The central bank's digital yuan wallet is one of the fastest-growing apps in China. The head of financial markets at the People's Republic of China said that one-fifth of the population have set up e-CNY wallet, and that 87.5 billion yuan of transactions has been made using the digital currency.

Shenzhen is one of the major cities in China that has been piloting the use of digital yuan. People need to enter a draw and apply to be early users. The PBOC made the e-CNY wallet available in China at the start of 2022, in a clear sign of speeding up the trial.

The digital yuan is not a substitute for the banned cryptocurrencies in China. The PBOC pointed out that cryptocurrencies could be an instrument of money-laundering and that they were deemed highly volatile, speculative, and lacking in intrinsic value.

The e-CNY wants to achieve different things. The central bank issued it as the statutory, digital version of China's cash in circulation, or "M0," and the regulators intend to make e-yuan payments work even without the internet.

The central bank's Working Group on e-CNY Research and Development published a research paper last year.

The forms of cash given to the public should be changed.

The central bank should support financial inclusion and digital cash.

Retail payment services should be supported with fair competition, efficiency and safety.

The improvement of cross-border payment should be explored.

Only users in a list of pilot cities and at the upcoming Winter Olympics venue can actually sign up, top up their accounts, and spend the virtual currency at one of the 8 million pilot scenarios.

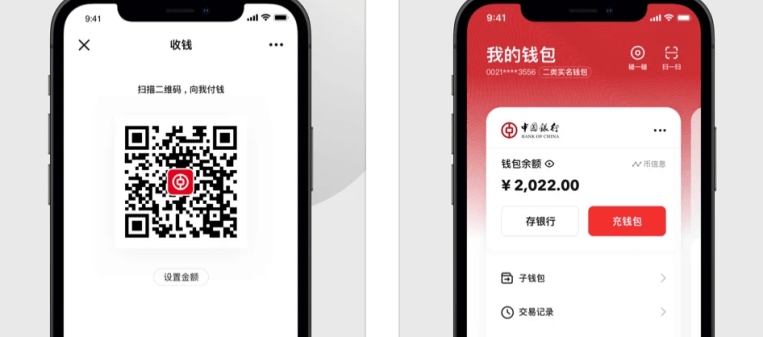

Users will have to move money from one of the commercial banks authorized by the PBOC to operate and circulate the digital currency, including digital-only banks like WeBank and MyBank.

The PBOC said in its report that e-CNY is supposed to complement rather than replace the popular payment services. It could support anonymity for small value transactions. In other cases, large amounts of funds sent from a provincial government to a town could be paid in e-CNY to prevent corruption using the digital currency's traceable capabilities.

If e-CNY wants to achieve a meaningful active user base, it needs to compete with private payments giants on user experience.

China is testing its digital currency in Shenzhen.