Another startup has announced a funding round. Dropee, a Malaysia-based B2B wholesale platform that also offers financial services, like working capital loans, to SMEs, said today it has closed a Series A round totaling $7 million. The Y Combinator alumni raised $5 million in debt and $3 million in equity. Other participants were LKF Capital, Resolution Venture, and HCL Capital.

Dropee plans to introduce new financing products for wholesalers and retailers in Malaysia, Singapore and Indonesia over the next 12 months by working with strategic partners. It has raised over $8 million.

KoinWorks is a Jakarta-based financial platform.

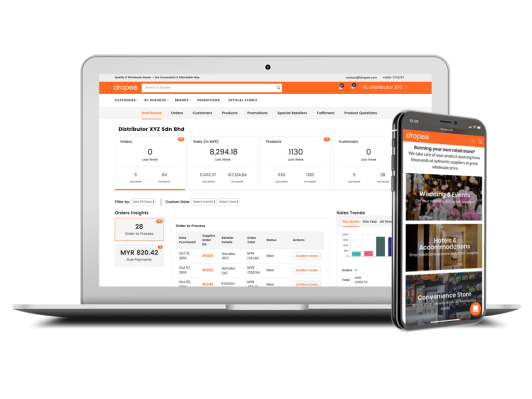

Dropee focuses on food and beverages and consumer goods. The startup says it is used by over 80,000 small and medium-sized businesses to buy wholesale inventory through its marketplace, and now totals more than $100 million in transaction value. Its marketplace is integrated with an e- commerce platform that manages offline-to-online orders.

Dropee was created because of the fact that one of the co-founders came from family businesses that are involved in B2B trading on fast- moving consumer goods products for over two generations. That gave them a close-up look at the inefficiencies in the wholesale trading space. Dropee was created to make the process more efficient.

Each B2B consumer sees a personalized selection of best-selling goods, complimentary products and campaigns based on their business needs through the platform. SMEs can order directly from its wholesale marketplace or an assigned sales agent, which will allow them to process orders more quickly.

Dropee began offering financial products in November of 2020. It can be difficult for traditional wholesalers to extend longer credit terms to small and medium-sized businesses. She said that credit financing for retailers increases the number of inventory purchases. Dropee uses multiple variables to gauge creditworthiness and loan terms, including transaction data to lifetime value per business network.

Dropee will use the new round of financing to expand its supply chain financing and to work with more brands and wholesalers in Southeast Asia to extend credit term payments for retailers.

Southeast Asian startups to watch in the future.