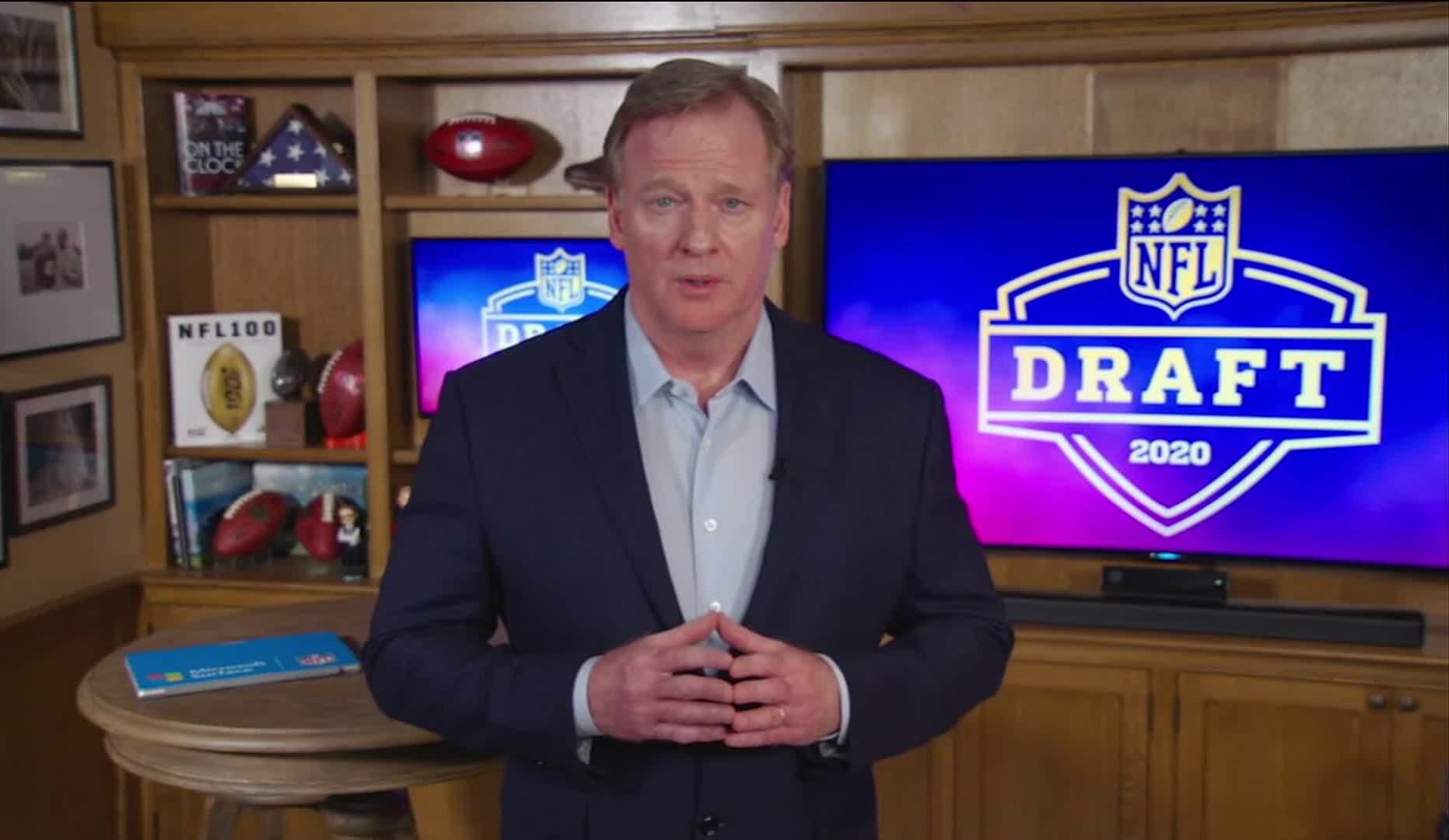

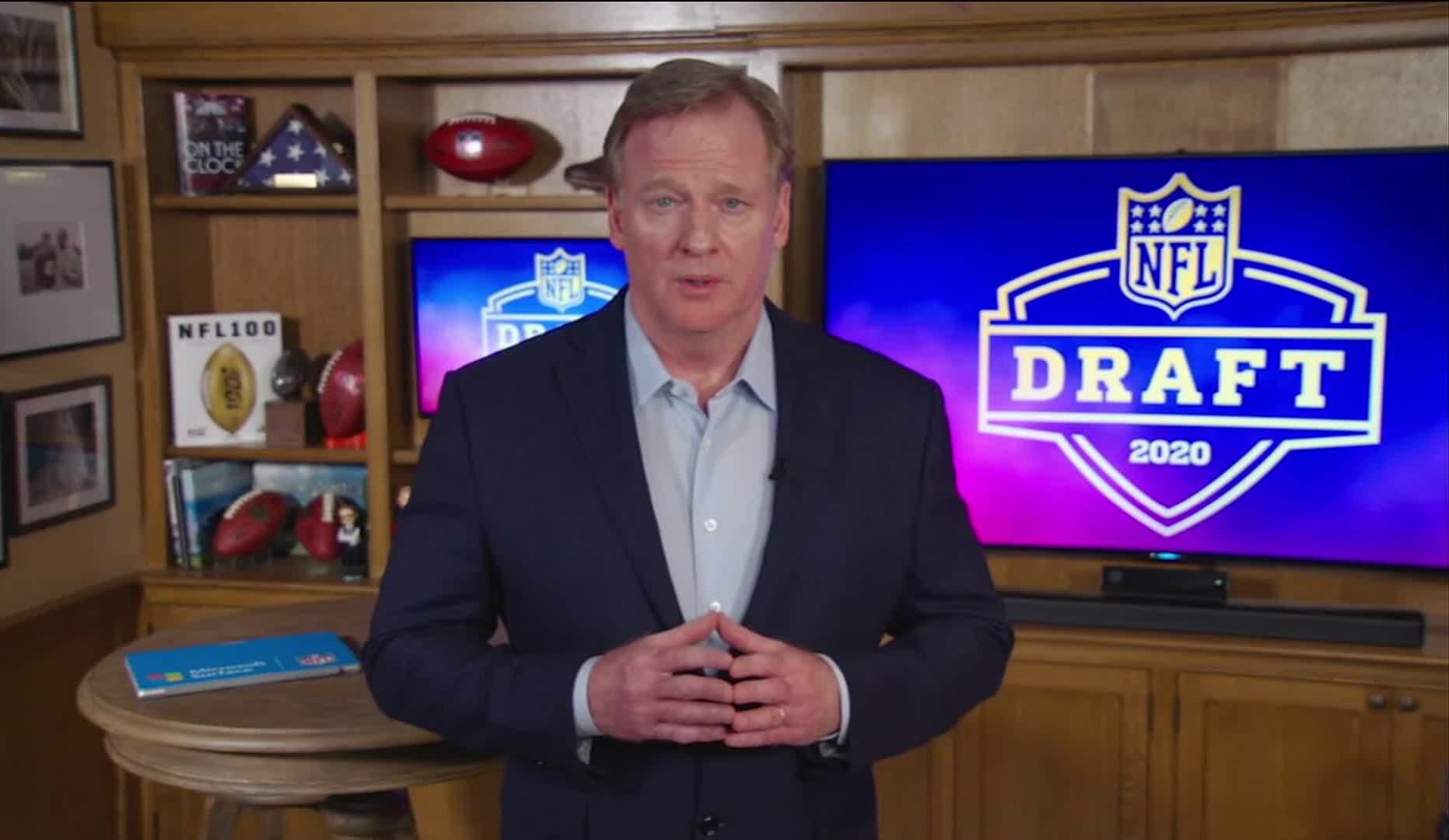

This still image is taken from video by the NFL. It shows Roger Goodell, the NFL Commissioner, speaking from Bronxville in New York, during the first round 2020 NFL Draft. (Photo by NFL via Getty Images). Photo by NFL via Getty Images

Last month, Disney CEO Bob Chapek was questioned about the importance ESPN and sports broadcasting for his streaming strategy. His response sounded like an unqualified answer. Chapek stated that sports is the most popular thing on television every year. In a virtual session, Chapek spoke Sept. 21. It's a vital part of the Walt Disney Company's consumer offerings. "Who knows what the future holds, but it is an important part of our consumer offerings." Chapek's basic response to the future of one of Disneys most valuable assets prompted no further questions or headlines. Chapek was actually addressing an existential threat to the media industry. This issue could one day shake the foundations of his media empire that includes some of the most important studios and film franchises around the globe, as well as the largest network for live sports. The big question for ESPN and Disney is how to embrace a future without television. The traditional TV model still makes billions of dollars each year for broadcast and cable networks. ESPN is a major beneficiary because media companies receive monthly subscription fees from pay-TV providers, regardless of how many people view their programming. While niche channels only make a few cents per month, sports networks can charge many dollars. Disney is the only company that makes more money with cable subscribers than any other company. According to Kagan, a research firm from S&P Global Market Intelligence, ESPN and its sister network ESPN2 each charge almost $10 per month. According to Kagan, this is at least four times the cost of almost all other national cable or broadcast networks. Disney requires that pay-TV providers include ESPN in their most popular cable plans. This is a simple requirement for TV providers. They wouldn't want to drop ESPN. The non-sports world is also cutting the cord. According to research firm eMarketer, more than 6 million people will have stopped paying for TV in 2020. This is the highest ever annual number. In the last decade, 25 million Americans dropped linear TV packages. This creates a problem within Disney that is poised to grow. Disney wants people signing up for its streaming entertainment products, Disney+ or Hulu. Wall Street also wants this. Streaming video is a growing business. Traditional pay TV is in decline. Chapek also sees it as a smart financial move. Although Disney earns more than $10 per month for sports subscribers, it makes much less for entertainment networks like Disney Channel and FX. These networks draw lower audiences and are not subject to high advertising rates. It's a major win for Disney if a cord cutter will pay $8 per month to Disney+ and $6 to Hulu. ESPN is the opposite. Disney is losing a lot of revenue by replacing an ESPN subscriber with an ESPN+ customer. The average ESPN+ customer contributes less than $5 per monthly. ESPN+ is a streaming service that offers limited content.

Getty Images; Patrick T. Fallon

When Disney+ was launched, Bob Iger, the chairman of Disney, said to investors that Disney was "all-in" with streaming video. ESPN isn’t. ESPN isn't. Their strategy is to hold on to the cable bundle as long as possible. They know it can bring in billions from households across the United States that pay $120 each for the network, even though they don't watch it. Analysts have even asked whether Disney should split off ESPN to allow Chapek more focus on streaming. A former executive at Disney, who asked not to be identified, stated that there was a "strategic misalignment” between ESPN and its parent company. Wall Street isn't happy with declining assets and that the businesses don't belong together. According to the executive, having ties with the legacy bundle will reduce a company's stock multiplier.

ESPN's Fit in Disney

Disney offers a strong financial incentive to maintain the marriage, even if the match does not make sense. Disney receives approximately $9 billion in domestic carriage fees annually from ESPN and its affiliated networks at $10 per month or $120 per annum. This is multiplied by the 75 million homes in the United States. The billions of dollars in advertising that comes with broadcasting sport brings in additional revenue. This cash allows ESPN to continue a cycle of spending big on rights for sports, allowing it to make huge investments. In a deal that will last until 2033, Disney agreed to spend $2.7 Billion on "Monday Night Football". ESPN will pay $1.4 billion annually to host NBA games. This amount will increase when the rights are renewed for the 2024-25 season. The network holds media rights to all major U.S. sports in some capacity. The agreement allows Disney to make original streaming content. This will help Disney compete with Amazon and Netflix. In an interview with CNBC, Jimmy Pitaro, chairman and majority owner of ESPN, stated that "We are successfully navigating the evolution in consumer choice." We believe that we can do multiple things simultaneously. We have all the flexibility we need as consumers continue to gravitate towards direct to consumer.

Chairman of Disney Consumer Products and Interactive Media Jimmy Pitaro FilmMagic

For the moment, ESPN's cash machine role works well. Rich Greenfield, a LightShed media analyst, stated that 25 million households in America will drop cable TV within the next four to five years. "If we go to 40 to 50 millions, the question is: 'Is there an economic model that justifies our current level of spending?' Greenfield said. According to sources familiar with the matter, ESPN must figure out how to replace $3 billion annually lost pay-TV subscription revenue. This decline is something that Disney executives anticipate. According to people familiar with the matter, Disney plans to increase the price of ESPN+ by adding more value content and keeping contractual obligations to pay-TV distributors for exclusive programming. Eli and Peyton Manning will broadcast their alternative broadcast of Monday Night Football, which will air ten times on ESPN+ and ESPN2. Two people familiar with Disney's plans said that if the number of subscribers to pay-TV bundles drops to less than 50 million, Disney will likely offer ESPN to consumers as a complete streaming package. The economics would change at that point as sports fans would pay more for linear TV. A full-service streaming service for sports could make Disney more than it would in a wholesale pay TV distribution model. Selling ESPN separately from the linear bundle is not feasible in the short term. In the last few years, Disney has been able to negotiate digital rights flexibility in nearly every major renewal of rights. According to sources familiar with the matter, the company is restricted by its linear pay TV obligations that require certain premium programming to remain exclusive to the cable package.

How much to stream ESPN?

David Levy, former president of WarnerMedia's Turner Broadcasting said that Disney will have a lot of leverage with consumers when it comes time to get rid of the bundle.

This file photo, taken May 16, 2018, shows then-Turner Broadcasting president David Levy at the Turner Networks 2018 Upfront. Evan Agostini | Invision | AP

Levy, now the chairman of data firm Genius Sports said that he believes Disney can get 30,000,000 customers to pay $30 per month for streaming ESPN. This is more than twice the price of a standard Netflix subscription. This would generate $10.8 billion more annually than Disney's current pay-TV affiliate revenues. Levy stated that sports has a built-in audience. It's very different from entertainment. Entertainment is unpredictable. Every show is a failure. You have to market your content. It's impossible to predict what will be successful and what won’t. Sports is the best content, regardless of the distribution model. Levy's estimate might be optimistic. CNBC was told by a top executive from one of America's largest pay-TV companies that 15% of subscribers were avid sports fans. This would mean that just over 11 million households in the United States would be affected. ESPN would still make $9 billion if it could offer a $30 streaming service. Leagues aren't afraid of the uncertainty surrounding how many subscribers will pay for their sports in an a la carte streaming world. According to sources familiar with the matter the NFL included early out-clauses in its 11-year contracts with networks. This allowed the league to cancel if the business model ceases to work. According to people familiar with the matter, the NFL can terminate its agreement with CBS, NBC, Fox, and ESPN after seven years, eight years, and if the business model stops working with ESPN. The linear bundle is important to Disney and other live-sports networks until it's no longer necessary. It is difficult to replace the revenue lost in a reliable manner. "We are convinced that the traditional pay-TV bundle will continue to be intact for a long period of time," said

Sean McManus is chairman of ViacomCBS's CBS Sports. "I don’t believe it ever drops to zero. It's possible that subscribers will continue to fall, but I don't believe it will ever reach a point where it can't support current rights agreements that we have for NFL football and other sports.

Churn baby churn

A streaming-only world would present ESPN with a new challenge: Churn. Cancelling ESPN will result in the cancellation of your entire linear package. It would be simple for football fans to subscribe only during games in the direct-to consumer market.

At the entrance of the ESPN Wide World of Sports complex, Lake Buena Vista (Fla.) Phelan M. Ebenhack via AP

ESPN executives are looking for ways to encourage annual ESPN+ membership to decrease month-to-month volatility. ESPN offered a pay-per view UFC fight for $69.99 on ESPN+. They also offered a full year membership for $89.99 that would include the match. This was a 35% discount. Combining ESPN+ with Hulu or Disney+ is a great way to churn as it is 33% less than buying them all individually. A more comprehensive ESPN+ offering would require another streaming service to be included. This would scare off non-sports fans who are used to paying less. Disney already offers sports packages in its international streaming services such as Star+ Latin America and Disney+ Hotstar India. The economics of international streaming are different than in the U.S., however. Instead of charging $5 or $7 per sport, you can now charge $30 per sport on Hulu and Disney+. Greenfield stated. "And then, you're trying compete against Netflix at $15. There's no model that I can see that works. There is no simple answer.

Both threats and saviors

There are also technology risks. According to sources familiar with the matter, ESPN executives are reluctant to give their valuable programming directly to consumers due to widespread password sharing among young users. John Kosner, who was the president of Kosner Media from 2003 to 2017, said that sharing a streaming password or watching a pirated stream seems like a petty crime. It really affects the business model for streaming sports. Another issue for Disney is whether younger viewers even want to watch live sports. Social media, mobile games, and other entertainment options may be losing the cultural appeal of televised sport. According to a 2020 Morning Consult survey, Americans aged 13-23 are twice as likely to watch live sports than millennials and twice as likely not to watch. Kosner said that the future relevance of sports is still a question. A new streaming bundle, which effectively replicates the pay TV experience but offers more options, could be a model that could save Disney some heartburn in the future. Media companies could be in a similar position if this becomes the preferred distribution method. They will make money even though not everyone is viewing their most popular services. Altice USA CEO Dexter Goei stated in May that such an offering could be a good option for the future sustainability of the media industry. It would allow us to concentrate primarily on our broadband product and "be a partnership for content on a straight-to-consumer base as opposed to a linear basis," Goei stated at JPMorgan’s Technology, Media & Communications conference. He said that it "will dramatically improve our business' cash-flow outlook."

FanDuel betting booths Source: FanDuel