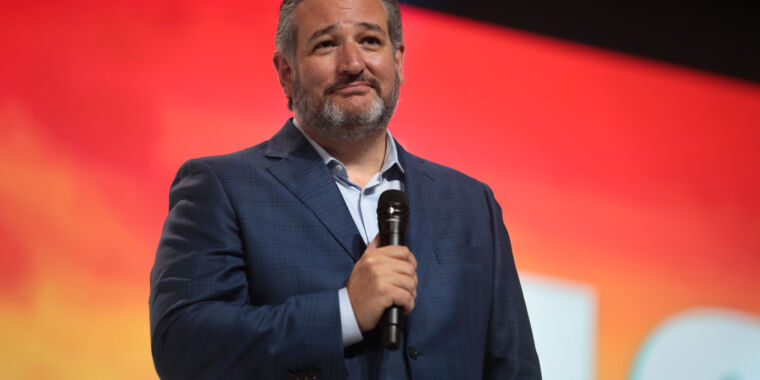

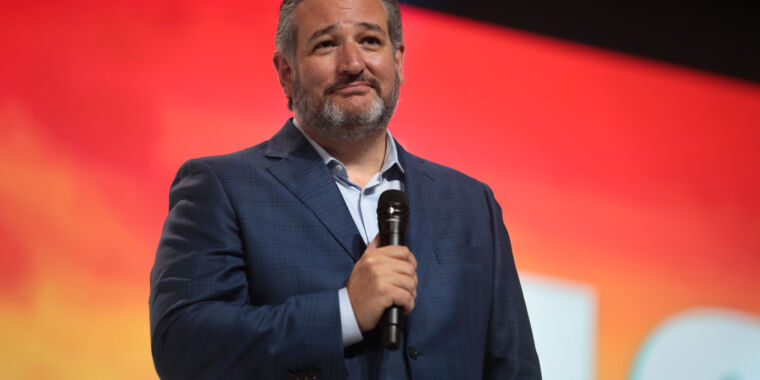

Ted Cruz (Republican from Texas) believes he has found a way for Texas to maintain its electric grid in the event of another deep freeze. He would like to harness the power of Bitcoin.

Cruz explained that bitcoin mining can be turned on and off instantly, so if there is a power cut or crisis or any other natural disaster that reduces power generation capacity, it can immediately shift the energy to the grid.

There are several reasons that he didn't say what he meant. Let's start with his assumptions. First, bitcoin mining operations that are large use thousands or hundreds of computers. This creates a need for power. If power plants are able to profitably mine bitcoin with the electricity they produce, and there are already examples of this, it stands to reason that investors will be attracted to building new power plants. These plants could theoretically be assigned to provide power to the grid during an emergency.

The argument seems solid at first glance. However, if you really dig in to it, the argument quickly crumbles.

One, blackouts in Texas during February's cold snap resulted from power companies failing to winterize generators. This was true regardless of whether the generators were natural gas or coal, nuclear, wind, or nuclear. The companies failed to prepare for the worst, putting lives at risk. Bitcoin mining is not critical infrastructure, unlike power plants that supply the grid. No one is affected if a crypto data centre goes down. Bitcoin miners are in it for the money and would not hesitate to spend more cash to winterize.

Let's say that the demand rises and the power remains on. If they are not compensated enough, bitcoin miners might not offer their generating capacities to the grid. Texas already has such a system in place. It offers generators a premium to bring additional power online in times of shortage. Wholesale electricity prices rose to $9,000/MWh during the February cold snap. This is the maximum permitted by law. Some people were even charged $10,000 per month for electricity.

Advertisement

This raises many ethical questions. For example, should power companies sell plans that have hidden fees that increase in times of greatest need to people? Do people from other countries have to pay the bill? These concerns aside, bitcoin miners will likely demand more than the $9,000 per MWh cap. One bitcoin sells for $57,000. To win that bitcoin, the mining rigs draw just under 0.285MWh. To put it another way, in order for bitcoin miners be willing to contribute, wholesale electricity prices must reach $16,300 per megawatt hour, which is almost twice the price during February's cold snap. These $10,000 bills could be converted into $16,300 bills.

It is possible to prevent such price spikes by enacting laws and regulations. Let's say ERCOTTexas grid regulator decides to force bitcoin miners to sell their power to the grid at the cost of other generators. Although Texas might be able to find some buyers, even from the notoriously regulatory-averse crypto community it is possible that Texas will not. But, would this be enough to stabilize Texas' grid in extreme weather conditions?

Texas lost half of its generating capacity last February, which was 52.3 GW. It is hard to imagine a world in which bitcoin could generate more than 50 GW of dedicated power generation capacity per state. Ted Cruz's vision of power plants would have to be built at a cost of over $50 billion, given current prices. There are likely more efficient ways to stabilize Texas' grid at that price.

Correction: We have updated the figures to reflect the Bitcoin reward per block that was not included in the original calculation.