More than 60 million small and medium-sized enterprises are the core of Indonesia's economy. Many people don't have access to working capital and they used manual processes to manage their finances. Large rounds of funding have been raised by startups that focus on small and medium-sized enterprises. KoinWorks is the newest. The Indonesia-based financial platform for small and medium-sized enterprises has raised $108 million in Series C funding. The round included $65 million in debt capital and $43 million in equity for KoinWorks.

KoinWorks has raised $180 million. Quona Capital, Triodos Investment Management, Saison Capital, ACV and East Venture are some of the investors who returned for the latest round. KoinWorks will use the new funds to hire about 400 new employees and scale their products.

KoinWorks has tech offices in Singapore, India, and Vietnam. KoinWorks was created to help small and medium-sized businesses get access to working capital. It has developed a platform of financial tools to help its customers, including e-commerce vendors and social commerce sellers, increase their sales.

KoinWorks raised $12 million for its lending platform in 2019. The startup says its user base tripled to 1.5 million customers, and there is a waitlist of 100,000 small and medium-sized businesses who are onboarded onto its new financial software. In an email to TechCrunch, co-founder and executive chairman Willy Arifin said that since the beginning of the year, monthly loan disbursements have tripled to nearly $50 million and revenue has doubled.

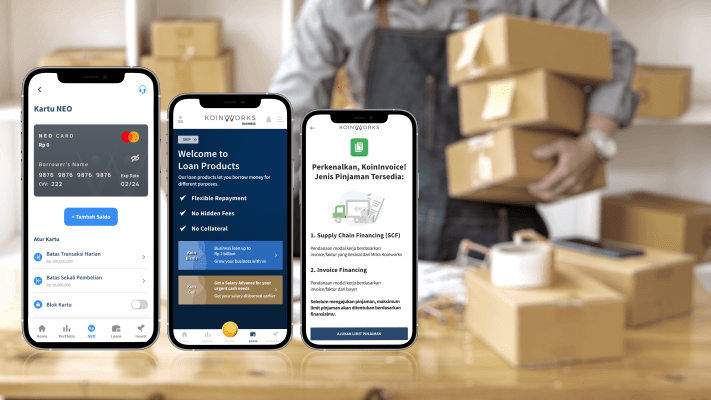

KoinWorks focuses on small and medium-sized enterprises that are not covered by traditional financial institutions and may not have a bank account or credit cards. Users can create an online bank account and card, borrow working capital, and access accounting, point-of-sale, early wage access, and human resources management systems tailored for small businesses on the platform.

The company became cash flow positive earlier this year, and its non-performing loan percentage is lower than 2%, thanks to the growth of its monthly disbursement rate. He says banks that serve traditional SMEs have double KoinWorks' bad loans. He said that 20% of businesses shifted their sales channels offline to online during the Pandemic, and 89% of businesses now use online channels to sell their products and services.

Over the last three years, KoinWorks competitors have grown to include other neobanks and startup that started out as accounting software but are now offering working capital loans and other financial services. Rivals BukuWarung and BukuKas have both raised significant rounds of funding.

Valar and Goodwater lead a $60 million Series A for BukuWarung, a fintech for Indonesian Micro, Small and Medium-sized Businesses.

We were among hundreds of traditional financial institutions when we started. Fast forward to the present day, we are seeing the same banks undergo digital transformation. Indonesia has an annual funding gap of $80 billion, so unbanked and underbanked people are still at a disadvantage. There is still room for improvement.

It is not a winner-takes-all market with tens of millions of entrepreneurs in Indonesia. The top five banks in the country have a combined market value of close to $170 billion. KoinWorks has a best in class approach tailored to the needs of small and medium sized businesses that we believe will have a significant impact on the future sector.

BukuKas gets $50 million from investors including DoorDash's Gokul Rajaram.

Donald Wiharia said that investing in KoinWorks is investing in the financial literacy of underbanked and underserved communities. We are very excited to be working with a team that understands the importance of each step in the journey of entrepreneurship.