Latin Americans who want to invest in companies that trade on the New York Stock Exchange can now do so with a new option in Vest.

The co-founder and CEO of Vest said that he and his co-conspirators decided to start the company in Mexico City in December 2020 because they believed that Latin Americans had not worked hard enough for their savings.

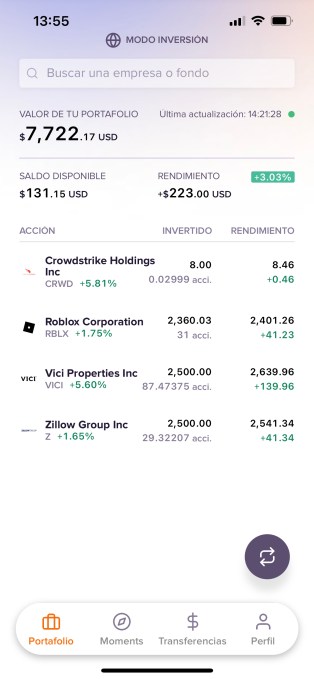

Direct access to U.S. equity investments to retail investors in all major economies in Latin America is what Vest aims to do. The startup operates an active broker so that users can buy and sell stocks. The company plans to expand its platform to include a passive investing product. Polhamus said that it plans to have both the active and passive products built with the same user interface so that investors can use both strategies in the same place.

The market simulation environment for learning and practicing for those who have no previous financial exposure has been developed by Vest in response to the fact that not everyone who wants to invest might have the financial literacy to do so. It also provides in-app content to educate on investing and provide insight into current events and economic trends.

All of Latin America except for Panama and the U.S. states of Arizona, California, Florida, Georgia, New Mexico, New York, Texas, Washington and Puerto Rico can download the app for free. The startup plans to offer users integration to local banking in other large markets this year.

The image is called Vest.

The company announced today that it has raised $6 million in a seed round led by the Founders Fund, which included participation from Class 5 Global. It is worth $22 million.

We want to empower investors throughout the Americas to build their financial future via a world-class investment and education platform.

The founding team of Vest is not deterred by the stock market turmoil. They see it as an opportunity to communicate with their users about what's most important as they build their financial foundation: investing for the long-term, in high-quality companies and assets that compound over time.

Polhamus said that some trading apps focus on promoting a high volume of transactions, where customers are enticed by visions of hitting a home and growing their net worth considerably overnight. Although things may get rough in the short term, historically speaking, time is the investor's friend.

Businesses that promote quick profits may struggle in volatile market moments, while businesses that promote sound investing disciplines will ultimately win the trust of their customers.

Vest has 36 employees, up from five a year ago.

The company plans to use its new capital to hire, acquire licenses to operate in its various markets, and engage strategic partners.

Matias Van Thienen said his firm had been looking for an investing and savings platform in Latin America that could offer global equities with a high-quality product and a suitable regulatory approach. It was introduced to Vest by one of its portfolio founders.

Van Thienen wrote via email that they invested based on the founding team's strong engineering background combined with deep understanding of the regulatory complexity required to scale this type of business.

The investor points out that Vest can offer global equities while operating in several countries without requiring local licenses, unlike most local offerings in the region.

Vest's product has the ability to appeal to a wide range of users, from highly active stock traders to those looking for a more passive savings product.

Van Thienen was born in Argentina and grew up in Miami, so he always had an interest in LatAm. Nubank and Kavak have been backed by the Founders Fund.

A wave of LatAm fintechs are laying down new global commerce rails