Almost three million Americans are denied a mortgage each year. Most don't know what to start. The system has become confusing and has caused people to never make it onto the housing ladder. The mortgage industry is geared only to those who are ready and qualified to buy, a relatively small percentage of those who would actually like to.

NerdWallet, Lower.com, Divvy, and Landis are just a few of the tech companies trying to make it easier to save for home loans. There is plenty of room for more entrants, especially ones that can help consumers through the process.

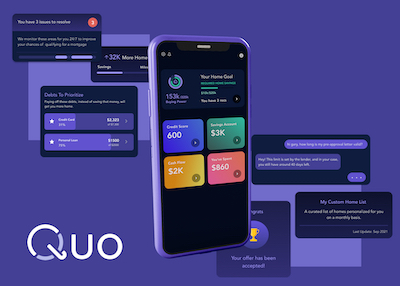

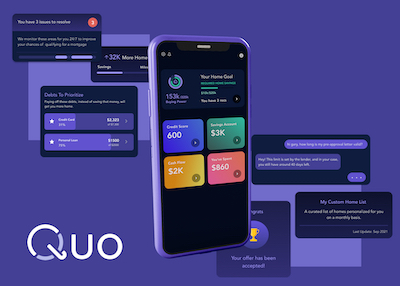

Quo is a new startup that claims to have a new approach to homeownership. The app shows users where they are today in terms of their financial position and goes through what mortgage qualification criteria they need to hit in order to secure a home loan.

It has raised $7.2 million in a seed funding round led by SignalFire, with participation by current investors and others.

Uncapped Mortgage, a licensed mortgage broker based out of Nashville, has also been acquired by QuoHome. Quo users can get mortgage brokering services from QuoHome.

The new funding will be used to accelerate the growth of the QuoHome coaching app. Quo claims that its users have amassed $200 million in home buying power and are working towards $1.2 billion in homes.

The Quo product connects your credit, savings and income information to build a financial profile. It compares your information to mortgage guidelines to find out how much you can afford today and how much you need to save to afford the home you want.

Working out which debts you should pay off and saving money for a down payment are two ways to be able to afford a home faster.

The mission of Quo was to make building wealth more equitable, starting with homeownership, and was founded by Tucker and Neel Yerneni.

After they got into economic problems, the household struggled with home financing for years.

I had experience with a broken financial system when I was a child. He said that Quo is their way of driving at the mission of making wealth more equitable. The members of our group have managed over $21 million in home savings with Quo since the launch of the beta in June. We are proving there is a more aligned and accessible way to approach this industry with our $7.2 million in funding.

The middle-class is trying to find some stability and economic uncertainty is spurring a new wave of fintech for savings and homeownership.