The Labor Department reported Friday that the U.S. economy created far fewer jobs than expected in November.

The unemployment rate fell to 4.2% from 4.6%, even though the labor force participation rate increased to 61.8%, its highest level since March 2020.

The unemployment rate was 4.5% and the number of new jobs was 573,000.

The measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons fell to 7.8% from 8.3%. An employment gain of 594,000 was indicated by the survey of households.

Leisure and hospitality, which includes bars, restaurants, hotels and similar businesses, saw a gain of just 23,000 after being a leading job creator for much of the recovery.

Markets shrugged off the numbers, with stocks pointing to a higher open on Wall Street.

The initial jobs tally this year has seen substantial revisions, with months showing low counts initially often bumped higher. The October and September counts were increased by 82,000.

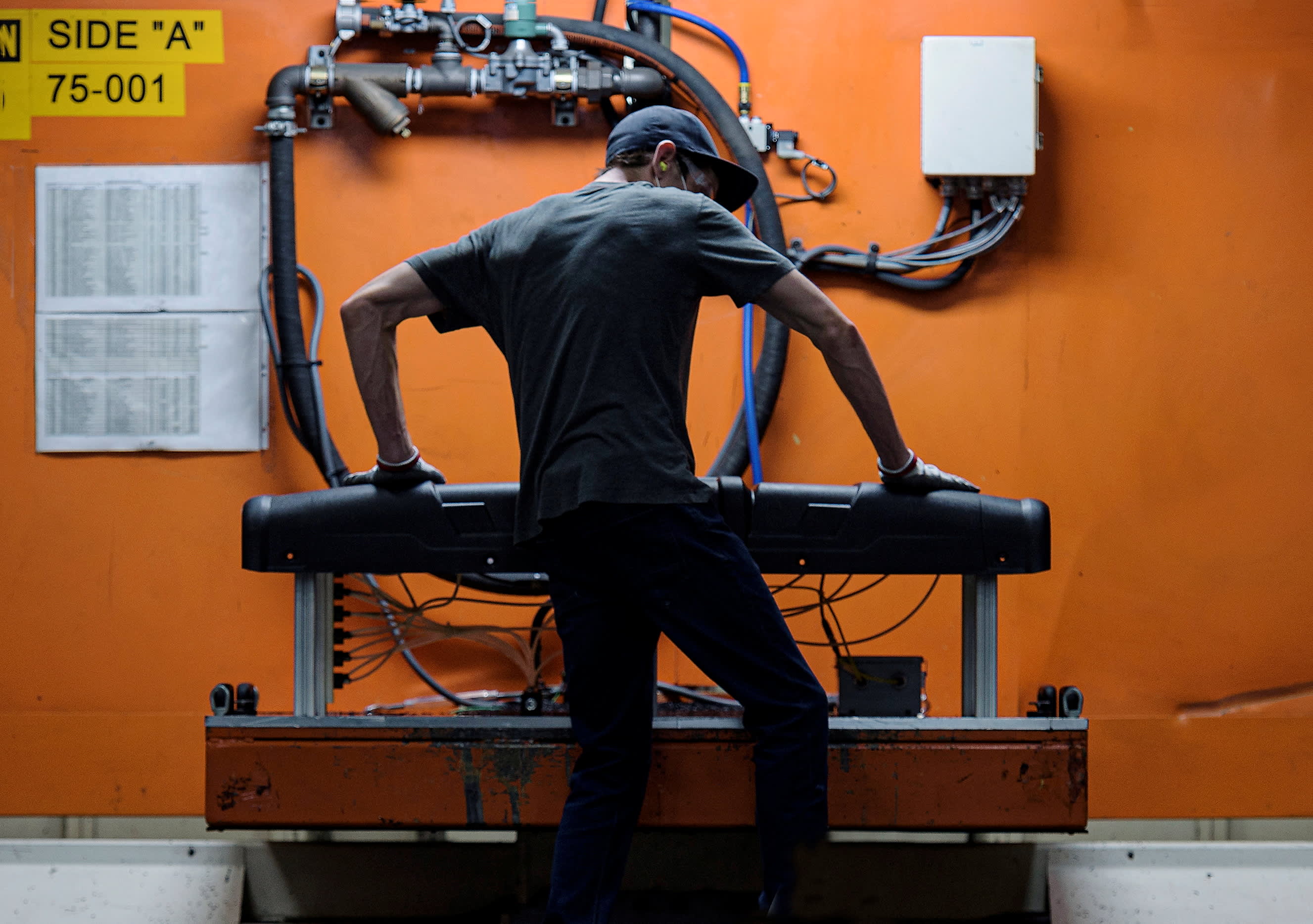

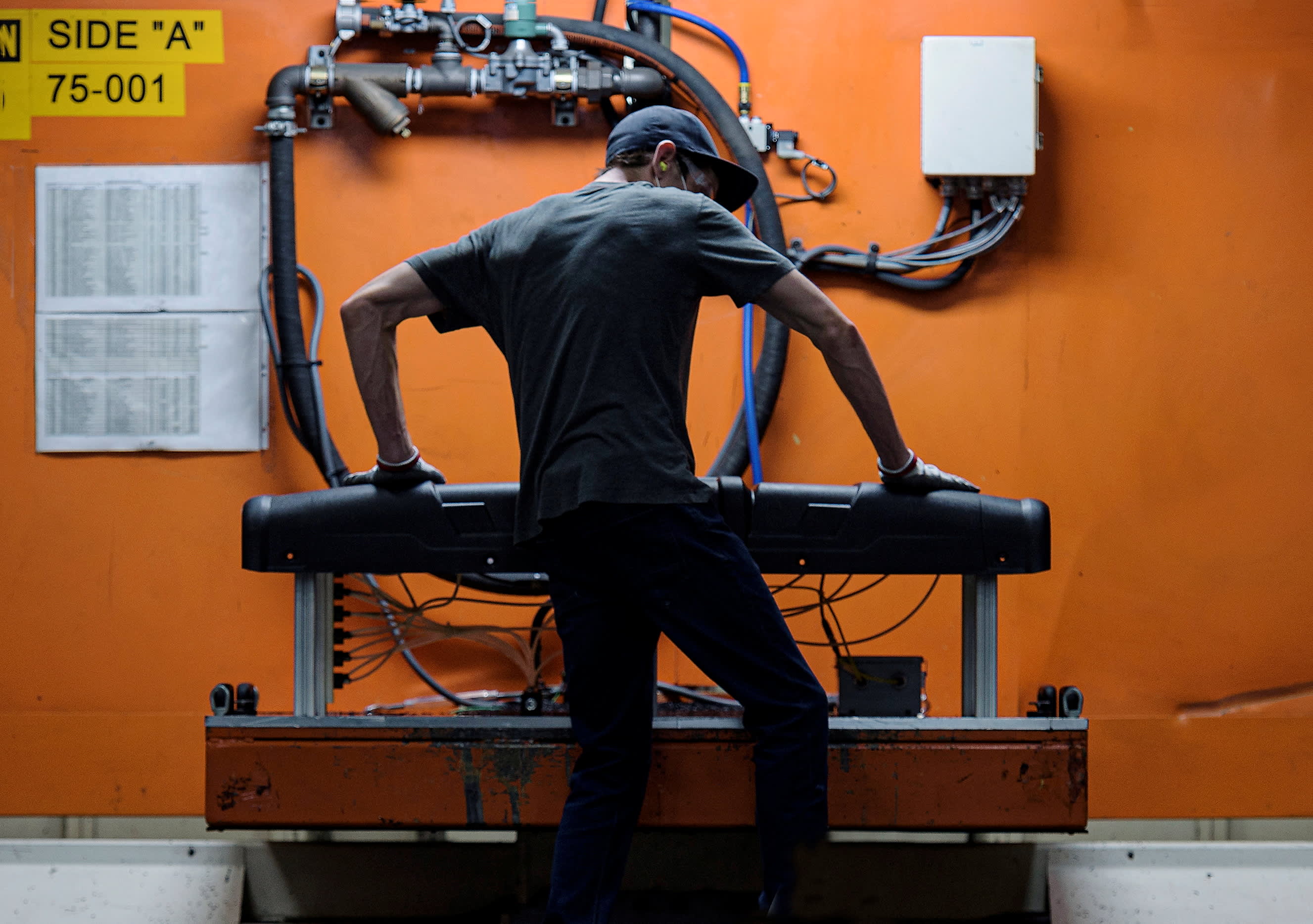

The professional and business services, transportation and warehousing, and construction sectors had the biggest gains in November. Retail saw a decline of 20,000 with the holiday season approaching. There were 10,000 jobs added by the government.

Worker wages increased for the month and year ago. The numbers were below estimates.

Policymakers have been watching the employment figures to see how close the economy is to a full recovery. The U.S. has been on a progressive but volatile path since the early days of the Covid-19 break.

The Federal Reserve put a new twist on the situation this week when they said that the measures they had put in place to support growth could be coming to an end sooner than expected.

The policy committee of the Fed is expected to discuss at its meeting this month stepping up the level of bond purchases that it is reducing. Powell said that he sees the unwind concluding a few months sooner than expected, which would open the possibility for interest rate hikes.

San Francisco Fed President Mary Daly backed up her comments on Thursday, saying that the need to rethink policy is caused by inflation that is stronger and more durable than expected. She said the Fed should think about raising the interest rate.

The summary of economic projections to be released this month, in which officials show their expectations for the future, likely will point to interest rate hikes pulled forward into 2022. The Fed is expected to raise its rates at least two times next year.

This is breaking news. You can check back here for more updates.