALA will be present in 12 African countries by the end of the year, including Nigeria.

Accel-backed mobile money platform NALA to start offering remittance services to East Africa

The low-hanging fruit is remittance. NALA has more offerings in the works that can be compared to Revolut, which was first launched in the U.K.

NALA is testing multi-currency accounts that will allow the African diaspora to store local African currency when abroad. Businesses in the diaspora can make payments to Africa using NALA.

Money transfers from Africa to the U.S. and the U.K. will be possible with the help of the Tanzanian fintech.

We are scaling that up, not just being in Uganda, but also in other countries. We want to build infrastructure across the continent so that we can send money back and forth from the continent. The founder said that they had submitted their application for a license in Uganda.

Subuola Abraham is a former group chief compliance officer at a pan-African bank. One of the few African tech companies with this deal is it's F.X. and fast-track growth across multiple regions.

The image is from NALA.

NALA will be launching a campaign this year where first users will be able to own shares in the company. Money transfer companies have made similar moves in the past.

Nicolas Esteves (CTO) andNicolai Eddy (COO) have experience at Osper and Monzo.

Local investors like DFS Lab are included in the new financing round.

NALA received funds from an impressive group of angel investors, which included: Jonas Templestein, co-founder and CTO of Monzo; Vladimir Tenev, Robinhood co-founder and CEO; Deel founder Alex Bouaziz; and Laura Spiekerman, co-founder of Alloy

Sheel Tyle, the founder and general partner at Amplo, will join the board of NALA.

NALA will be able to hire more talent, build payment rails in Africa and expand to new countries thanks to the investment.

We don't want to be compared to a regular company, and people will do that naturally. Remittance is just the beginning of what we're going to build. This $10 million round is going to do a lot of what we want to do.

Nala has built a hassle-free, offline mobile money payment platform for Africa

Chipper Cash gets $2B valuation with $150M extension round led by FTX