Venture bull markets are great for founders but not in the manner they might expect.

Every day seems to bring news about record-breaking startup funding, unicorns being created and tech companies going public. It is clear that we are currently in an accelerating and long-running venture bull market.

This all makes it clear that almost every indicator of startup funding is positive. Venture firms are more profitable, have larger deal sizes, are valued higher, and are more hospitable to founders. All of this is happening.

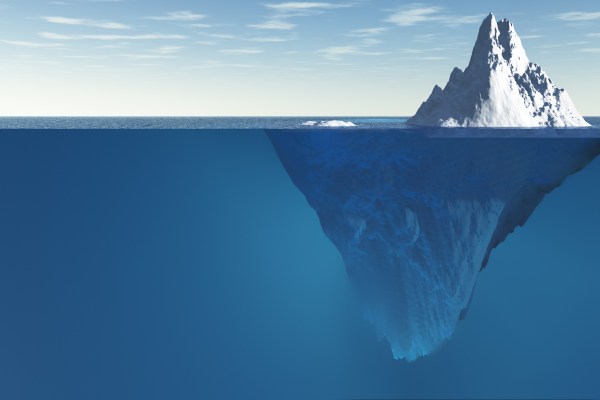

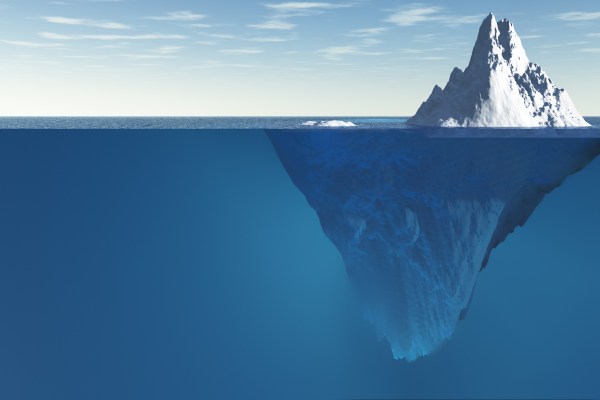

However, a closer look reveals that these trends are much more nuanced and do not apply equally across funding stages. The truth is that most of these underlying truths and rules do not change.

It isn't. The venture alphabet soup consisting of A, B and C rounds seems to suggest it all the same. It's more like playing a completely different sport.

Be aware of outliers

Venture stage definitions, from seed to the late-stage Series D or E rounds, are open to interpretation. However, outliers at each stage challenge general patterns. The industry is as old as outliers, which are unusually large financings and high valuations relative the company's maturity. These days, however, there are many more outliers and they are more extreme than ever.

Databricks, for example, raised two large private rounds in 2021, a $1 Billion Series G and $1.6 Billion Series H. These funding rounds are larger than most IPOs of recent years, and Databricks certainly is not the only company doing something similar. Crunchbase reports that there were on average 35 megadeals, with over $100 million raised per month, between 2016 and 2019. Crunchbase estimates that this number will rise to 126 per month by 2021.

Two major trends are responsible for this. The first is the highly lucrative exit market, which has made it possible to fund mega-late-stage rounds and venture rounds exceeding $100 million. Companies are becoming more private, which means they require additional capital in the late stages of their development before going public. This is something that companies have never had to do. We'll discuss this further below.

It is crucial to recognize that averages and aggregates don't tell the whole story. A better picture of the market's real performance is provided by the median funding round size and valuations. When you read the next report about a record month for venture funding, pay attention to what is being highlighted.

Different stages behave in different ways

Many people believe that the significant growth is a universal phenomenon across all stages of the funding process. However, this is not the truth. The venture bull market has a very different effect on different stages. This is an analysis by Cloud Apps Capital Partners of PitchBook data relating to fully documented U.S. financings (seed through series D) in the cloud application space from 2018 through the first half 2021.

Late stage is where the greatest impact seems to have occurred. The median round size for Series C and D financings increased by more than two-thirds to $63million in 2021, from $31million in 2018. The pre-money valuations increased by 151% and the ownership of the share equity investors dropped from 18% to 12%. The amount of money involved in the financing has increased by a third, but Series C- and D investors now own a third less.